Gurrent Previous Year Year Accounts payable $ 924,000 $ 800,000 Gurrent maturities of serial bonds 200,000 200,000 | раyable Serial bonds payable. 10% 1,000,000 1,200,000 Common stock $10 par value 250,000 250,000 Paid-in capital in excess of par 1,250,000 1,250,000 Retained earnings 860,000 500,000

Q: Ratio of liabilities to stockholders' equity The following data were taken from Alvarado Company's…

A: Liabilities to stockholders equity ratio = Total liabilities/Total stockholders equity

Q: Ratio of Liabilities to Stockholders' Equity and Number of Times Interest Earned The following data…

A: Ratio of liabilities to stockholders' equity = Total liabilities / Stockholders' equity

Q: A company's net income before interest & tax was OMR 400000 for its most recent year. The company's…

A: Formula used: Times interest earned ratio = Net income before interest & taxInterest expense

Q: e Retained Earnings balance was $23,700 on January 1 Net income for the year was $19.300, If…

A: Dividend declared during the year = Beginning retained earnings + Net income - Ending retained…

Q: Ratio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were…

A: Ratio analysis is done to compare data of two years or items provided in the financial statements to…

Q: The right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of…

A: Net income =$148 million Last year retained earnings = $476 million Current year retained earnings…

Q: Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one…

A: Since you have posted a question with multiple questions, we will solve the first question for you.…

Q: Averill Products Inc. reported the following on the company's income statement in two recent years:…

A: a. Calculate the time interest earned ratio for the current year and the prior year

Q: Ratio of liabilities to stockholders' equity The following data were taken from Alvarado Company's…

A: Ratio of liabilities to stockholders equity :— It is calculated by dividing total liabilities by…

Q: The following data were taken from the financial statements of Loveseth Inc. for the current fiscal…

A: Accounting Ratios are defined as the group of the metric used for evaluating the profitability as…

Q: Adieu Company reported the following current assets and current liabilities for two recent years:…

A: The quick ratio is the ratio that is used to check the liquidity of the company. In the quick ratio,…

Q: The comparative accounts payable and long-term debt balances for a company follow.…

A: Horizontal AnalysisHorizontal analysis refers to the measurement of percentage change in the…

Q: Ratio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were…

A: Formulae for interest earned ratio is = EBITDA/Interest expense EBITDA= Earnings before interest,…

Q: The comparative accounts payable and long-term debt balances for a company follow. Current Year…

A: The comparative financial statements present the figures for successive years side by side, along…

Q: Six Measures of Solvency or Profitability The following data were taken from the financial…

A: Ratio: It is the relation between the two numbers of the same kind. It is usually expressed as “a”…

Q: Selected information taken from the financial statements of Wiley Company for two successibe years…

A: Percentage change = (Amount for comparision year - Amount for Base year) / Amount for Base year

Q: Current Position Analysis The following data were taken from the balance sheet of Nilo Company at…

A: Ratio analysis is a method of measuring the financial position of the organization with different…

Q: Selected balance sheet data follow for Zeveea Company for the year ended December 31 (in millions).…

A: Given that, Total Liabilities = $11315 Total Liabilities and Share holders equity = $16511

Q: The income statement for Hudson Company reported net income of $345,000 for the year ended December…

A:

Q: Ratio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were…

A: 1. Total Liabilities includes current liabilities as well as non current liabilities : Calculation…

Q: A. Gympa reported on its income statement a net income $647,000 for the year ended December 31…

A: Note: Since you have asked multiple question, we will solve the first question for you. If you want…

Q: Ratio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were…

A: The ratio analysis helps to analyse the financial statements of the business.

Q: The comparative accounts payable and long-term debt balances for a company follow. Current Year…

A: Formula: Amount of change = Current year - previous year Percentage change = [ ( Current year -…

Q: Ratio the liabilities to stockholders equity and times interest earned. following data were taken…

A: Times-Interest Earned Ratio is determined to analyze the capability of satisfy interest obligation…

Q: Six Measures of Solvency or Profitability The following data were taken from the financial…

A: d. Return on total assets (ROTA): The return on total assets calculates the profit generating…

Q: Ratio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were taken…

A: Calculate interest expense:

Q: Adieu Company reported the following current assets and current liabilities for two recent years:…

A: A ratio that measures the ability of a company to pay current liability through its near cash or…

Q: Current Position Analysis The following data were taken from the balance sheet of Albertini Company…

A: Working capital, which comprises inventory, cash, accounts payable, accounts receivable, and…

Q: a. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one…

A: Ratio Analysis: This refers to the performance measurement of the business, in order to know the…

Q: The right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of…

A: Since, more than one un-related question is posted, only first question is answered here. Please…

Q: Ratio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were taken…

A: Ratio analysis: The analysis of a company using the financial ratios and comparing its trends and…

Q: Current Position Analysis The following data were taken from the balance sheet of Nilo Company at…

A: a Current Year Previous Year Total current assets 1,856,000 1,300,000 Less: Total…

Q: Ratio of Liabilities to Stockholders' Equity and Times Interest Earned The following data were taken…

A: Ratio analysis is a tool used to measure and evaluate the financial condition and profitability of a…

Q: Determine for each year 1 capital, 2 the current ratio, and 3 the quick ratio. Round ratio to one…

A: Current Ratio: This ratio represents the liquidity ratio measuring the capability of the firm to pay…

Q: Instructions a. Compute the following (round to one decimal place): 1. Current ratio 3. Working…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: The following data were taken from the balance sheet of Albertini Company at the end of two recent…

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the…

Q: imes interest earned Berry Company reported the following on the company's income statement in two…

A: Time interest earned is a measurement of an organization's capacity to meet the debt obligation…

Q: a. Determine the ratio of liabilities to stockholders' equity at the end of each year. Round to one…

A: Financial Ratios: Financial ratios are the metrics used to evaluate the liquidity, capabilities,…

Q: I'm having trouble solving this problem. Thanks!

A: (a) Determine the times interest earned ratio:

Q: Current Position Analysis The following data were taken from the balance sheet of Nilo Company at…

A: Current assets are those type of assets which are either in cash or can be converted into cash into…

Q: The following data were taken from Alvarado Company’s balance sheet: Dec. 31, 20Y4 Dec. 31,…

A: The ratio of liabilities to stakeholder's equity can be calculated by dividing a company's…

Q: Balance sheet and income statement data indicate the following: Company A Company B $1,200,000…

A: The bond and the income data of two companies is given to us. Based on the data, we are required to…

Q: Berry Company reported the following on the company's income statement in two recent years: Current…

A: Requirement a:Calculate the times-interest earned ratio for the current year and the prior year.

Q: Current Position Analysis The following data were taken from the balance sheet of Nilo Company at…

A: Working capital indicate the short term liquid funds available after meeting all the current…

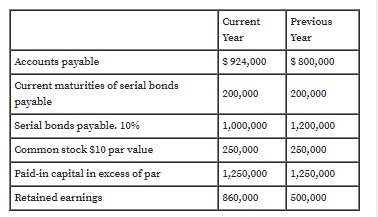

Ratio of liabilities to

The following data were taken from the financial statements of Hunters Inc.for December 31 of two recent years:

The income before income tax was $480,000 and $420,000 for the current and previous years,respectively.

a. Determine the ratio of liabilities to stockholders equity at the end of each year.Round to one decimal place.

b. Determine the times interest earned ratio for both years.Round to one decimal place.

c. What conclusion can be drawn from these data as the company's ability to meet its currently maturing debts?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Peoples Bank Ltd.Balance sheetAs at 31/03/2021Assets $(000) Liab. & Equity $(000)Cash 50,000 Payables 50,000Short term Invest 50,000 short term deposits 500,000Long term Invest. 180,000 long term deposits. 180,000Loans 550,000 Long-term bonds 50,000Other 50,000 Equity 100,000Total 880,000 880,000 The long-term investment portfolio comprises shares in an associate company (25%), azero-coupon bond (25%), government fixed rate bonds (40) and shares in publicly tradedcompanies (10%).The loan portfolio is composed as follows: 10% residential mortgages, 50% consumerand 40% commercial. The loan portfolio has a 5% delinquency, and the average return is8%. Fixed rate loans are 60% and floating rate 40%.Deposits are primarily short term. The renewal rate is declining and expected to continueinto the medium term. The average deposit rate is 4%.Interest rates are expected to rise in the short term for both, loans and deposits. A. Based on the balance sheet and the information above, identify…Peoples Bank Ltd.Balance sheetAs at 31/03/2021Assets $(000) Liab. & Equity $(000)Cash 50,000 Payables 50,000Short term Invest 50,000 short term deposits 500,000Long term Invest. 180,000 long term deposits. 180,000Loans 550,000 Long-term bonds 50,000Other 50,000 Equity 100,000Total 880,000 880,000 The long-term investment portfolio comprises shares in an associate company (25%), azero-coupon bond (25%), government fixed rate bonds (40) and shares in publicly tradedcompanies (10%).The loan portfolio is composed as follows: 10% residential mortgages, 50% consumerand 40% commercial. The loan portfolio has a 5% delinquency, and the average return is8%. Fixed rate loans are 60% and floating rate 40%.Deposits are primarily short term. The renewal rate is declining and expected to continueinto the medium term. The average deposit rate is 4%.Interest rates are expected to rise in the short term for both, loans and deposits. A. Recommend to management two strategies to reduce each risk B.…l-Itihad Corporation Balance SheetDecember 31, 2019AssetsLiability & EquityCurrent AssetsCurrent LiabilityCash$5,000Accounts payable22,000Short term securities10,000Accrual Account8,000Account Receivables30,000Short term debt6,000Inventory32,000Total Current Liability36,000Long-term debt40,000Total Current Assets77,000TotalLiability76,000Long term AssetsEquityNet Property & equipment70,000CommonStocks64,000Retained earnings17,000Total Equity81,000Total Liability and Equity157,000Other assts 10000Total Assets157,000Sur Corporation Income StatementDecember 31, 2019Other Financial information of Sur corporation December 31, 2019Net sales (revenue)$150,000· Average Number of Common shares outstanding 16,000 Shares· Market price of Common share $3.5Cost of goods sold80,000Gross profit70,000Operating expenses30,000EBIT- (Operating profit)40,000Interest expense10,000EBT- ( Earnings before taxes)30,000Income tax 10,000Net Income (net profit)20,000You have to find the following ratios…

- Presented below is the trial balance of Walter Corporation at December 31, 2020.Cash 197,000Sales 7,900,000Trading Securities (at cost, P145,000) 153,000Cost of goods sold 4,800,000Long-term investments in bonds 299,000Long-term investment in share capital - ordinary 277,000Short-term notes payable 90,000Accounts payable 455,000Selling expenses 2,000,000Investment revenue 63,000Land 260,000Buildings 1,040,000Dividends payable 136,000Accrued liabilities 96,000Accounts receivables 435,000Accumulated Depreciation – Building 352,000Allowance for doubtful accounts 25,000Administrative Expenses 900,000Interest Expense 211,000Inventories 597,000Provision for pension (long term) 80,000Long term notes payable 900,000Equipment 600,000Bonds Payable 1,000,000Accumulated Depreciation – Equipment 60,000Franchise 160,000Shares Capital – Ordinary 1,000,000Treasury Shares 191,000Patent 195,000Retained Earnings 78,000Other comprehensive income 80,000 Requirements:1. How much is the total assets?2. How…1. Avalanche Inc. revealed the following information for the year ended December 31. 2021 Preference share. P100 par-P2.4 million; Share premium, preference - P700,000; Ordinary share, P15 par-P3.5 million, Share premium, ordinary-P1.5 million. Subscribed ordinary share - P100,000, Retained earnings - P2 million, Subscription receivable, ordinary - P20,000 How much is the legal capital? A.P6 million B.PB 1 million CP5.9 million D.P8 2 million 2.At the beginning of 2021, DAI Corp. was organized with authorized capital of 200,000, P500 par value shares. The following transactions transpired during its first year of business. February 4- Issued 15.000 shares at P510 per share April 10- Issued 3,000 shares for services received (FMV of the services is P1.7 million). October 23-Issued 5,000 shares in exchange for a land (FMV) the land is P3 million) What amount should be reported as share premium? A.11.500.000 B. 23.000 C.850.000 D.12.350.000 3. At the beginning of 2021, DAI Corp. was…Q14 An entity issued 1 500 debentures with face value of R20 000 each. The coupon rate on the debentures is 12% paid annually in arrears. In order to speed the sale of the debentures, the directors decided to issue them at 10% discount. What amount would be recorded by the entity in its statement of financial position under non-current liabilities? Select one: a. R20 000 b. R15 000 000 c. R30 000 000 d. R27 000 000

- ABC Company provided the following information on December 31, 2020Share capital 5,000,000Subscribed share capital 3,000,000Subscription receivable 2,000,000Share premium 1,500,000Treasury Shares, at cost 700,000Retained Earnings 1,000,000Cumulative unrealized gain on Financial Asset at FVOCI 600,000What is the contributed capital on December 31, 2020?Please provide solutions and explanation. Thank you so much. 1. On April 1, 20x1, Ronald Ryan Co. acquired 12%, P4,000,000 bonds dated January 1, 20x1 at 98 including interest. The bonds mature on December 31, 20x3 but pays annual interest at each year-end. How much is the initial carrying amount of the investment? a. 3,920,000 b. 3,800,000 c. 4,000,000 d. 4,120,000 2. On January 1, 20x1, Mitch Co. acquired 12%, P4,000,000 bonds at 98. Commission paid to brokers amounted to P204,000. Principal is due on December 31, 20x4 but interest payments are made annually starting December 31, 20x1. The adjusted effective interest rate on the investment is closest to a. 12% b. 11% c. 10.2650% d. indeterminable 3. Use the following information for the next three questions: On January 1, 20x1, ABC Co. acquired 10%, ₱1,000,000 bonds for ₱827,135. The bonds mature on December 31, 20x3 and pay annual interest every December 31. ABC Co. incurred transaction costs ₱80,000 on the acquisition.…Durable Co.’s December 30, 20X0, balance sheet contained the following items in the long-term liabilities section: Unsecured 9.375% registered bonds (P25,000 maturing annually beginning in 20x4) ₱275,000 11.5% convertible bonds, callable beginning in 20x9, due 2010 125,000 Secured 9.875% guarantee security bonds, due 2x10 ₱250,000 10.0% commodity backed bonds (P50,000 maturing annually beginning in 20x5) 200,000 What are the total amounts of serial bonds and debenture bonds?

- Paul Company presented the following information pertaining to its investments in equity securities. FVPL FVOCICost P1,000,000 P1,000,000Market value December 31, 2020 1,050,000 980,000 December 31, 2019 950,000 920,0001. What amount should Paul Company report as unrealized gain on its 2020 profit or loss? a. P160,000 b. P110,000 c. P100,000 d. P 50,000 2.What amount should Paul report as unrealized gains/losses in the shareholders' equity of its December 31, 2020 statement of financial position? a. P60,000 credit b. P20,000 debit c. P80,000 debit d. P20,000 credit1. Computational. On January 1, 20x1, ABC purchased bonds with face amount of P5,000,000. The entity paid P4,700,000 plus transaction cost of P42,130 for the bond investment. The business model of the entity in managing the financial asset is to collect contractual cash flows that are solely payment of principal and interest and also to sell the bonds the open market. The bonds mature on December 31, 20x3 and pays 6% interest annually on December 31 each year with 8% effective interest rate (after incorporating the transaction cost on initial recognition). The bonds are quoted at 106 and 108 on December 31, 20x1 and December 31, 20x2. The bonds are sold at 103 on July 1, 20x3, excluding accrued interest. Use 4-decimal present value factor. For the year ended December 31, 20x3, how much is the total impact to profit or loss as a result of the business model of ABC in holding this investment? (sample answer: 2,350,450.55)Paul Company presented the following information pertaining to its investments in equity securities. FVPL FVOCICost P1,000,000 P1,000,000Market value December 31, 2020 1,050,000 980,000 December 31, 2019 950,000 920,000 2.What amount should Paul report as unrealized gains/losses in the shareholders' equity of its December 31, 2020 statement of financial position?