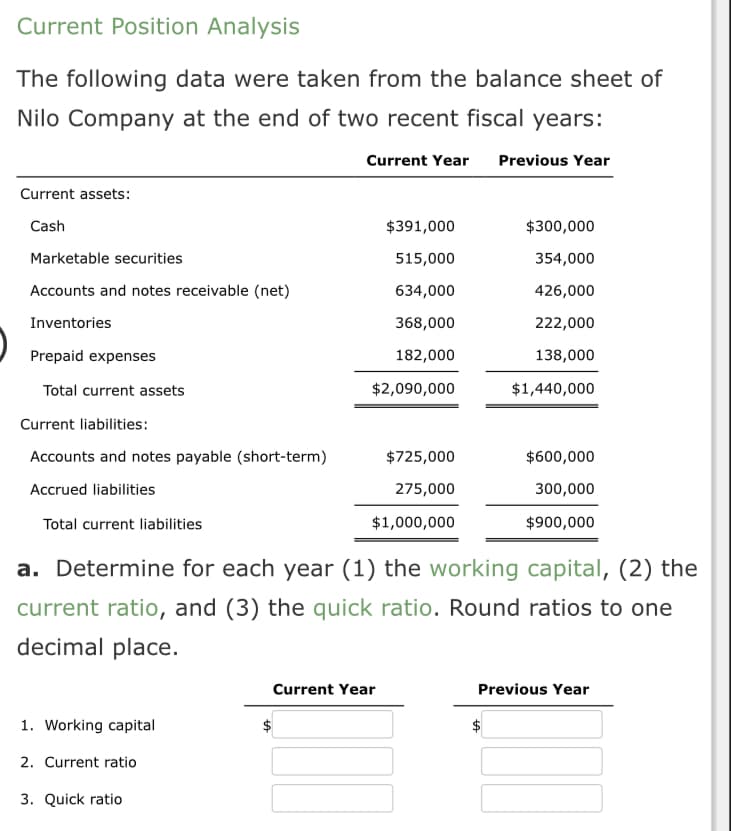

Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities Current Year Previous Year 1. Working capital 2. Current ratio 3. Quick ratio $391,000 515,000 634,000 368,000 182,000 $2,090,000 $725,000 275,000 $1,000,000 $300,000 354,000 426,000 222,000 138,000 $1,440,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year $600,000 300,000 $900,000 Previous Year

Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses Total current assets Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities Current Year Previous Year 1. Working capital 2. Current ratio 3. Quick ratio $391,000 515,000 634,000 368,000 182,000 $2,090,000 $725,000 275,000 $1,000,000 $300,000 354,000 426,000 222,000 138,000 $1,440,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year $600,000 300,000 $900,000 Previous Year

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 6E: The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal...

Related questions

Question

Transcribed Image Text:Current Position Analysis

The following data were taken from the balance sheet of

Nilo Company at the end of two recent fiscal years:

Current assets:

Cash

Marketable securities

Accounts and notes receivable (net)

Inventories

Prepaid expenses

Total current assets

Current liabilities:

Accounts and notes payable (short-term)

Accrued liabilities

Total current liabilities

1. Working capital

2. Current ratio

Current Year Previous Year

3. Quick ratio

$391,000

515,000

634,000

368,000

182,000

$2,090,000

$725,000

275,000

$1,000,000

a. Determine for each year (1) the working capital, (2) the

current ratio, and (3) the quick ratio. Round ratios to one

decimal place.

Current Year

$300,000

354,000

426,000

222,000

138,000

$1,440,000

$600,000

300,000

$900,000

LA

Previous Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning