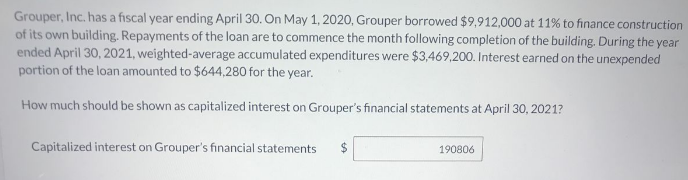

Grouper, Inc. has a fiscal year ending April 30. On May 1, 2020, Grouper borrowed $9,912,000 at 11% to finance construction of its own building. Repayments of the loan are to commence the month following completion of the building. During the year ended April 30, 2021, weighted-average accumulated expenditures were $3,469,200. Interest earned on the unexpended portion of the loan amounted to $644,280 for the year. How much should be shown as capitalized interest on Grouper's financial statements at April 30, 2021? Capitalized interest on Grouper's financial statements 190806

Grouper, Inc. has a fiscal year ending April 30. On May 1, 2020, Grouper borrowed $9,912,000 at 11% to finance construction of its own building. Repayments of the loan are to commence the month following completion of the building. During the year ended April 30, 2021, weighted-average accumulated expenditures were $3,469,200. Interest earned on the unexpended portion of the loan amounted to $644,280 for the year. How much should be shown as capitalized interest on Grouper's financial statements at April 30, 2021? Capitalized interest on Grouper's financial statements 190806

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

Transcribed Image Text:Grouper, Inc. has a fiscal year ending April 30. On May 1, 2020, Grouper borrowed $9,912,000 at 11% to finance construction

of its own building. Repayments of the loan are to commence the month following completion of the building. During the year

ended April 30, 2021, weighted-average accumulated expenditures were $3,469,200. Interest earned on the unexpended

portion of the loan amounted to $644,280 for the year.

How much should be shown as capitalized interest on Grouper's financial statements at April 30, 2021?

Capitalized interest on Grouper's financial statements

190806

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College