> Problems Group A P9-30A Determining asset cost and recording partial-year depreciation, straight-line Discount Parking, near an land improvements, and construct and furnish a small building: Learning Objectives 1, 2 airport, incurred the following costs to acquire land, make 1. Bldg. $461,100 $ 80,000 6,300 b. Delinquent real estate taxes on the land to be paid by Discount Parking c. Additional dirt and earthmoving a. Purchase price of three acres of land 9,000 3,200 d. Title insurance on the land acquisition e. Fence around the boundary of the property 9,600 1,000 f. Building permit for the building g. Architect's fee for the design of the building h. Signs near the front of the property 20,700 9,300 i. Materials used to construct the building 215,000 j. Labor to construct the building 175,000 k. Interest cost on construction loan for the building I. Parking lots on the property 9,400 m. Lights for the parking lots n. Salary of construction supervisor (80% to building; 20% to parking lot and concrete walks) o. Furniture 28,500 11,200 50,000 p. Transportation of furniture from seller to the building q. Additional fencing 11,200 6,600 Discount Parking depreciates land improvements over 15 years, buildings over 40 years, and furniture over 10 years, all on a straight-line basis with zero residual value 2,200

> Problems Group A P9-30A Determining asset cost and recording partial-year depreciation, straight-line Discount Parking, near an land improvements, and construct and furnish a small building: Learning Objectives 1, 2 airport, incurred the following costs to acquire land, make 1. Bldg. $461,100 $ 80,000 6,300 b. Delinquent real estate taxes on the land to be paid by Discount Parking c. Additional dirt and earthmoving a. Purchase price of three acres of land 9,000 3,200 d. Title insurance on the land acquisition e. Fence around the boundary of the property 9,600 1,000 f. Building permit for the building g. Architect's fee for the design of the building h. Signs near the front of the property 20,700 9,300 i. Materials used to construct the building 215,000 j. Labor to construct the building 175,000 k. Interest cost on construction loan for the building I. Parking lots on the property 9,400 m. Lights for the parking lots n. Salary of construction supervisor (80% to building; 20% to parking lot and concrete walks) o. Furniture 28,500 11,200 50,000 p. Transportation of furniture from seller to the building q. Additional fencing 11,200 6,600 Discount Parking depreciates land improvements over 15 years, buildings over 40 years, and furniture over 10 years, all on a straight-line basis with zero residual value 2,200

Chapter17: Property Transactions: §1231 And Recapture Provisions

Section: Chapter Questions

Problem 40P

Related questions

Question

#30

Transcribed Image Text:Plant Assets, Natural Res-

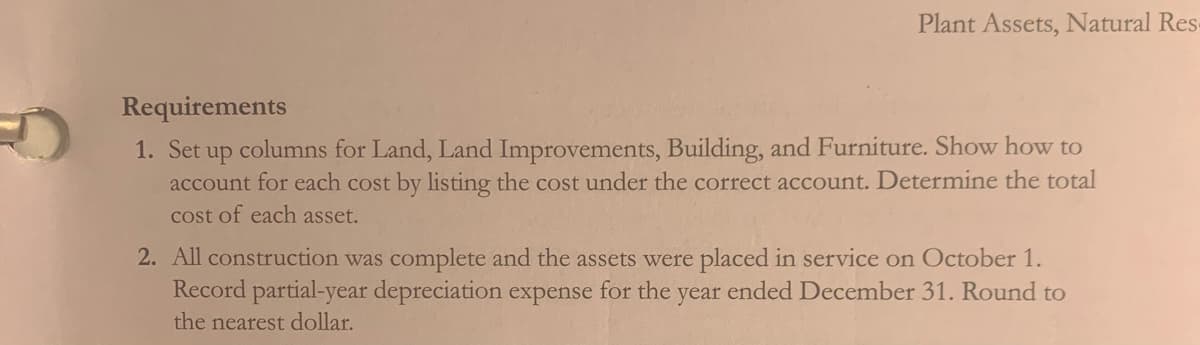

Requirements

1. Set up columns for Land, Land Improvements, Building, and Furniture. Show how to

account for each cost by listing the cost under the correct account. Determine the total

cost of each asset.

2. All construction was complete and the assets were placed in service on October 1.

Record partial-year depreciation expense for the year ended December 31. Round to

the nearest dollar.

