GreatJob Company buys and sells home appliances and uses the perpetual inventory system. The company has a year-end of December 31. Assume 13% HST on all purchase and sale transactions. During 2020, the company had the following transactions. Purchased vacuum cleaners worth $52,000 from W Wholesalers, by Jan signing a one-year, 7% note payable; interest is to be accrued on 15 December 31 and paid at maturity plus principal. Feb Sold vacuum cleaners for $35,000 cash, which includes a 3-year 4 warranty. GreatJob bought these vacuum cleaners for $21,000. Feb Recorded $19,000 of estimated warranty liability for the year. 4 Feb Paid the full amount owing to W Wholesalers including accrued 15 interest. May Received utilities bill for $2,600, to be paid exactly after 15 days 8 (disregard HST for this transaction). May Paid the utilities bill which was received on May 8. 23 Received $36,160 cash (including $4,160 HST) for the sale of vacuum Jul cleaners which cost the company $19,200. The delivery is to be made 11 on August 31. Aug Delivered the vacuum cleaners paid for on July 11. 31 Prepare journal entries to record the above transactions.

GreatJob Company buys and sells home appliances and uses the perpetual inventory system. The company has a year-end of December 31. Assume 13% HST on all purchase and sale transactions. During 2020, the company had the following transactions. Purchased vacuum cleaners worth $52,000 from W Wholesalers, by Jan signing a one-year, 7% note payable; interest is to be accrued on 15 December 31 and paid at maturity plus principal. Feb Sold vacuum cleaners for $35,000 cash, which includes a 3-year 4 warranty. GreatJob bought these vacuum cleaners for $21,000. Feb Recorded $19,000 of estimated warranty liability for the year. 4 Feb Paid the full amount owing to W Wholesalers including accrued 15 interest. May Received utilities bill for $2,600, to be paid exactly after 15 days 8 (disregard HST for this transaction). May Paid the utilities bill which was received on May 8. 23 Received $36,160 cash (including $4,160 HST) for the sale of vacuum Jul cleaners which cost the company $19,200. The delivery is to be made 11 on August 31. Aug Delivered the vacuum cleaners paid for on July 11. 31 Prepare journal entries to record the above transactions.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 14EB: Anderson Air is a customer of Handler Cleaning Operations. For Anderson Airs latest purchase on...

