Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1FSA: Financial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at...

Related questions

Question

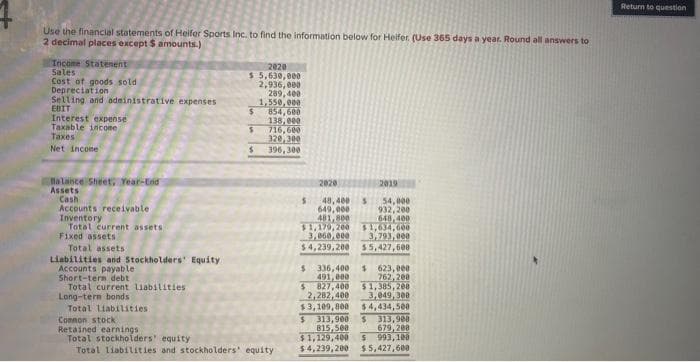

Transcribed Image Text:Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to

2 decimal places except $ amounts.)

Income Statement

Sales

Cost of goods sold

Depreciation

Selling and administrative expenses

EBIT

Interest expense

Taxable income

Taxes

Net income

Balance Sheet, Year-End

Assets

Cash

Accounts receivable

Inventory

Total current assets i

Fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Short-term debt

Total current Liabilities.

Long-tern bonds

Total liabilities

2020

$ 5,630,000

2,936,000

289,400

1,550,000

$

S

$

854,600

138,000

716,600

320,300

396,300

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

S

2020

48,400 S

649,000

481,800

$1,179,200 $1,634,600

3,060,000

3,793,000

$4,239,200

$5,427,600

$

2019

54,000

932,200

648,400

$ 336,400 $ 623,000

491,000

762,200

827,400

2,282,400

$3,109,800

$1,385,200

3,049,300

$4,434,500

$ 313,900 $ 313,988

679,208

815,500

$1,129,400 $ 993,108

$4,239,200

$5,427,600

Return to question

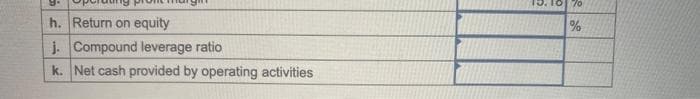

Transcribed Image Text:9.

h. Return on equity

j. Compound leverage ratio

k. Net cash provided by operating activities

10 70

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage