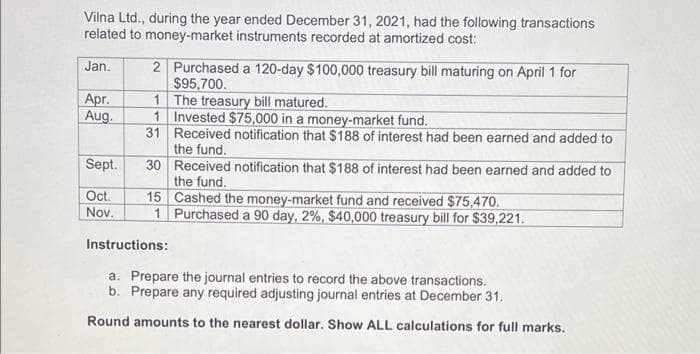

Vilna Ltd., during the year ended December 31, 2021, had the following transactions related to money-market instruments recorded at amortized cost: 2 Purchased a 120-day $100,000 treasury bill maturing on April 1 for $95,700. 1 The treasury bill matured. 1 Invested $75,000 in a money-market fund. 31 Received notification that $188 of interest had been earned and added to the fund. 30 Received notification that $188 of interest had been earned and added to the fund. 15 Cashed the money-market fund and received $75,470. 1 Purchased a 90 day, 2%, $40,000 treasury bill for $39,221. Jan. Apr. Aug. Sept. Oct. Nov. Instructions: a. Prepare the journal entries to record the above transactions. b. Prepare any required adjusting journal entries at December 31. Round amounts to the nearest dollar. Show ALL calculations for full marks.

Vilna Ltd., during the year ended December 31, 2021, had the following transactions related to money-market instruments recorded at amortized cost: 2 Purchased a 120-day $100,000 treasury bill maturing on April 1 for $95,700. 1 The treasury bill matured. 1 Invested $75,000 in a money-market fund. 31 Received notification that $188 of interest had been earned and added to the fund. 30 Received notification that $188 of interest had been earned and added to the fund. 15 Cashed the money-market fund and received $75,470. 1 Purchased a 90 day, 2%, $40,000 treasury bill for $39,221. Jan. Apr. Aug. Sept. Oct. Nov. Instructions: a. Prepare the journal entries to record the above transactions. b. Prepare any required adjusting journal entries at December 31. Round amounts to the nearest dollar. Show ALL calculations for full marks.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 15E: Investments On October 4, 2019, Collins Company purchased 100 bonds of Steph Company for 6,400 as a...

Related questions

Question

Transcribed Image Text:Vilna Ltd., during the year ended December 31, 2021, had the following transactions

related to money-market instruments recorded at amortized cost:

2 Purchased a 120-day $100,000 treasury bill maturing on April 1 for

$95,700.

1 The treasury bill matured.

1 Invested $75,000 in a money-market fund.

31 Received notification that $188 of interest had been earned and added to

the fund.

30 Received notification that $188 of interest had been earned and added to

the fund.

15 Cashed the money-market fund and received $75,470.

1 Purchased a 90 day, 2%, $40,000 treasury bill for $39,221.

Jan.

Apr.

Aug.

Sept.

Oct.

Nov.

Instructions:

a. Prepare the journal entries to record the above transactions.

b. Prepare any required adjusting journal entries at December 31.

Round amounts to the nearest dollar. Show ALL calculations for full marks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning