Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $270,000 immediately and signing a noninterest-bearing note requiring the company to pay $670,000 on March 28, 2023. An interest rate of 8% properly reflects the time value of money for this type of loan agreement. Title search, insurance, and other closing costs totaling $27,000 were paid at closing. At the end of April, the old building was demolished at a cost of $77,000, and an additional $57,000 was paid to clear and grade the land. Construction of a new building began on May 1 and was completed on October 29. Construction expenditures were as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) May 1 $ 2,250,000 July 30 1,850,000 September 1 1,320,000 October 1 2,220,000 San Antonio borrowed $4,100,000 at 8% on May 1 to help finance construction. This loan, plus interest, will be paid in 2022. The company also had a $5,950,000, 8% long-term note payable outstanding throughout 2021. In November, the company purchased 10 identical pieces of equipment and office furniture and fixtures for a lump-sum price of $670,000. The fair values of the equipment and the furniture and fixtures were $539,000 and $231,000, respectively. In December, San Antonio paid a contractor $320,000 for the construction of parking lots and for landscaping. Question: 1. Determine the initial values of the various assets that San Antonio acquired or constructed during 2021. The company uses the specific interest method to determine the amount of interest capitalized on the building construction. (Hint: Expenditures on March 28 and April 30 to acquire land on which to construct the building are included as part of accumulated expenditures for determining the amount of interest capitalized on the building. This means the interest capitalization period begins on March 28.) I only want to figure out the initial value of the building. I get a value of $7,799,400 (see attached) but it is incorrect. I suspect it has something to do with the hint (see question 1), but I can't seem to get the "correct" value.

Early in its fiscal year ending December 31, 2021, San Antonio Outfitters finalized plans to expand operations. The first stage was completed on March 28 with the purchase of a tract of land on the outskirts of the city. The land and existing building were purchased by paying $270,000 immediately and signing a noninterest-bearing note requiring the company to pay $670,000 on March 28, 2023. An interest rate of 8% properly reflects the time value of money for this type of loan agreement. Title search, insurance, and other closing costs totaling $27,000 were paid at closing.

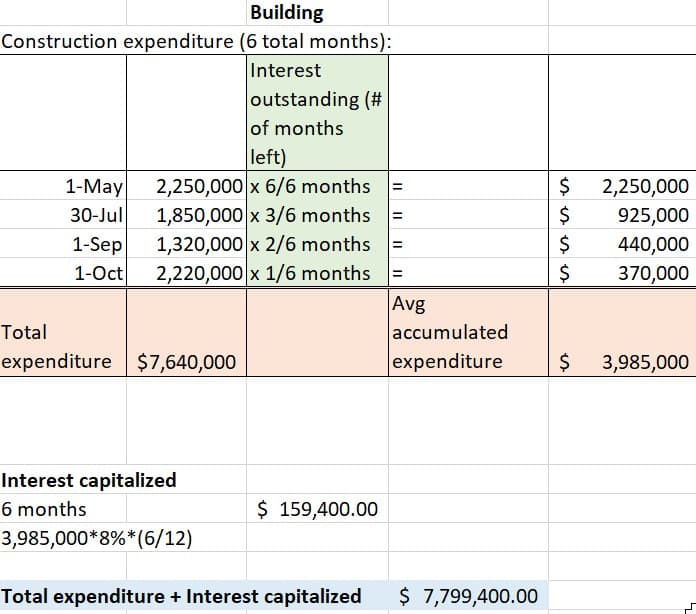

At the end of April, the old building was demolished at a cost of $77,000, and an additional $57,000 was paid to clear and grade the land. Construction of a new building began on May 1 and was completed on October 29. Construction expenditures were as follows: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)

| May 1 | $ | 2,250,000 | |

| July 30 | 1,850,000 | ||

| September 1 | 1,320,000 | ||

| October 1 | 2,220,000 | ||

San Antonio borrowed $4,100,000 at 8% on May 1 to help finance construction. This loan, plus interest, will be paid in 2022. The company also had a $5,950,000, 8% long-term note payable outstanding throughout 2021.

In November, the company purchased 10 identical pieces of equipment and office furniture and fixtures for a lump-sum price of $670,000. The fair values of the equipment and the furniture and fixtures were $539,000 and $231,000, respectively. In December, San Antonio paid a contractor $320,000 for the construction of parking lots and for landscaping.

Question:

1. Determine the initial values of the various assets that San Antonio acquired or constructed during 2021. The company uses the specific interest method to determine the amount of interest capitalized on the building construction. (Hint: Expenditures on March 28 and April 30 to acquire land on which to construct the building are included as part of accumulated expenditures for determining the amount of interest capitalized on the building. This means the interest capitalization period begins on March 28.)

I only want to figure out the initial value of the building. I get a value of $7,799,400 (see attached) but it is incorrect. I suspect it has something to do with the hint (see question 1), but I can't seem to get the "correct" value.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Hi I've attempted to use your method for calculated interest, but it is registered as incorrect as well. I've tried changing the period amounts...same results. Don't know what could be going wrong.