Related questions

Question

100%

C3.9

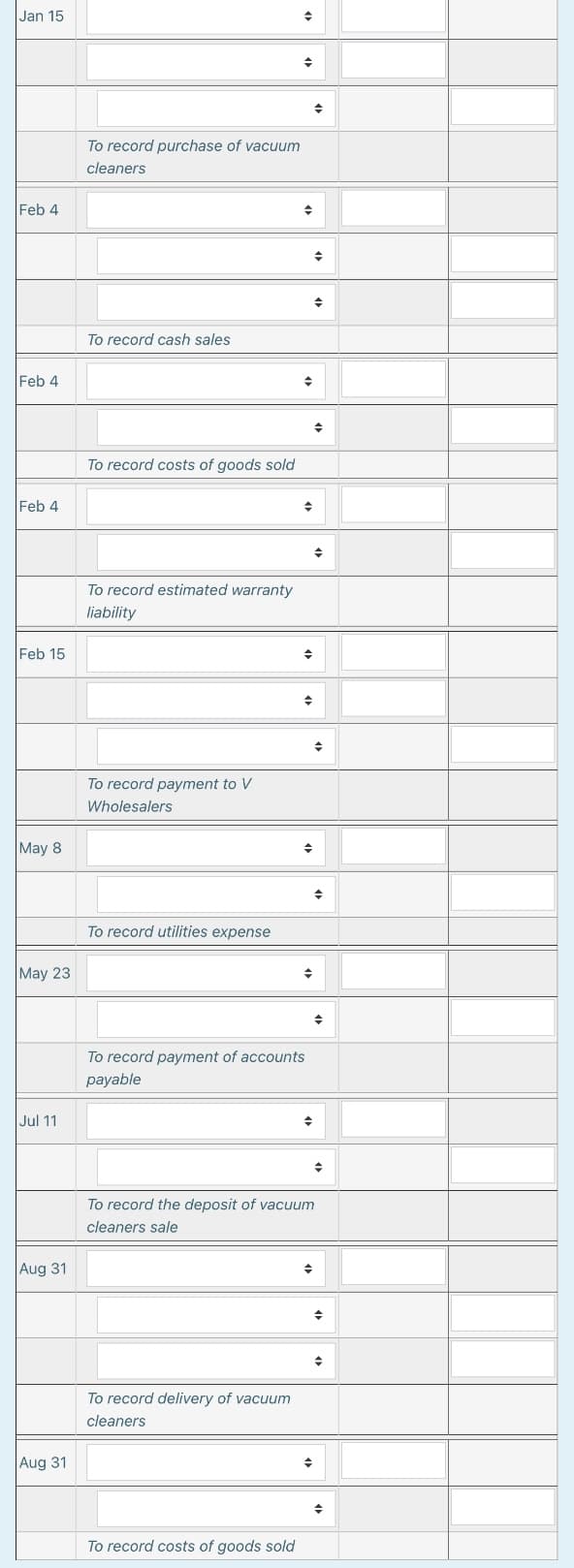

Transcribed Image Text:Jan 15

수

To record purchase of vacuum

cleaners

Feb 4

To record cash sales

Feb 4

To record costs of goods sold

Feb 4

To record estimated warranty

liability

Feb 15

To record payment to V

Wholesalers

May 8

To record utilities expense

May 23

To record payment of accounts

payable

Jul 11

To record the deposit of vacuum

cleaners sale

Aug 31

To record delivery of vacuum

cleaners

Aug 31

To record costs of goods sold

Transcribed Image Text:Take me to the text

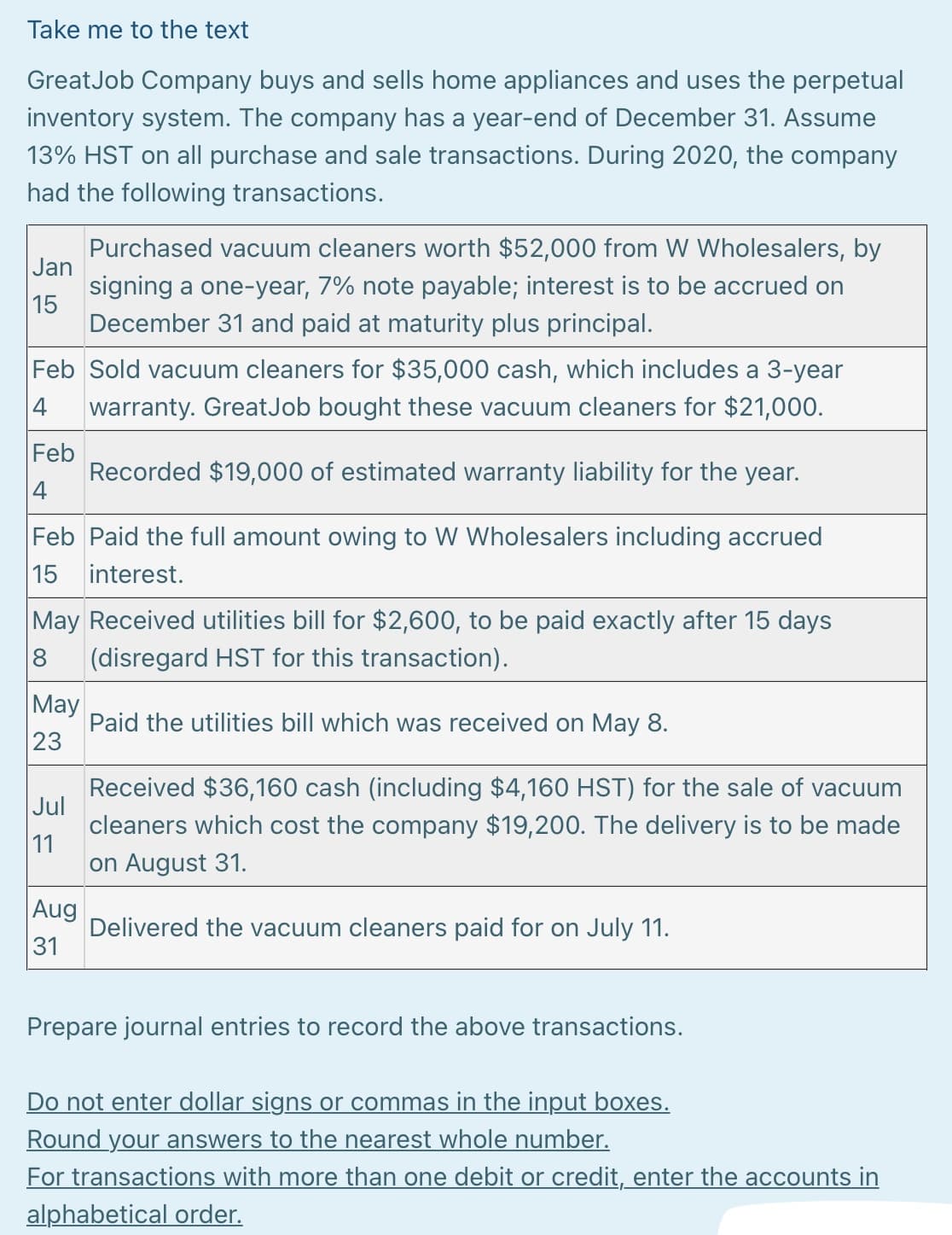

GreatJob Company buys and sells home appliances and uses the perpetual

inventory system. The company has a year-end of December 31. Assume

13% HST on all purchase and sale transactions. During 2020, the company

had the following transactions.

Purchased vacuum cleaners worth $52,000 from W Wholesalers, by

Jan

signing a one-year, 7% note payable; interest is to be accrued on

15

December 31 and paid at maturity plus principal.

Feb Sold vacuum cleaners for $35,000 cash, which includes a 3-year

|4

warranty. GreatJob bought these vacuum cleaners for $21,000.

Feb

Recorded $19,000 of estimated warranty liability for the year.

4

Feb Paid the full amount owing to W Wholesalers including accrued

15 interest.

May Received utilities bill for $2,600, to be paid exactly after 15 days

8

(disregard HST for this transaction).

May

Paid the utilities bill which was received on May 8.

23

Received $36,160 cash (including $4,160 HST) for the sale of vacuum

Jul

cleaners which cost the company $19,200. The delivery is to be made

11

on August 31.

Aug

Delivered the vacuum cleaners paid for on July 11.

31

Prepare journal entries to record the above transactions.

Do not enter dollar signs or commas in the input boxes.

Round your answers to the nearest whole number.

For transactions with more than one debit or credit, enter the accounts in

alphabetical order.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning