Gross income from business (gross of P12, Business Expenses Royalty from books Gain on direct sale to buyer of shares of sto domestic corporation held as capital asset Loss on sale of land in the Philippines held capital asset with cost of P1,500,000 when the zonal value is P1,200,000 w much is the total income tax expense of Ana?

Q: You will perform the following: (0) (ii) 3 LI KID (IV) Select an accounting principle and explain…

A: There are primarily four types of financial statements, each serving different purposes, that are…

Q: Ganado Europe (B). Using facts in the chapter for Ganado Europe, assume as in Problem 11.1 that the…

A: Exchange rate: An exchange rate can be defined as a metric used to compare the value of the currency…

Q: 3 Water Sports Ltd. pays $360 less 25% for a backyard above-ground pool kit. Overhead expenses are…

A: A markdown rate is the difference between the highest price dealers can charge for a product and the…

Q: Please show working and calculations in answers Calculate the value of “Ending Inventory” based on…

A: ENDING INVENTORY Ending inventory is the Physical Value of Stock left at the end of the Period.…

Q: Ohio University has a $150 change fund for each shift. The following is a summary of today’s…

A: Petty cash is the amount of cash set aside for meeting daily business operations. The change fund…

Q: Required: a. Compute the direct material price and efficiency variances. b. Compute the direct labor…

A: Sales activity variance=(units sold-projected units sold)*price per unit $270000(U)=(units…

Q: Roll Board Inc. manufactures several models of high-quality skateboards. The company's ABC system…

A: MARGIN Margin is Computed by deducting Total Cost from Total Sales Value. In other word Margin…

Q: On December 31, 2021, after a slight mishap, Wreckless Transport Co. decides to evaluate its…

A: The question has asked to prepare journal entries about the impairment of assets. Impairment of…

Q: On Sept 1, 2021, Firm A issued a 9-month, 12% promissory note in exchange for cash of $240,000.…

A: In this question, we need to pass journal entry for: Issuance of Notes. Adjusting entry for accrual…

Q: - Determine the materials budget for the year.

A: Meaning of direct material purchase budget This budget shows how much direct material or material is…

Q: First United Bank Inc. is evaluating three capital investment projects using the net present value…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: Sarah has received her bank statement for the month ending November 30, which showed the following:…

A: Answer to Question:- BANK…

Q: TaskMaster employs a standard cost system in which direct materials inventory is carried at standard…

A: Direct Labour Rate Variance :— It is the difference between actual direct labour hours at Standard…

Q: Chapter 17 Homework PR 17-4A Measures of liquidity, solvency, and profitability The comparative…

A: The question has asked to compute the financial ratios. Financial ratios: Financial ratios…

Q: During 2021, Culver Corporation spent $169,920 in research and development costs. As a result, a new…

A: Journal Entry is the primary step to record the transaction in the books of accounts. The expense…

Q: Could you please calculate d. and e. Thank you.

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: Compute the following schedule of food sales by each meal period. If necessary, show the percentages…

A: Lets understand the basics. Management do various type of analysis of sales and cost in order to…

Q: Seasons Hospital uses the allowance method to account for its uncollectible accounts. It has the…

A: Bad debt expense as a percentage of receivables method = (Accounts receivable x Estimated percentage…

Q: S Several years ago, Junior acquired a home that he vacationed in part of the time and rented out…

A: Computation of number of number of days for personal use Personal use = 14 days Rented to…

Q: Question. The Gorman Group issued $900,000 of 13% bonds on June 30, 2021, for $967,707. The bonds…

A: INTRODUCTION: A journal entry is a record of a commercial transaction made in an organization's…

Q: Compute the following for year 2: 2-a. Percentage markup on sales. (Round percentage answer to 1…

A: Since you have posted a question with multiple sub-parts, we will do the first three sub-parts for…

Q: The Fellowes Company has developed standards for direct labor. During June, 75 units were scheduled…

A: Direct Labour rate Variance :— It is the difference between actual hours at standard rate and actual…

Q: A hotel offers a couples weekend package plan for $500. This plan includes accommodations for two…

A: Revenue is the earnings of an entity. It could be either by selling or providing services. It is…

Q: . Prepare the following variance analyses for both chocolates and the total, based on the actual…

A: Particulars calculation Cocoa Sugar a Standard Material required for Dark chocolate (4300 units)…

Q: Jake's Roof Repair has provided the following data concerning its costs: Fixed Cost per Month $…

A: Answer to Question:- Jake's Roof…

Q: Caldwell Supply, a wholesaler, has determined that its operations have three primary activities:…

A: Target cost is the maximum cost which is to be charged from a product in order to earn a desired…

Q: I don't know how I would come up with all the other answers? It only lets me know the asset minus…

A: Part 1a: Workings: Annual straight-line depreciation expense=Cost of asset-Estimated residual…

Q: All questions are mandatory Quran (10) Which of the following combinations of personal assets would…

A:

Q: The amount of gross estate if Angelo was a nonresident alien without reciprocity under the absolute…

A: Gross estate is the which has been on the name of the deceased person like here in the question…

Q: Select a business of your choice, write 10 different transactions for a month, analyze the…

A: Every business involved different time of transactions and different type that are associated with…

Q: Debit Credit Balance, December 31, prior year 13,800 Receipts from customers 82,800 Payments for…

A: Cash flow statement records the cash inflow and cash outflow transaction of the business for that…

Q: C. f. Purchased direct raw materials worth IDR 25,000,000 and indirect raw materials worth IDR…

A: Journal Entry: The process of entering an accounting transaction into the financial records of a…

Q: The home was acquired for $83,000 in 2005. On May 12, 2021, the Arcs installed new fixtures (7-year…

A: INTRODUCTION: Depreciation is the process of subtracting the whole cost of an expensive item…

Q: What will increase the following account items – Debit or Credit? Fill in the blanks. Assets…

A: General Rule :— Debit the Receiver, Credit the Giver. Debit What comes in , Credit What goes out.…

Q: In 1997, many East Asian currencies suddenly and dramatically devalued. What is the percentage…

A: Formula to calculate % change (Increase ) in investment value : (Revised investment value - Intial…

Q: Preferred stock: 10 percent, $14 par value, 40,000 shares authorized Common stock: $9 par value,…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Stock split versus stock dividend-Firm Mammoth Corporation is considering a 3-for-2 stock split. It…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Lany Co. received a government grant of P2,000,000 related to a factory building that it purchased…

A: An entity receives financial help from the government under the terms of a grant when it complies…

Q: Direct Materials and Direct Labor Variance Analysis Shasta Fixture Company manufactures faucets in a…

A: The variance is the difference between standard and actual production costs. The materials variance…

Q: Calculate the market-share and market size variances for Emcee Inc. in 2017. Comment on the results.

A: 1. Market Size Variance =Budgeted Market Share % × (Actual Market Sales Quantity in units – Budgeted…

Q: The Year 1 selling expense budget for Apple Corporation is as follows. Miscellaneous expenses are…

A: Miscellaneous expenses refer to the amount that is incurred on the small transactions that is…

Q: A certain state uses the following progressive tax rate for calculating individual income tax:…

A: Tax liability is the obligation that a taxpayer has to pay on its income. It is paid to the…

Q: Martin Services Company provides their employees vacation benefits and a defined contribution…

A: INTRODUCTION: The amount that a company deducts as an expense for pension obligations owed to…

Q: If a company shows a profit on its Income Statement, how will this affect (a) the Balance Sheet and…

A: Explanation - There are three statements of the organization which show different accounting…

Q: Equipment with a cost of $143,431 has an estimated residual value of $8,131 and an estimated life of…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: Choose the response that correctly states the maximum penalty the IRS can assess against a paid tax…

A: who fails to satisfy the due diligence requirements when preparing a return for an individual.…

Q: Management is planning to increase sales volume 3.75 percent and leave menu prices the same.…

A: Lets understand the basics. Change in total sales can be happen due to either because of, (1) Change…

Q: Purchased $1,100 of computer supplies on credit from Harris Office Products. Note: Enter debits…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Requirement 2. Prepare an unadjusted trial balance. (Exclude any accounts with a zero balance from…

A: 1. Unadjusted Trial Balance: An unadjusted trial balance is a listing of all the business accounts…

Q: (Analyzing operating return on assets) The D. A. Winston Corporation earned an operating profit…

A: Total Asset Turnover Ratio :— It is calculated by dividing sales by total assets. Operating Profit…

Step by step

Solved in 2 steps

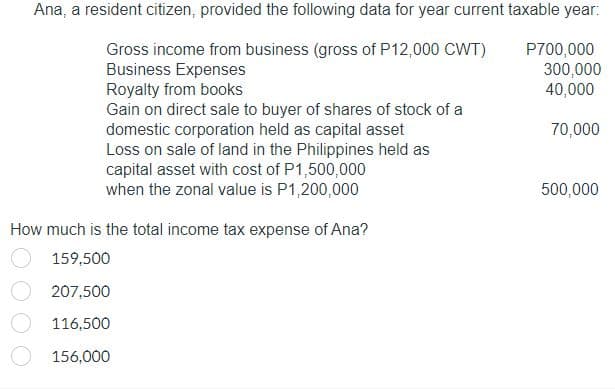

- Ana, a resident citizen, provided the following data for year current taxable year: Gross income from business (gross of P12,000 CWT) P700,000 Business Expenses 300,000 Royalty from books 40,000 Gain on direct sale to buyer of shares of stock of a domestic corporation held as capital asset 70,000 Loss on sale of land in the Philippines held as capital asset with cost of P1,500,000 when the zonal value is P1,200,000 500,000 How much is the income tax payable of Ana? Ana, a resident citizen, provided the following data for year current taxable year: Gross income from business (gross of P12,000 CWT) P700,000 Business Expenses 300,000 Royalty from books…Ana, a self-employed resident citizen provided the following data for 2018 taxable year:Sales P2,800,000Cost of sales 1,125,000Business expenses 650,000Interest income from peso bank deposit 80,000Interest income from bankdeposit under FCDS 120,000Gain on sale of land in the Philippines held ascapital asset with cost P1.5Mwhen zonal is P1.2M 500,000 How much is the total income tax expense of Ana for the year? * P342,500 P321,500 P358,000 P351,500 How much is the total income tax of Ana assuming she opted to be taxed at 8%? * P321,500 P358,000 P342,500 P351,500 Assuming Ana is a VAT-registered taxpayer, how much is her total income tax expense assuming she opted to be taxed at 8% income tax rate? * P342,500 P351,500 P321,500 P358,000 Using the same date except that her gross sales for the year was P3.8M, how much is her total income tax expense assuming she opted to be taxed at 8% income tax rate? * P351,500 P321,500 P342,500 P652,000Ana, a self-employed resident citizen provided the following data for 2018 taxable year:Sales P2,800,000Cost of sales 1,125,000Business expenses 650,000Interest income from peso bank deposit 80,000Interest income from bankdeposit under FCDS 120,000Gain on sale of land in the Philippines held ascapital asset with cost P1.5Mwhen zonal is P1.2M 500,000 Using the same date except that her gross sales for the year was P3.8M, how much is her total income tax expense assuming she opted to be taxed at 8% income tax rate? * P351,500 P321,500 P342,500 P652,000

- Dakota, a self-employeed resident citizen provided the following data for 2018 taxable year sales php 2,800,000 cost of sale 1,125,000 business expenses 650,000 interest income from peso bank deposit 80,000 interest income from deposit under FCDS 120,000 gain on sale of land in the philippines held as a capital asset with cost php 1,500,000 when zonal is php 1,200,000 500,000 How much is the total income tax expense of Dakota for the year P321,500 P342,500 P351,500 P358,000Dakota, a self-employeed resident citizen provided the following data for 2018 taxable year sales php 2,800,000 cost of sale 1,125,000 business expenses 650,000 interest income from peso bank deposit 80,000 interest income from deposit under FCDS 120,000 gain on sale of land in the philippines held as a capital asset with cost php 1,500,000 when zonal is php 1,200,000 500,000 How much is the total income tax of Dakota assuming she opted to be taxed at 8%? P321,500 P342,500 P351,500 P358,000Cong, single, had the following data for 2021 taxable year: Gross business income, Philippines, P1,000,000.00 Gross business income, USA, P500,000.00 Business expenses, Philippines, P700,000.00 Business expenses, USA, P430,000.00 Compensation income, Philippines, P600,000.00 Dividend income from a domestic corporation, P50,000.00 Dividend income from a foreign corporation, P40,000.00 Interest income from peso bank deposit – Philippines, P20,000.00 Interest income from bank deposits abroad, P30,000.00 Interest income from FCDS deposits, P40,000.00 Royalty income from composition, P25,000.00 Raffle draw winnings, P10,000.00 PCSO winnings, P200,000.00 Creditable withholding taxes on business income, P125,000.00 Required: 1. Net Taxable Income 2. Total final taxes on passive income 3. Income Tax Payable *Kindly provide calculations and explanation. Thanks!

- Anji, a resident citizen, realized the following gains from the sale of assets: Capital Gains on sale of shares of a domestic corporation not traded thru PSE (Selling price of P1,120,000, Cost of P1,000,000) - P120,000; Gain on sale of shares of a domestic corporation sold in the PSE (Selling Price of P115,000, Cost of P90,000) - P25,000; Gain on sale of real property located in the Philippines (Selling price P2,000,000, FMV P3,000,000;)- P500,000; Gain on sale of real property abroad (Selling price of P2,000,000, Cost of P1,700,000) - P300,000; How much is the total capital gains tax?X is a resident citizen, realized the following gains from the sale ofassets: Capital Gains on sale of shares of a domestic corporation nottraded thru PSE (Selling price of P1,120,000, Cost of P1,000,000) -P120,000 Gain on sale of shares of a domestic corporation sold in the PSE (Selling Price of P115,000, Cost of P90,000) - P25,000; Gain on sale of real property located in the Philippines (Selling price P2,000,000, FMV P3,000,000;)- P500,000; Gain on sale of real property abroad (Selling price of P2,000,000, Cost of P1,700,000) - P300,000; How much is the total capital gains tax?Kara sold to Mia shares of stock of a foreign corporation at a selling price of P1,000,000 with an acquisition cost of P380,000. On the same date, Kara sold to Mia shares of stock of a domestic corporation at a selling price of P600,000, and an acquisition cost of P400,000. If Kara is a resident citizen and is a dealer in securities, and the shares were sold directly to Mia, how much is the capital gains tax due of Kara from the transaction?

- From the following details of sale of a principal residence located in the Philippines by a resident citizen: Cost - P1,000,000 Fair value - P6,000,000 Selling price - P5,500,000 Proceeds of sale were used to acquire new residence for P4,700,000 Other requirements by BIR/NIRC complied with. Compute the capital gains tax liability of the seller/taxpayer.A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data regarding the sale are as follows: Gain on sale - P500,000 Zonal value - 2,200,000 Cost - 2,000,000 Expenses on sale - 150,000 Compute the capital gains tax.Emma, a U.S. resident, received the following income items for the current tax year. Identify the sourcing of each item as either U.S. or foreign. $10,000 dividend from International Consolidated, Inc., a foreign corporation that reported gross income of $4,000,000 effectively connected with the con- duct of a U.S. trade or business for the immediately preceding three tax years. International’s total gross income for the same period was $12,000,000. $5,000 interest on Warren Corporation bonds. Warren is a U.S. corporation that derived $6,000,000 of its gross income for the immediately preceding three tax years from operation of an active foreign business. Warren’s total gross income for this same period was $7,200,000.