As a retailer, Zertan Corporation sells software programs manufactured and packaged by other parties. Zertan also purchases computer parts, assembles them as specified by customers in purchase orders, and sells them as operating stand-alone computers. All of Zertan's operations take place in State F, which levies a 9% sales tax. Results for the current year are as follows: a) What is Zertan's own sales tax expense for the year? __________ b) How much State F sa;es tax must Zertan collect and pay to the state on behalf of other taxpayers subject to the tax? ___________

As a retailer, Zertan Corporation sells software programs manufactured and packaged by other parties. Zertan also purchases computer parts, assembles them as specified by customers in purchase orders, and sells them as operating stand-alone computers. All of Zertan's operations take place in State F, which levies a 9% sales tax. Results for the current year are as follows: a) What is Zertan's own sales tax expense for the year? __________ b) How much State F sa;es tax must Zertan collect and pay to the state on behalf of other taxpayers subject to the tax? ___________

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 2BE: Support department allocations The centralized computer technology department of Hardy Company has...

Related questions

Question

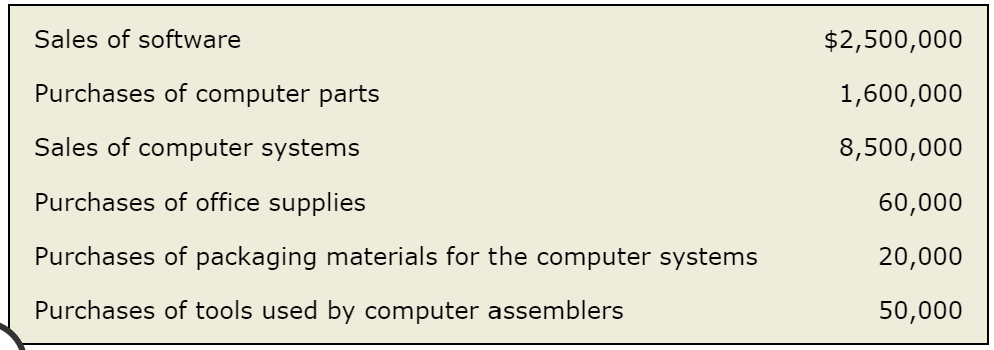

As a retailer, Zertan Corporation sells software programs manufactured and packaged by other parties. Zertan also purchases computer parts, assembles them as specified by customers in purchase orders, and sells them as operating stand-alone computers. All of Zertan's operations take place in State F, which levies a 9% sales tax. Results for the current year are as follows:

a) What is Zertan's own sales tax expense for the year? __________

b) How much State F sa;es tax must Zertan collect and pay to the state on behalf of other taxpayers subject to the tax? ___________

Transcribed Image Text:Sales of software

Purchases of computer parts

Sales of computer systems

Purchases of office supplies

Purchases of packaging materials for the computer systems

Purchases of tools used by computer assemblers

$2,500,000

1,600,000

8,500,000

60,000

20,000

50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning