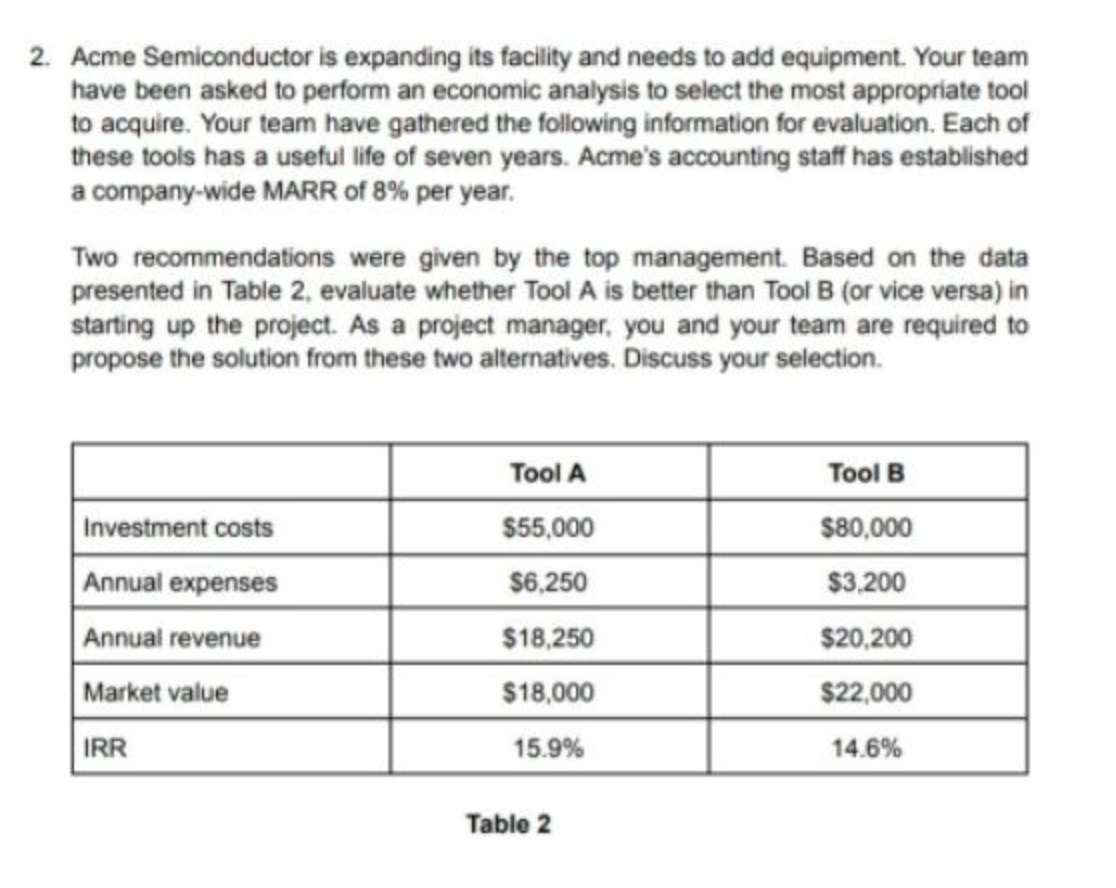

Acme Semiconductor is expanding its facility and needs to add equipment. have been asked to perform an economic analysis to select the most appro to acquire. Your team have gathered the following information for evaluatio these tools has a useful life of seven years. Acme's accounting staff has e a company-wide MARR of 8% per year. Two recommendations were given by the top management. Based on presented in Table 2, evaluate whether Tool A is better than Tool B (or vice starting up the project. As a project manager, you and your team are n propose the solution from these two alternatives. Discuss your selection.

Q: Consider the information below about the following three stocks: AAA, BBB and CCC: Market Price…

A:

Q: Q5. You are assigned a task to compare portfolios W, X, Y and Z. During the most recent 4-year…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: AT&T Inc $20.60 Previous Close 20.66 Market Cap 147.475B Open 20.63 Beta (5Y Monthly) 0.69 Bid…

A: CAPM or capital asset pricing model is used to calculate expected rate of return on investment or…

Q: Determine the value of the perpetuity annual amount $20,000 discount rate 8%

A: A perpetuity is an annuity that goes on forever. In other words a perpetuity is an annuity that has…

Q: Suppose that you start working for a company at age 25. You are offered two rather unlikely, but…

A: Future value of annuity Annuity is a series of equal amount at equal interval over a specified…

Q: It is important to know how to build an amortization schedule when firms (or individuals) take out…

A: Given: Loan amount (P): $60,000 Number of periods (n): 3 years =3*12= 36 months Interest (i): 12%…

Q: s a yield to maturity of 4.29%. This bond makes Dayments per year and thus has 8 periods until…

A: *Answer:

Q: Rahmat plans to withdraw his money RM 3,090 each year for five years, beginning at the 14th year. To…

A: Here, To Find: Part 1. Cash flow diagram =? Part 2. Amount of deposits for 12 years =?

Q: On her recent birthday on April 18, 2019, Lyn was given by her mother a certain amount of money as…

A: The concept of the time value of money states that the money inherently has the interest-earning…

Q: Show the answer on excel and how you did it: Puppet is evaluating two alternative, mutually…

A: Cash flows for both the options are tabulated below and the incremental Cash flows are computed Cash…

Q: Taylor Company has a target capital structure that consists of $3.3 million of debt capital, $2.5…

A: WACC (Weighted Average Cost of Capital) : It represents a firm's average cost of capital from all…

Q: what does fichacuristic mean?

A: NOTE: The word "fichacuristic" is a spelling/typo error of the word "futuristic" in Step 2 first…

Q: How much will she have at 70? he expects to live for 20 years if she retires at 65 and for 15 years…

A: *Answer: a. The amount that she will have at the age of 65 is $423,504.48 Workings:

Q: Explain how will you analyze Financial Statements of a Bank.

A: Bank financial statement Although banks' financial statements generally follow a similar format to…

Q: Marty Corp is issuing a perpetual bond today that will pay $100 per year starting in 3 years. If…

A: Given: Particulars Amount Amount paid $100 Years 3 Cost of capital 5%

Q: n 2016, the Allen Corporation had sales of $60 million, total assets of $47 million, and total…

A: Answer - Computation of Net Operating Income and Net Income - Particulars Working Amount…

Q: "our coin collection contains 54 1952 silver dollars. If your grandparents purchased them for their…

A: Future value of present value includes the amount being deposited and amount of interest being…

Q: 5. A 4 year Treasury Bond with a face value of $1,000 and an annual coupon rate of 5.80% has a yield…

A: Price sensitivity of a bond: The price sensitivity or the price elasticity of a bond is the ratio of…

Q: Table 17-A-1 Payback Method Input Year Cash Flow 0 (70,000) Balance (70,000)

A: Pay back period is one of the basic and simple method of capital budgeting in which time required to…

Q: Aini wishes to have 93,000USD to purchase a car in 6 years as part of her financial goals. How much…

A: Future Value = 93,000 USD Time Period = 6 Years Interest Rate = 8%

Q: Required: a. Calculate the effective gross income (EGA) for the next five years. b. Calculate the…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: An asset costs $420,000 and will be depreciated in a straight-line manner over its 3-year life. It…

A: Hai there! Thank you for the question. Post has multiple questions. As per company guidelines expert…

Q: He then asks you to describe the advantages and disadvantages of a 15-year loan versus a 30-year…

A: Mortgages:-A mortgages is an loan that is used to purchase various assets like home, land etc. In…

Q: roblem 2: Value of Control: Intrinsic Valuation Acquirer Corporation would like to purchase the…

A: Dividend discount model with constant growth Dividend discount model is used to value a share. With…

Q: Davie bought his home several years ago with a 30-year fixed rate mortgage at an interest rate of…

A: Original Loan amount will be = Purchase price - Down payment =227000 - 40000 = $187,000…

Q: b. John needs to pay $55,000, $60,000 and $65,000 at the end of next 3 years respectively. The…

A: i) Duration of the obligation will be, = Σ( PV of CF*n) / Σ PV of CF ; PV of CF = Present…

Q: what is the yield in percent, on the bond held to maturity?

A: Market Price of bond = $970 Future Value of bond after one year = $1,000 Formula:Current Value of…

Q: bred costs Profit 31,200 23,400 12% 9% a) What percentage improvement is needed in a supply chain…

A: In the percentage of sales method, we express all line items in an income statement as a percentage…

Q: The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed $490,000 in the common stock…

A: Change in Capital between 2021 and 2020 = $530000 - $490000 = $40000 Here Increase in capital…

Q: FV(Monthly.) = $100(1.01)60

A: We need to use future value formula to solve this problem FV =PV(1+i)n where FV=future value PV…

Q: 6. Kate earns 3.5% p.a. effective interest from her savings account. The inflation rate is 5.1% p.a.…

A: The Fisher equation is used to determine the relationship between real and nominal interest rates to…

Q: What is the amount of the quarterly deposits A such that you will be able to withdraw the amounts…

A: Present value of the cash outflow must be equal to the present value of cash inflows to make both…

Q: The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new…

A: Initial Investment $ 40,000.00 MACRS Year Depreciation 1 33% 2 45% 3 15% 4 7%…

Q: What are the four sources of capital for a firm? Explain

A: The company needs capital for the operations of the company but each have own cost of capital that…

Q: ank's current maximum combined loan-to-value is 80%. Joseph is purchasing a home from Mr. and Mrs.…

A: Loan to value ratio tell us that how much is loan possible against the value of property that is…

Q: Chris offers you an investmet where if ou investment where if you invest $1,000 today, he'll return…

A: The rate of return can be calculated as: R= (Maturity amount- Initial investment)/ Initial…

Q: case study: should stockholders wealth maximization be thought of as long term or a short term goal?…

A: Stockholder’s wealth maximization means maximization of shareholder’s wealth and a shareholder’s…

Q: 1) What are the critical issues a partnership should address in a buy - sell agreement? 2) what are…

A: Sole proprietorship, partnership, and company: In a sole proprietorship, the business's owner is…

Q: Company A borrowed P9, 000, 000, 000 from Wordly Bank on Jan. 1, 2018 and P12, 000,000,000 on Jan.…

A: Time Value of Money states that a dollar today is worth than a dollar some time later. This is…

Q: One of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently…

A: In-house production: An activity or process that is carried out within a business rather than via…

Q: Calculate the after-tax cost of a $35 million debt issue that Pullman Manufacturing Corporation (35%…

A: Before tax cost of debt is will be its yield rate, Yield rate of debt = 6/8…

Q: Q4. Samuel is planning to invest in a 12 year, 7% semiannual-pay, noncallable bond but is concerned…

A: Here, To Find: Part A. Current price of the bond =? Part B. Effective duration of the bond =?

Q: a) A company is considering investing in Project X. The project requires an initial investment of…

A: NPV is a capital budgeting techniques which help in decision making on the basis of future cash…

Q: Timmie wishes his son Timmeus to receive P203B ten years from now. What amount should he invest if…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The amount initially…

Q: If the Australian dollar devalues against the Japanese yen by 10%, the yen will appreciate by 10.11%…

A: Currency appreciation and depreciation The majority of economies are linked and dependent on one…

Q: Your sister will start college in five years. She has just informed your parents that she wants to…

A: Here, To Find: Amount of savings to invest each year for next five years =?

Q: Finance Use the data in the following table to calculate a. The effective duration when rates…

A: Data given: 4% Coupon 10 year T-note YTM Price 4.50% 97.78 4.20% 99.11 4.00% 100.00…

Q: the dividend yield and capital gain yield over the first year?

A: Information Provided: Dividend growth rate = 5% Next Dividend = $3.50 Required return = 13%

Q: Explain why the Cedi continues to depreciate against most major international currencies and offer…

A: Many causes have contributed to the cedi's devaluation. Businesses in Ghana use foreign money to…

Q: (a) Identify each of the following cash flow to indicate whether it is a benefit, a disbenefit, or a…

A: Benefit means something which results into profit, favorable for the organization. Dis-benefit…

Step by step

Solved in 2 steps

- Malone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?Javier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.Kent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the divisions reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The divisions cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of 250,000, and Proposal B requires 312,500. Both projects could be funded, given the status of the divisions capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. Required: 1. Compute the NPV for each proposal. 2. Compute the payback period for each proposal. 3. According to your analysis, which proposal(s) should be accepted? Explain. 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.

- Merkley Company, a manufacturer of machine parts, implemented lean manufacturing at the end of 20X1. Three value streams were established: one for new product development and two order fulfillment value streams. One of the value streams set a goal to increase its ROS to 45% of sales by the end of the year. During the year, the value stream made significant improvements in several areas. The Box Scorecard below was prepared, with performance measures for the beginning of the year, midyear, and end of year. Although the members of the value stream were pleased with their progress, they were disappointed in the financial results. They were still far from the targeted ROS of 45%. They were also puzzled as to why the improvements made did not translate into significantly improved financial performance. Required: 1. From the scorecard, what was the focus of the value-stream team for the first 6 months? The second 6 months? What are the implications of these changes? 2. Using information from the scorecard, offer an explanation for why the financial results were not as good as expected.Dana Baird was manager of a new Medical Supplies Division. She had just finished her second year and had been visiting with the companys vice president of operations. In the first year, the operating income for the division had shown a substantial increase over the prior year. Her second year saw an even greater increase. The vice president was extremely pleased and promised Dana a 5,000 bonus if the division showed a similar increase in profits for the upcoming year. Dana was elated. She was completely confident that the goal could be met. Sales contracts were already well ahead of last years performance, and she knew that there would be no increases in costs. At the end of the third year, Dana received the following data regarding operations for the first three years: The predetermined fixed overhead rate is based on expected actual units of production and expected fixed overhead. Expected production each year was 10,000 units. Any under-or overapplied fixed overhead is closed to Cost of Goods Sold. Assumes a LIFO inventory flow. Upon examining the operating data, Dana was pleased. Sales had increased by 20 percent over the previous year, and costs had remained stable. However, when she saw the yearly income statements, she was dismayed and perplexed. Instead of seeing a significant increase in income for the third year, she saw a small decrease. Surely, the Accounting Department had made an error. Required: 1. Explain to Dana why she lost her 5,000 bonus. 2. Prepare variable-costing income statements for each of the three years. Reconcile the differences between the absorption-costing and variable-costing incomes. 3. If you were the vice president of Danas company, which income statement (variable-costing or absorption-costing) would you prefer to use for evaluating Danas performance? Why?Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).

- Bradford Company, a manufacturer of small tools, implemented lean manufacturing at the end of 20x1. The companys goal for the year was to increase the ROS to 40 percent of sales. A value-stream team was established and began to work on lean improvements. During the year, the team was able to achieve significant results on several fronts. The Box Scorecard below reflects the performance measures at the beginning of the year, midyear, and end of year. Although the team members were pleased with their progress, they were disappointed in the financial results. They were still far from the targeted ROS of 40 percent. They were also puzzled as to why the improvements made did not translate into significantly improved financial performance. Required: 1. From the scorecard, what was the focus of the value-stream team for the first six months? The second six months? What are the implications of these changes? 2. Using information from the scorecard, offer an explanation for why the financial results were not as good as expected. 3. Suppose that on December 31, 20x2, a potential customer offered to purchase an order of goods that would increase weekly revenues in January by 100,000 and material cost by 30,000. Using the old standard cost system, the projected conversion cost of the order would be 60,000. Would you recommend that the order be accepted or rejected? Explain.Poleski Manufacturing, which maintains the same level of inventory at the end of each year, provided the following information about expenses anticipated for next year: The selling price of Poleskis single product is 16. In recent years, profits have fallen and Poleskis management is now considering a number of alternatives. Poleski wants to have a net income next year of 250,000, but expects to sell only 120,000 units unless some changes are made. The president of Poleski has asked you to calculate the companys projected net income (assuming 120,000 units are sold) and the sales needed to achieve the companys net income objective for next year. Also, compute Poleskis contribution margin per unit, contribution margin ratio, and break-even point for next year. The worksheet CVP has been provided to assist you. Note that the data from the problem have already been entered into the Data Section of the worksheet.At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: Required: 1. Compute the following measures for 20x1 and 20x3: a. Actual velocity and cycle time b. Percentage of total revenue from new customers (assume one unit per customer) c. Percentage of very satisfied customers (assume each customer purchases one unit) d. Market share e. Percentage change in actual product cost (for 20x3 only) f. Percentage change in days of inventory (for 20x3 only) g. Defective units as a percentage of total units produced h. Total hours of training i. Suggestions per production worker j. Total revenue k. Number of new customers 2. For the measures listed in Requirement 1, list likely strategic objectives, classified according to the four Balance Scorecard perspectives. Assume there is one measure per objective.

- Acme Semiconductor is expanding its facility and needs to add equipment. There are three process tools under consideration. You have been asked to perform an economic analysis to select the most appropriate tool to acquire. You have gathered the following information for evaluation. Each of these tools has a useful life of seven years. Acme’s accounting staff has established a company-wide MARR of 8% per year.Which one of the process tools should be selected?Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial Investment Cost of equipment (salvage value) 170000 380000 Annual revenues and costs Sales revenue 250000 350000 Variable expenses 120000 170000 Depreciation expense 34000 76000 Fixed out-of-pocket operating costs 70000 50000 The company’s discount rate is 16%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4. Calculate the project…Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 170,000 $ 380,000 Annual revenues and costs: Sales revenues $ 250,000 $ 350,000 Variable expenses $ 120,000 $ 170,000 Depreciation expense $ 34,000 $ 76,000 Fixed out-of-pocket operating costs $ 70,000 $ 50,000 The company’s discount rate is 16%. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate…