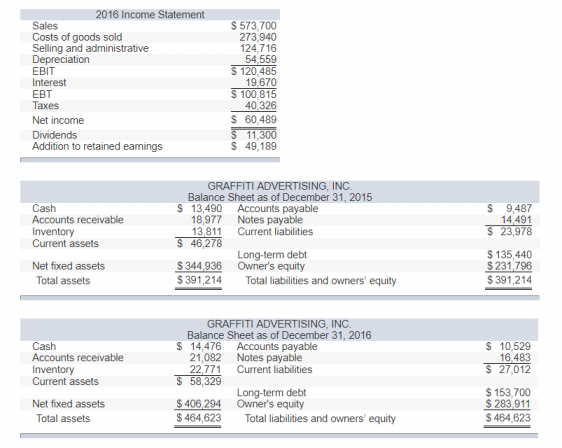

Graffiti Advertising, Inc., reported the following financial statements for the last two years. a. Calculate the operating cash flow. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b.Calculate the change in net working capital. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. Calculate the net capital spending. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

Graffiti Advertising, Inc., reported the following financial statements for the last two years.

a. Calculate the operating cash flow. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

b.Calculate the change in net working capital. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

c. Calculate the net capital spending. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

d. Calculate the cash flow from assets. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

e. Calculate the cash flow to creditors. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

f. Calculate the cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 6 images