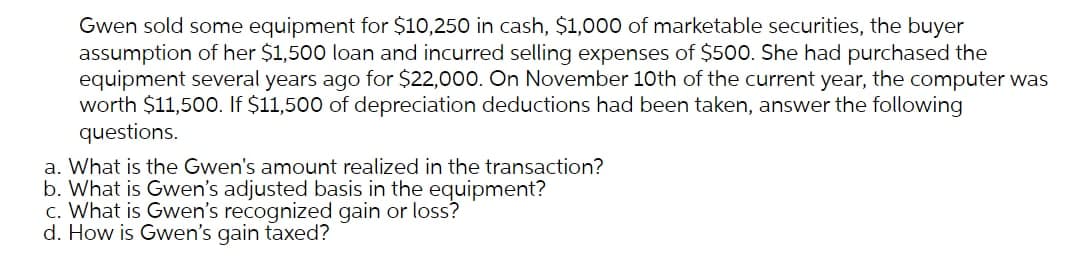

Gwen sold some equipment for $10,250 in cash, $1,000 of marketable securities, the buyer assumption of her $1,500 loan and incurred selling expenses of $500. She had purchased the equipment several years ago for $22,000. On November 10th of the current year, the computer was worth $11,500. If $11,500 of depreciation deductions had been taken, answer the following questions. a. What is the Gwen's amount realized in the transaction?

Gwen sold some equipment for $10,250 in cash, $1,000 of marketable securities, the buyer assumption of her $1,500 loan and incurred selling expenses of $500. She had purchased the equipment several years ago for $22,000. On November 10th of the current year, the computer was worth $11,500. If $11,500 of depreciation deductions had been taken, answer the following questions. a. What is the Gwen's amount realized in the transaction?

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 21CE

Related questions

Question

Transcribed Image Text:Gwen sold some equipment for $10,250 in cash, $1,000 of marketable securities, the buyer

assumption of her $1,500 loan and incurred selling expenses of $500. She had purchased the

equipment several years ago for $22,000. On November 10th of the current year, the computer was

worth $11,50O. If $11,500 of depreciation deductions had been taken, answer the following

questions.

a. What is the Gwen's amount realized in the transaction?

b. What is Gwen's adjusted basis in the equipment?

c. What is Gwen's recognized gain or loss?

d. How is Gwen's gain taxed?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College