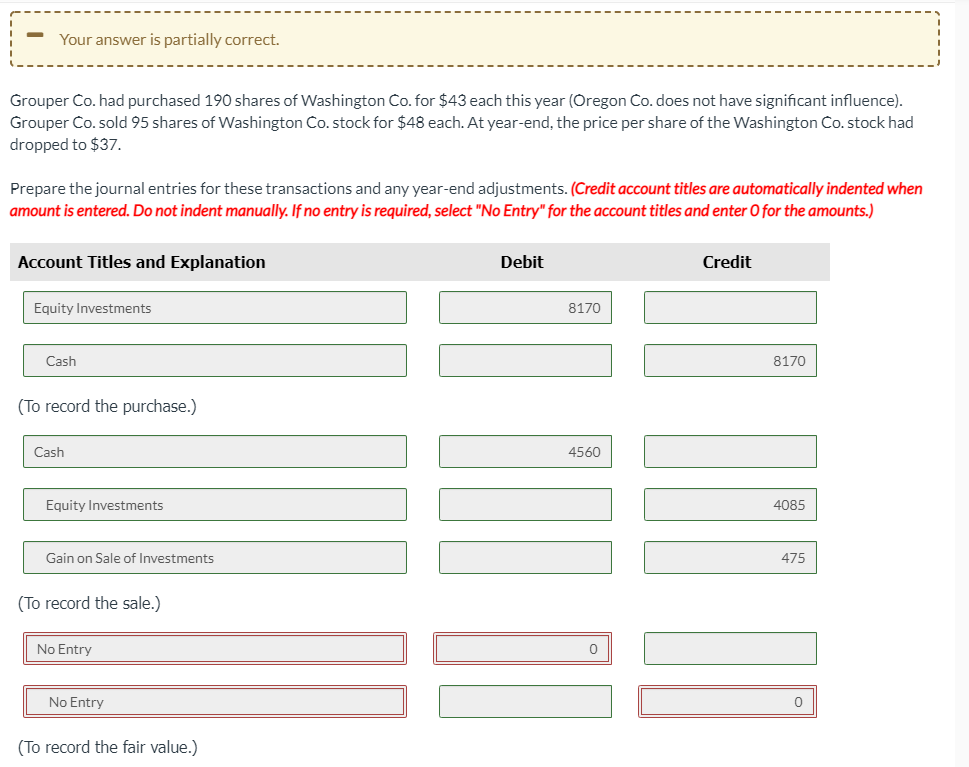

Grouper Co. had purchased 190 shares of Washington Co. for $43 each this year (Oregon Co. does not have significant influence). Grouper Co. sold 95 shares of Washington Co. stock for $48 each. At year-end, the price per share of the Washington Co. stock had dropped to $37. Prepare the journal entries for these transactions and any year-end adjustments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Equity Investments 8170 Cash 8170 (To record the purchase.) Cash 4560 Equity Investments 4085 Gain on Sale of Investments 475 (To record the sale.) No Entry No Entry (To record the fair value.)

Grouper Co. had purchased 190 shares of Washington Co. for $43 each this year (Oregon Co. does not have significant influence). Grouper Co. sold 95 shares of Washington Co. stock for $48 each. At year-end, the price per share of the Washington Co. stock had dropped to $37. Prepare the journal entries for these transactions and any year-end adjustments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Equity Investments 8170 Cash 8170 (To record the purchase.) Cash 4560 Equity Investments 4085 Gain on Sale of Investments 475 (To record the sale.) No Entry No Entry (To record the fair value.)

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter20: Corporations: Organization And Capital Stock

Section: Chapter Questions

Problem 1CP: Prepare general journal entries for the following transactions, identifying each transaction by...

Related questions

Question

ENTERED AS NO ENTRY AND WHERE MARKED WRONG.

LIST OF ACCOUNTS

- Accumulated Other Comprehensive Loss

- Allowance for Doubtful Accounts

- Allowance to Reduce Inventory to Market

Bad Debt Expense- Bonds Payable

- Cash

- Call Option

- Common Stock

- Cost of Goods Sold

- Debt Investments

- Dividend Revenue

- Dividend Receivable

- Equity Investments

- Fair Value Adjustment

- Futures Contract

- Gain on Sale of Investments

- Gain on Settlement of Call Option

- Gain on Settlement of Put Option

- Interest Expense

- Interest Receivable

- Interest Revenue

- Inventory

- Investment Income

- Loss on Impairment

- Loss on Sale of Investments

- Loss on Settlement of Call Option

- Loss on Settlement of Put Option

- No Entry

- Notes Payable

- Paid-in Capital in Excess of Par - Common Stock

- Put Option

- Recovery of Loss from Impairment

Retained Earnings - Revenue from Investment

- Sales Revenue

- Swap Contract

- Unrealized Holding Gain or Loss - Equity

- Unrealized Holding Gain or Loss - Income

Transcribed Image Text:Your answer is partially correct.

Grouper Co. had purchased 190 shares of Washington Co. for $43 each this year (Oregon Co. does not have significant influence).

Grouper Co. sold 95 shares of Washington Co. stock for $48 each. At year-end, the price per share of the Washington Co. stock had

dropped to $37.

Prepare the journal entries for these transactions and any year-end adjustments. (Credit account titles are automatically indented when

amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Equity Investments

8170

Cash

8170

(To record the purchase.)

Cash

4560

Equity Investments

4085

Gain on Sale of Investments

475

(To record the sale.)

No Entry

No Entry

(To record the fair value.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT