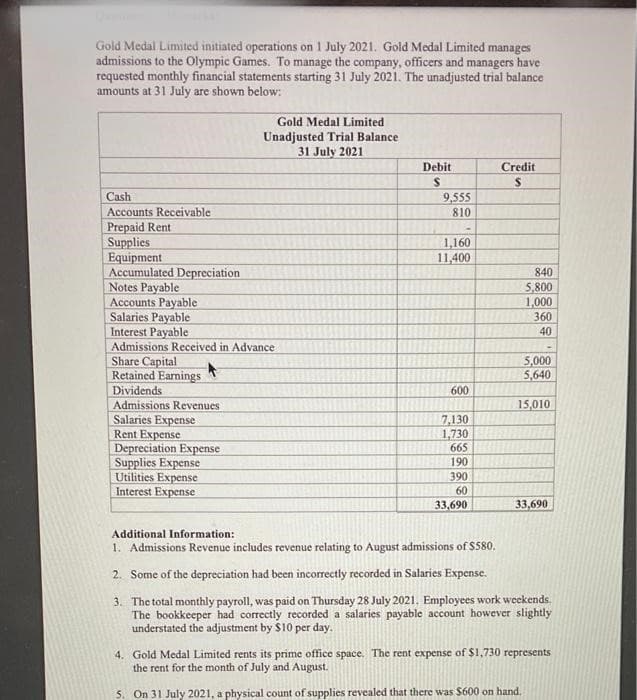

Gold Medal Limited initiated operations on 1 July 2021. Gold Medal Limited manages admissions to the Olympic Games. To manage the company, officers and managers have requested monthly financial statements starting 31 July 2021. The unadjusted trial balance amounts at 31 July are shown below: Gold Medal Limited Unadjusted Trial Balance 31 July 2021 Debit Credit Cash Accounts Receivable Prepaid Rent Supplies Equipment Accumulated Depreciation Notes Payable Accounts Payable Salaries Payable Interest Payable Admissions Received in Advance Share Capital Retained Earnings Dividends Admissions Revenues Salaries Expense Rent Expense Depreciation Expense Supplies Expense Utilities Expense Interest Expense 9,555 810 1,160 11,400 840 5,800 1,000 360 40 5,000 5,640 600 15,010 7,130 1,730 665 190 390 60 33,690 33,690 Additional Information: 1. Admissions Revenue includes revenue relating to August admissions of $580. 2. Some of the depreciation had been incorrectly recorded in Salaries Expense. 3. The total monthly payroll, was paid on Thursday 28 July 2021. Employees work weekends. The bookkeeper had correctly recorded a salaries payable account however slightly understated the adjustment by $10 per day. 4. Gold Medal Limited rents its prime office space. The rent expense of $1,730 represents the rent for the month of July and August. 5. On 31 July 2021, a physical count of supplies revealed that there was $600 on hand.

Gold Medal Limited initiated operations on 1 July 2021. Gold Medal Limited manages admissions to the Olympic Games. To manage the company, officers and managers have requested monthly financial statements starting 31 July 2021. The unadjusted trial balance amounts at 31 July are shown below: Gold Medal Limited Unadjusted Trial Balance 31 July 2021 Debit Credit Cash Accounts Receivable Prepaid Rent Supplies Equipment Accumulated Depreciation Notes Payable Accounts Payable Salaries Payable Interest Payable Admissions Received in Advance Share Capital Retained Earnings Dividends Admissions Revenues Salaries Expense Rent Expense Depreciation Expense Supplies Expense Utilities Expense Interest Expense 9,555 810 1,160 11,400 840 5,800 1,000 360 40 5,000 5,640 600 15,010 7,130 1,730 665 190 390 60 33,690 33,690 Additional Information: 1. Admissions Revenue includes revenue relating to August admissions of $580. 2. Some of the depreciation had been incorrectly recorded in Salaries Expense. 3. The total monthly payroll, was paid on Thursday 28 July 2021. Employees work weekends. The bookkeeper had correctly recorded a salaries payable account however slightly understated the adjustment by $10 per day. 4. Gold Medal Limited rents its prime office space. The rent expense of $1,730 represents the rent for the month of July and August. 5. On 31 July 2021, a physical count of supplies revealed that there was $600 on hand.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 22CE: Service Revenue Softball Magazine Company received advance payments of $75,000 from customers during...

Related questions

Question

prepare income statement with the help of below question please answer it asap thnx

Transcribed Image Text:Qui

Gold Medal Limited initiated operations on 1 July 2021. Gold Medal Limited manages

admissions to the Olympic Games. To manage the company, officers and managers have

requested monthly financial statements starting 31 July 2021. The unadjusted trial balance

amounts at 31 July are shown below:

Gold Medal Limited

Unadjusted Trial Balance

31 July 2021

Debit

Credit

Cash

9,555

Accounts Receivable

810

Prepaid Rent

Supplies

Equipment

Accumulated Depreciation

Notes Payable

Accounts Payable

Salaries Payable

Interest Payable

Admissions Received in Advance

Share Capital

Retained Earnings

Dividends

1,160

11,400

840

5,800

1,000

360

40

5,000

5,640

600

Admissions Revenues

15,010

Salaries Expense

Rent Expense

Depreciation Expense

Supplies Expense

Utilities Expense

Interest Expense

7,130

1,730

665

190

390

60

33,690

33,690

Additional Information:

1. Admissions Revenue includes revenue relating to August admissions of $580.

2. Some of the depreciation had been incorrectly recorded in Salaries Expense.

3. The total monthly payroll, was paid on Thursday 28 July 2021. Employees work weekends.

The bookkeeper had correctly recorded a salaries payable account however slightly

understated the adjustment by $10 per day.

4. Gold Medal Limited rents its prime office space. The rent expense of $1,730 represents

the rent for the month of July and August.

5. On 31 July 2021, a physical count of supplies revealed that there was $600 on hand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning