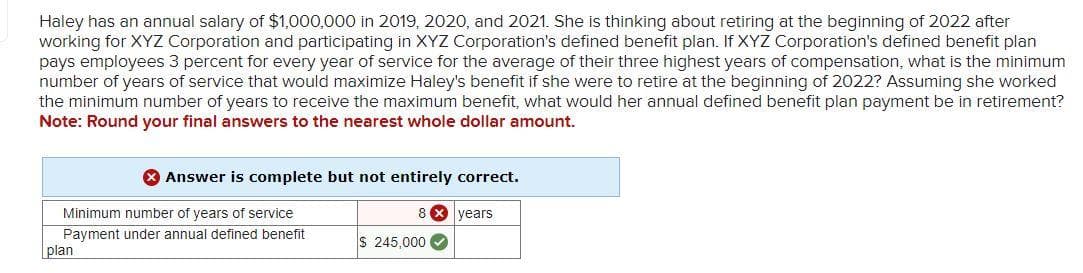

Haley has an annual salary of $1,000,000 in 2019, 2020, and 2021. She is thinking about retiring at the beginning of 2022 after working for XYZ Corporation and participating in XYZ Corporation's defined benefit plan. If XYZ Corporation's defined benefit plan pays employees 3 percent for every year of service for the average of their three highest years of compensation, what is the minimum number of years of service that would maximize Haley's benefit if she were to retire at the beginning of 2022? Assuming she worked the minimum number of years to receive the maximum benefit, what would her annual defined benefit plan payment be in retirement? Note: Round your final answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Minimum number of years of service Payment under annual defined benefit plan 8x years $ 245,000

Haley has an annual salary of $1,000,000 in 2019, 2020, and 2021. She is thinking about retiring at the beginning of 2022 after working for XYZ Corporation and participating in XYZ Corporation's defined benefit plan. If XYZ Corporation's defined benefit plan pays employees 3 percent for every year of service for the average of their three highest years of compensation, what is the minimum number of years of service that would maximize Haley's benefit if she were to retire at the beginning of 2022? Assuming she worked the minimum number of years to receive the maximum benefit, what would her annual defined benefit plan payment be in retirement? Note: Round your final answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Minimum number of years of service Payment under annual defined benefit plan 8x years $ 245,000

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 46P

Related questions

Question

RD.16.

I cannot figure out what the minimum years of service would be.. thanks!.

Transcribed Image Text:Haley has an annual salary of $1,000,000 in 2019, 2020, and 2021. She is thinking about retiring at the beginning of 2022 after

working for XYZ Corporation and participating in XYZ Corporation's defined benefit plan. If XYZ Corporation's defined benefit plan

pays employees 3 percent for every year of service for the average of their three highest years of compensation, what is the minimum

number of years of service that would maximize Haley's benefit if she were to retire at the beginning of 2022? Assuming she worked

the minimum number of years to receive the maximum benefit, what would her annual defined benefit plan payment be in retirement?

Note: Round your final answers to the nearest whole dollar amount.

Answer is complete but not entirely correct.

8x years

Minimum number of years of service

Payment under annual defined benefit

plan

$ 245,000✔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT