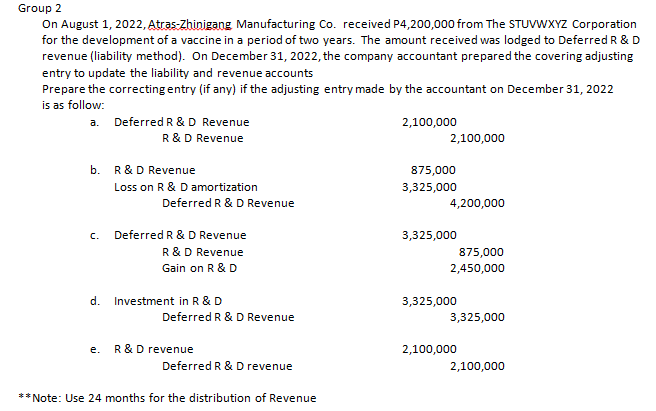

Group 2 On August 1, 2022, AtrasZhinigang Manufacturing Co. received P4,200,000 from The STUVWXYZ Corporation for the development of a vaccine in a period of two years. The amount received was lodged to Deferred R & D revenue (liability method). On December 31, 2022, the company accountant prepared the covering adjusting entry to update the liability and revenue accounts Prepare the correcting entry (if any) if the adjusting entry made by the accountant on December 31, 2022 is as follow: a. Deferred R & D Revenue 2,100,000 R&D Revenue 2,100,000 b. R& D Revenue 875,000 Loss on R & D amortization 3,325,000 Deferred R & D Revenue 4,200,000 c. Deferred R & D Revenue 3,325,000 R&D Revenue 875,000 Gain on R & D 2,450,000 d. Investment in R &D 3,325,000 Deferred R & D Revenue 3,325,000 e. R& D revenue 2,100,000 Deferred R & D revenue 2,100,000 **Note: Use 24 months for the distribution of Revenue

Group 2 On August 1, 2022, AtrasZhinigang Manufacturing Co. received P4,200,000 from The STUVWXYZ Corporation for the development of a vaccine in a period of two years. The amount received was lodged to Deferred R & D revenue (liability method). On December 31, 2022, the company accountant prepared the covering adjusting entry to update the liability and revenue accounts Prepare the correcting entry (if any) if the adjusting entry made by the accountant on December 31, 2022 is as follow: a. Deferred R & D Revenue 2,100,000 R&D Revenue 2,100,000 b. R& D Revenue 875,000 Loss on R & D amortization 3,325,000 Deferred R & D Revenue 4,200,000 c. Deferred R & D Revenue 3,325,000 R&D Revenue 875,000 Gain on R & D 2,450,000 d. Investment in R &D 3,325,000 Deferred R & D Revenue 3,325,000 e. R& D revenue 2,100,000 Deferred R & D revenue 2,100,000 **Note: Use 24 months for the distribution of Revenue

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 29P

Related questions

Question

give the solutions and explain how you come up with that answer

Transcribed Image Text:Group 2

On August 1, 2022, Atras-Zhinigang Manufacturing Co. received P4,200,000 from The STUVWXYZ Corporation

for the development of a vaccine in a period of two years. The amount received was lodged to Deferred R & D

revenue (liability method). On December 31, 2022, the company accountant prepared the covering adjusting

entry to update the liability and revenue accounts

Prepare the correcting entry (if any) if the adjusting entry made by the accountant on December 31, 2022

is as follow:

Deferred R & D Revenue

2,100,000

a.

R&D Revenue

2,100,000

b.

R &D Revenue

875,000

Loss on R & D amortization

3,325,000

Deferred R &D Revenue

4,200,000

Deferred R & D Revenue

3,325,000

c.

R&D Revenue

875,000

Gain on R & D

2,450,000

d. Investment in R & D

3,325,000

Deferred R & D Revenue

3,325,000

e. R&D revenue

2,100,000

Deferred R & D revenue

2,100,000

** Note: Use 24 months for the distribution of Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT