Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $13.9 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,250 common shares at $4.3 each. 20 Issued 7,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $31,000. 31 Issued 75,000 common shares in exchange for land, building, and equipment, which have fair market values of $355,000, $475,000, and $43,000, respectively. Mar. 4 Purchased equipment at a cost of $8,110 cash. This was thought to be a special bargain price. It was felt that at least $10,300 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $91,000. The Income Summary account was closed. 2021 Jan. 4 Issued 3,000 preferred shares at $67 per share. Dec. 31 The Income Summary account was closed. Profit for 2021 was $211,000. 2022 Dec. 4 The company declared a cash dividend of $0.72 per share on the common shares payable on December 18 and also declared the required dividend on the preferred shares. 18 Paid the dividends declared on December 4. 31 Profit for the year ended December 31, 2022, was $173,075. The Income Summary account was closed. 3. Prepare the equity section on the December 31, 2022, balance sheet. Analysis Component: Determine the net assets of Hammond Manufacturing Inc. for 2020, 2021, and 2022. Is the trend favourable or unfavourable?

Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $13.9 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,250 common shares at $4.3 each. 20 Issued 7,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $31,000. 31 Issued 75,000 common shares in exchange for land, building, and equipment, which have fair market values of $355,000, $475,000, and $43,000, respectively. Mar. 4 Purchased equipment at a cost of $8,110 cash. This was thought to be a special bargain price. It was felt that at least $10,300 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $91,000. The Income Summary account was closed. 2021 Jan. 4 Issued 3,000 preferred shares at $67 per share. Dec. 31 The Income Summary account was closed. Profit for 2021 was $211,000. 2022 Dec. 4 The company declared a cash dividend of $0.72 per share on the common shares payable on December 18 and also declared the required dividend on the preferred shares. 18 Paid the dividends declared on December 4. 31 Profit for the year ended December 31, 2022, was $173,075. The Income Summary account was closed. 3. Prepare the equity section on the December 31, 2022, balance sheet. Analysis Component: Determine the net assets of Hammond Manufacturing Inc. for 2020, 2021, and 2022. Is the trend favourable or unfavourable?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 88PSA: Ratio Analysis Consider the following information taken from the stockholders equity section: How do...

Related questions

Question

Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $13.9 non-cumulative

| 2020 | |||

| Jan. | 12 | Issued 40,250 common shares at $4.3 each. | |

| 20 | Issued 7,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $31,000. | ||

| 31 | Issued 75,000 common shares in exchange for land, building, and equipment, which have fair market values of $355,000, $475,000, and $43,000, respectively. | ||

| Mar. | 4 | Purchased equipment at a cost of $8,110 cash. This was thought to be a special bargain price. It was felt that at least $10,300 would normally have had to be paid to acquire this equipment. | |

| Dec. | 31 | During 2020, the company incurred a loss of $91,000. The Income Summary account was closed. | |

| 2021 | |||

| Jan. | 4 | Issued 3,000 preferred shares at $67 per share. | |

| Dec. | 31 | The Income Summary account was closed. Profit for 2021 was $211,000. | |

| 2022 | |||

| Dec. | 4 | The company declared a cash dividend of $0.72 per share on the common shares payable on December 18 and also declared the required dividend on the preferred shares. | |

| 18 | Paid the dividends declared on December 4. | ||

| 31 | Profit for the year ended December 31, 2022, was $173,075. The Income Summary account was closed. |

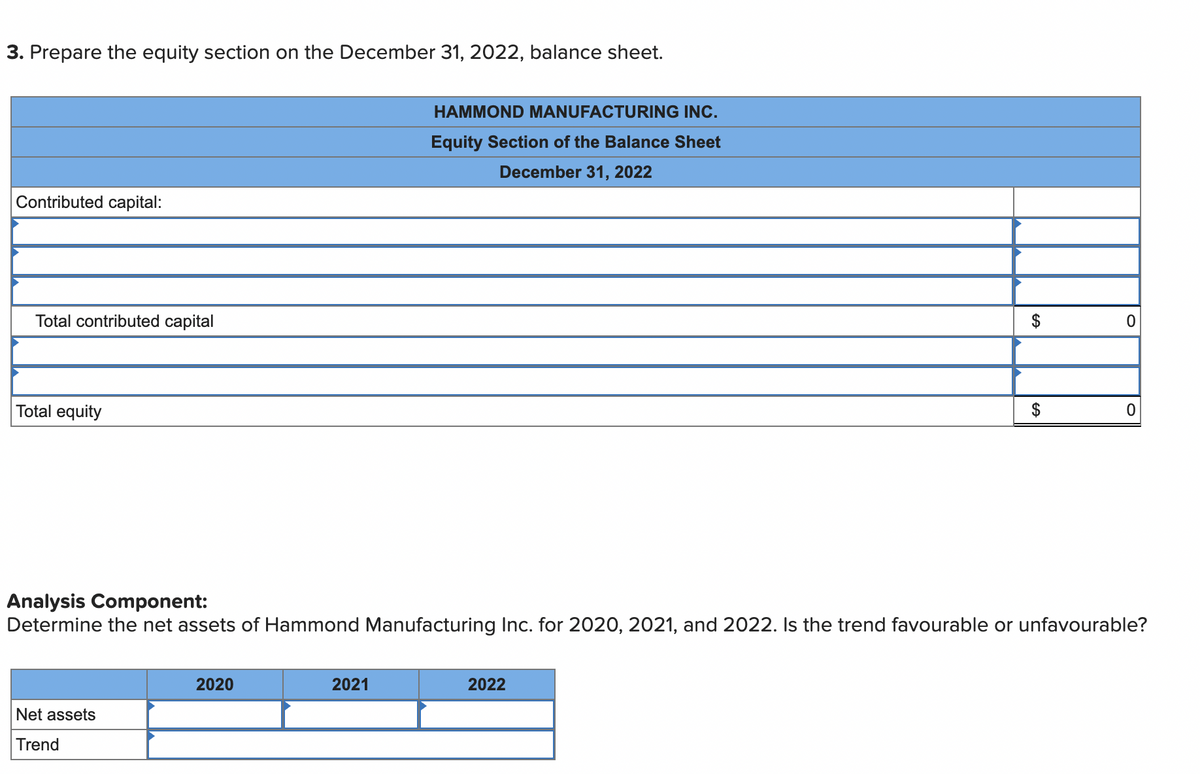

3. Prepare the equity section on the December 31, 2022,

Analysis Component:

Determine the net assets of Hammond Manufacturing Inc. for 2020, 2021, and 2022. Is the trend favourable or unfavourable?

Transcribed Image Text:3. Prepare the equity section on the December 31, 2022, balance sheet.

HAMMOND MANUFACTURING INC.

Equity Section of the Balance Sheet

December 31, 2022

Contributed capital:

Total contributed capital

$

Total equity

$

Analysis Component:

Determine the net assets of Hammond Manufacturing Inc. for 2020, 2021, and 2022. Is the trend favourable or unfavourable?

2020

2021

2022

Net assets

Trend

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,