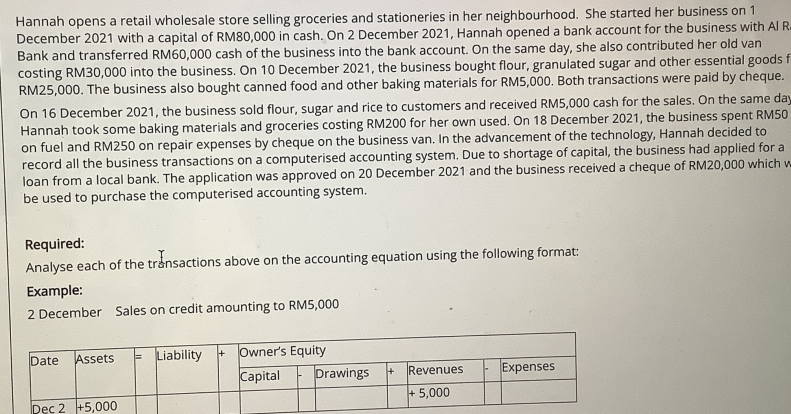

Hannah opens a retail wholesale store selling groceries and stationeries in her neighbourhood. She started her business on 1 December 2021 with a capital of RM80,000 in cash. On 2 December 2021, Hannah opened a bank account for the business with Al Bank and transferred RM60,000 cash of the business into the bank account. On the same day, she also contributed her old van costing RM30,000 into the business. On 10 December 2021, the business bought flour, granulated sugar and other essential goods RM25,000. The business also bought canned food and other baking materials for RM5,000. Both transactions were paid by cheque On 16 December 2021, the business sold flour, sugar and rice to customers and received RM5,000 cash for the sales. On the same di Hannah took some baking materials and groceries costing RM200 for her own used. On 18 December 2021, the business spent RMS on fuel and RM250 on repair expenses by cheque on the business van. In the advancement of the technology, Hannah decided to record all the business transactions on a computerised accounting system. Due to shortage of capital, the business had applied for. loan from a local bank. The application was approved on 20 December 2021 and the business received a cheque of RM20,000 which be used to purchase the computerised accounting system.

Hannah opens a retail wholesale store selling groceries and stationeries in her neighbourhood. She started her business on 1 December 2021 with a capital of RM80,000 in cash. On 2 December 2021, Hannah opened a bank account for the business with Al Bank and transferred RM60,000 cash of the business into the bank account. On the same day, she also contributed her old van costing RM30,000 into the business. On 10 December 2021, the business bought flour, granulated sugar and other essential goods RM25,000. The business also bought canned food and other baking materials for RM5,000. Both transactions were paid by cheque On 16 December 2021, the business sold flour, sugar and rice to customers and received RM5,000 cash for the sales. On the same di Hannah took some baking materials and groceries costing RM200 for her own used. On 18 December 2021, the business spent RMS on fuel and RM250 on repair expenses by cheque on the business van. In the advancement of the technology, Hannah decided to record all the business transactions on a computerised accounting system. Due to shortage of capital, the business had applied for. loan from a local bank. The application was approved on 20 December 2021 and the business received a cheque of RM20,000 which be used to purchase the computerised accounting system.

Chapter6: Business Expenses

Section: Chapter Questions

Problem 22P

Related questions

Question

3

Transcribed Image Text:Hannah opens a retail wholesale store selling groceries and stationeries in her neighbourhood. She started her business on 1

December 2021 with a capital of RM80,000 in cash. On 2 December 2021, Hannah opened a bank account for the business with Al R.

Bank and transferred RM60,000 cash of the business into the bank account. On the same day, she also contributed her old van

costing RM30,000 into the business. On 10 December 2021, the business bought flour, granulated sugar and other essential goods f

RM25,000. The business also bought canned food and other baking materials for RM5,000. Both transactions were paid by cheque.

On 16 December 2021, the business sold flour, sugar and rice to customers and received RM5,000 cash for the sales. On the same day

Hannah took some baking materials and groceries costing RM200 for her own used. On 18 December 2021, the business spent RM50

on fuel and RM250 on repair expenses by cheque on the business van. In the advancement of the technology, Hannah decided to

record all the business transactions on a computerised accounting system. Due to shortage of capital, the business had applied for a

loan from a local bank. The application was approved on 20 December 2021 and the business received a cheque of RM20,000 which w

be used to purchase the computerised accounting system.

Required:

Analyse each of the trånsactions above on the accounting equation using the following format:

Example:

2 December Sales on credit amounting to RM5,000

Date

Assets

Liability

+ Owner's Equity

Capital

Drawings

+ Revenues

Expenses

+ 5,000

Dec 2 +5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT