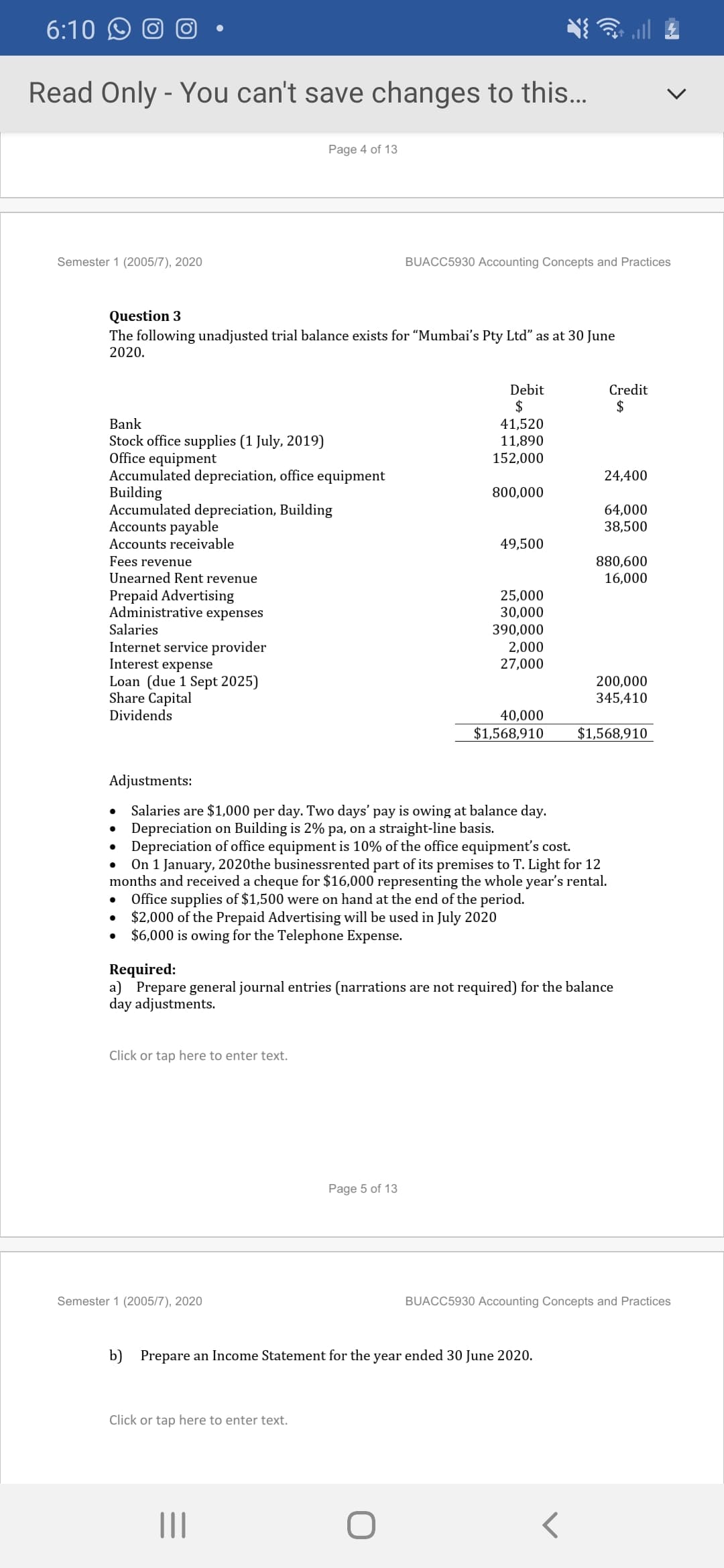

The following unadjusted trial balance exists for “Mumbai's Pty Ltd" as at 30 June 2020. Debit Credit $ 41,520 11,890 2$ Bank Stock office supplies (1 July, 2019) Office equipment Accumulated depreciation, office equipment Building Accumulated depreciation, Building Accounts payable Accounts receivable 152,000 24,400 800,000 64,000 38,500 49,500 Fees revenue Unearned Rent revenue 880,600 16,000 Prepaid Advertising Administrative expenses 25,000 30,000 390,000 Salaries Internet service provider Interest expense Loan (due 1 Sept 2025) Share Capital 2,000 27,000 200,000 345,410 Dividends 40,000 $1,568,910 $1,568,910 Adjustments: Salaries are $1,000 per day. Two days' pay is owing at balance day. Depreciation on Building is 2% pa, on a straight-line basis. Depreciation of office equipment is 10% of the office equipment's cost. On 1 January, 2020the businessrented part of its premises to T. Light for 12 months and received a cheque for $16,000 representing the whole year's rental. Office supplies of $1,500 were on hand at the end of the period. $2,000 of the Prepaid Advertising will be used in July 2020 $6,000 is owing for the Telephone Expense. Required: a) Prepare general journal entries (narrations are not required) for the balance day adjustments. Click or tap here to enter text. Page 5 of 13 ter 1 (2005/7), 2020 BUACC5930 Accounting Concepts and Practices b) Prepare an Income Statement for the year ended 30 June 2020.

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images