Transcribed Image Text:> Problems Group A

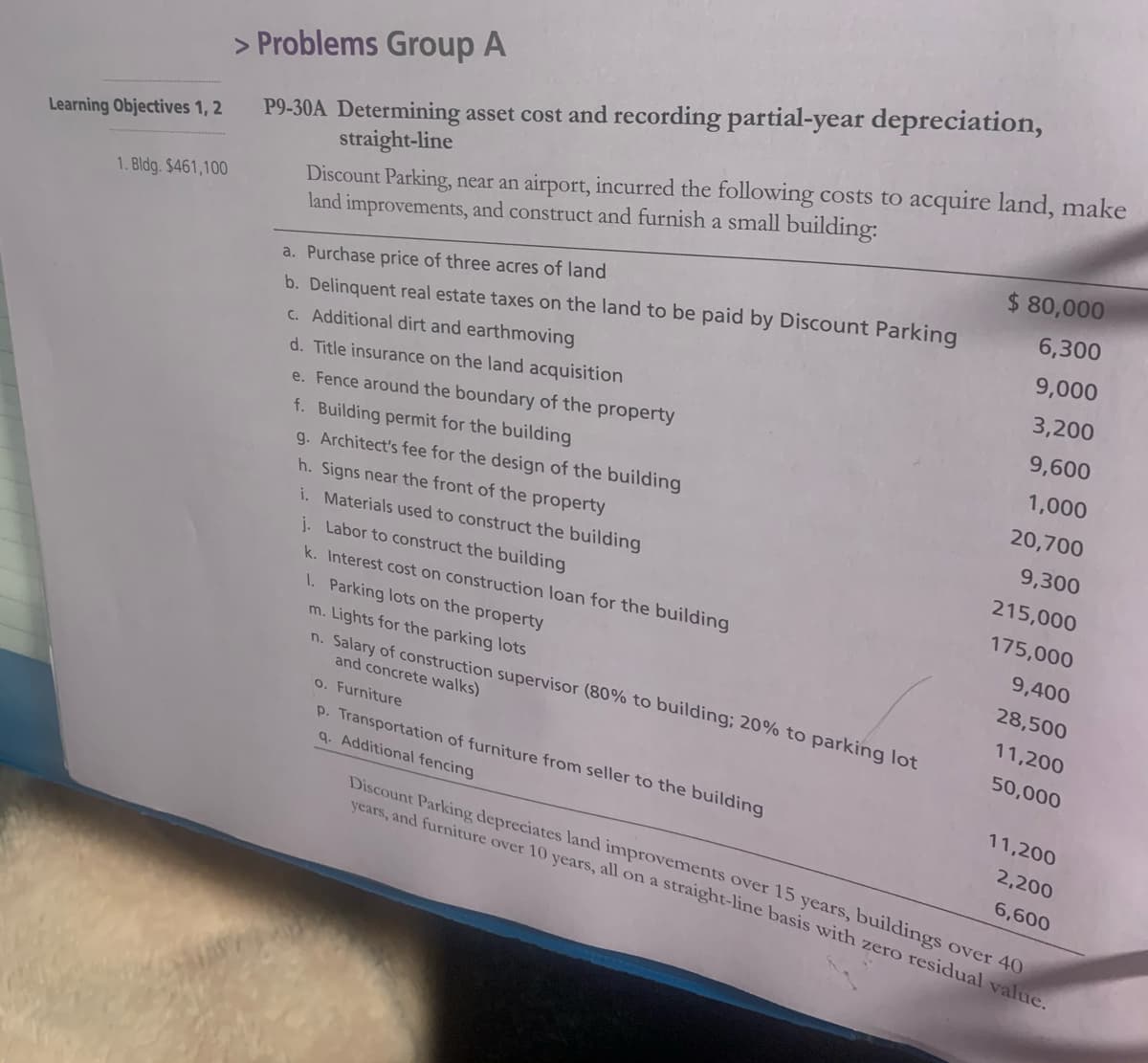

Discount Parking, near an airport, incurred the following costs to acquire land, make

land improvements, and construct and furnish a small building:

P9-30A Determining asset cost and recording partial-year depreciation,

Learning Objectives 1, 2

straight-line

1. Bldg. $461,100

$ 80,000

a. Purchase price of three acres of land

b. Delinquent real estate taxes on the land to be paid by Discount Parking

c. Additional dirt and earthmoving

6,300

9,000

3,200

d. Title insurance on the land acquisition

e. Fence around the boundary of the property

9,600

1,000

f. Building permit for the building

g. Architect's fee for the design of the building

h. Signs near the front of the property

20,700

9,300

i. Materials used to construct the building

215,000

j. Labor to construct the building

175,000

k. Interest cost on construction loan for the building

1. Parking lots on the property

9,400

m. Lights for the parking lots

n. Salary of construction supervisor (80% to building; 20% to parking lot

28,500

11,200

and concrete walks)

o. Furniture

50,000

p. Transportation of furniture from seller to the building

q. Additional fencing

11,200

2,200

Discount Parking depreciates land improvements over 15 years, buildings over 40

6,600

vears, and furniture over 10 years, all on a straight-line basis with zero residual value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning