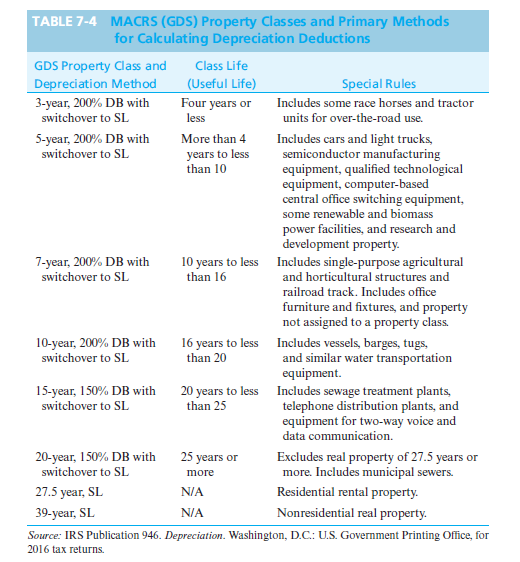

TABLE 7-4 MACRS (GDS) Property Classes and Primary Methods for Calculating Depreciation Deductions Class Life GDS Property Class and Depreciation Method 3-year, 200% DB with switchover to SL (Useful Life) Special Rules Four years or Includes some race horses and tractor less units for over-the-road use. Includes cars and light trucks, semiconductor manufacturing equipment, qualified technological equipment, computer-based central office switching equipment, some renewable and biomass power facilities, and research and development property. 10 years to less Includes single-purpose agricultural and horticultural structures and 5-year, 200% DB with switchover to SL More than 4 years to less than 10 7-year, 200% DB with switchover to SL than 16 railroad track. Includes office furniture and fixtures, and property not assigned to a property class. 10-year, 200% DB with 16 years to less Includes vessels, barges, tugs, and similar water transportation equipment. 20 years to less Includes sewage treatment plants, telephone distribution plants, and equipment for two-way voice and data communication. switchover to SL than 20 15-year, 150% DB with switchover to SL than 25 Excludes real property of 27.5 years or more. Includes municipal sewers. 25 years or 20-year, 150% DB with switchover to SL more 27.5 year, SL N/A Residential rental property. 39-year, SL N/A Nonresidential real property. Source: IRS Publication 946. Depreciation. Washington, D.C.: U.S. Government Printing Office, for 2016 tax returns.

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

A firm purchased and placed in service a new piece of semiconductor

manufacturing equipment. The cost basis for the equipment is $100,000.

Determine (a) the

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images