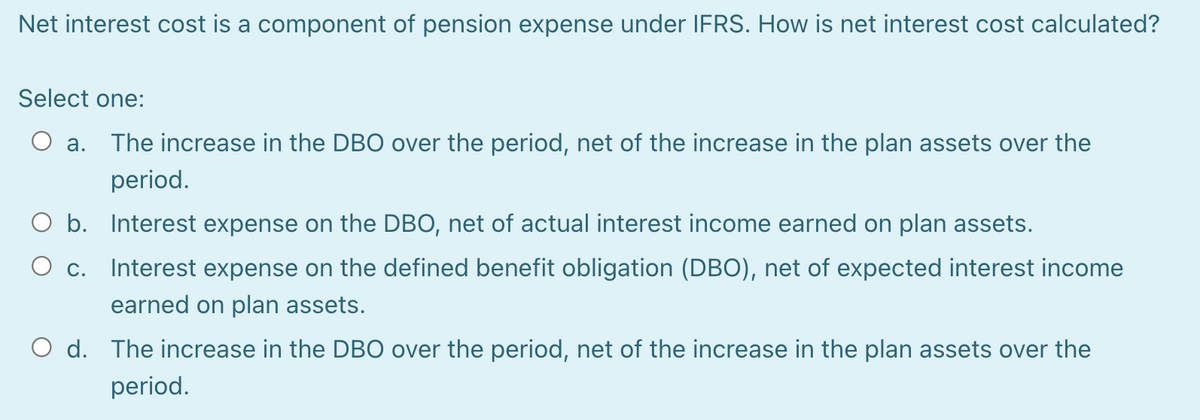

Net interest cost is a component of pension expense under IFRS. How is net interest cost calcul Select one: O a. The increase in the DBO over the period, net of the increase in the plan assets over the period. O b. Interest expense on the DBO, net of actual interest income earned on plan assets. c. Interest expense on the defined benefit obligation (DBO), net of expected interest incor earned on plan assets. O d. The increase in the DBO over the period, net of the increase in the plan assets over the period.

Net interest cost is a component of pension expense under IFRS. How is net interest cost calcul Select one: O a. The increase in the DBO over the period, net of the increase in the plan assets over the period. O b. Interest expense on the DBO, net of actual interest income earned on plan assets. c. Interest expense on the defined benefit obligation (DBO), net of expected interest incor earned on plan assets. O d. The increase in the DBO over the period, net of the increase in the plan assets over the period.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 1MC: The actuarial present value of all the benefits attributed by the pension benefit formula to...

Related questions

Question

Transcribed Image Text:Net interest cost is a component of pension expense under IFRS. How is net interest cost calculated?

Select one:

O a. The increase in the DBO over the period, net of the increase in the plan assets over the

period.

O b. Interest expense on the DBO, net of actual interest income earned on plan assets.

O c.

Interest expense on the defined benefit obligation (DBO), net of expected interest income

earned on plan assets.

O d. The increase in the DBO over the period, net of the increase in the plan assets over the

period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub