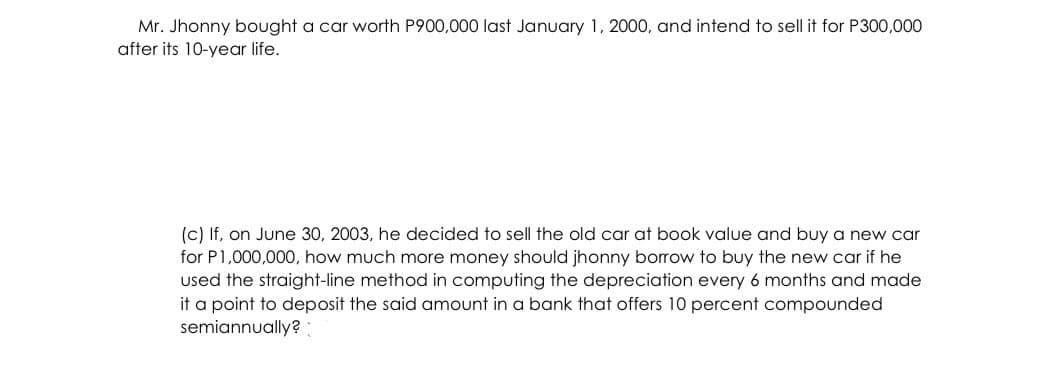

Mr. Jhonny bought a car worth P900,000 last January 1, 2000, and intend to sell it for P300,000 after its 10-year life. (c) If, on June 30, 2003, he decided to sell the old car at book value and buy a new car for P1,000,000, how much more money should jhonny borrow to buy the new car if he used the straight-line method in computing the depreciation every 6 months and made it a point to deposit the said amount in a bank that offers 10 percent compounded semiannually?

Mr. Jhonny bought a car worth P900,000 last January 1, 2000, and intend to sell it for P300,000 after its 10-year life. (c) If, on June 30, 2003, he decided to sell the old car at book value and buy a new car for P1,000,000, how much more money should jhonny borrow to buy the new car if he used the straight-line method in computing the depreciation every 6 months and made it a point to deposit the said amount in a bank that offers 10 percent compounded semiannually?

Chapter13: Property Transact Ions: Determination Of Gain Or Loss, Basis Considerations, And Nontaxable Exchanges

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:Mr. Jhonny bought a car worth P900,000 last January 1, 2000, and intend to sell it for P300,000

after its 10-year life.

(c) If, on June 30, 2003, he decided to sell the old car at book value and buy a new car

for P1,000,00O, how much more money should jhonny borrow to buy the new car if he

used the straight-line method in computing the depreciation every 6 months and made

it a point to deposit the said amount in a bank that offers 10 percent compounded

semiannually? :

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT