Goring Corporation has Accumulated E otiレ

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 37P

Related questions

Question

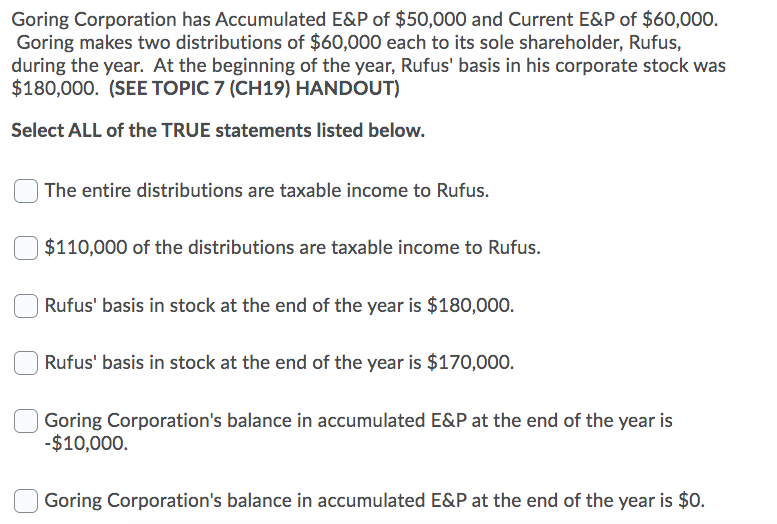

Transcribed Image Text:Goring Corporation has Accumulated E&P of $50,000 and Current E&P of $60,000.

Goring makes two distributions of $60,000 each to its sole shareholder, Rufus,

during the year. At the beginning of the year, Rufus' basis in his corporate stock was

$180,000. (SEE TOPIC 7 (CH19) HANDOUT)

Select ALL of the TRUE statements listed below.

The entire distributions are taxable income to Rufus.

| $110,000 of the distributions are taxable income to Rufus.

| Rufus' basis in stock at the end of the year is $180,000.

Rufus' basis in stock at the end of the year is $170,000.

Goring Corporation's balance in accumulated E&P at the end of the year is

-$10,000.

Goring Corporation's balance in accumulated E&P at the end of the year is $0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you