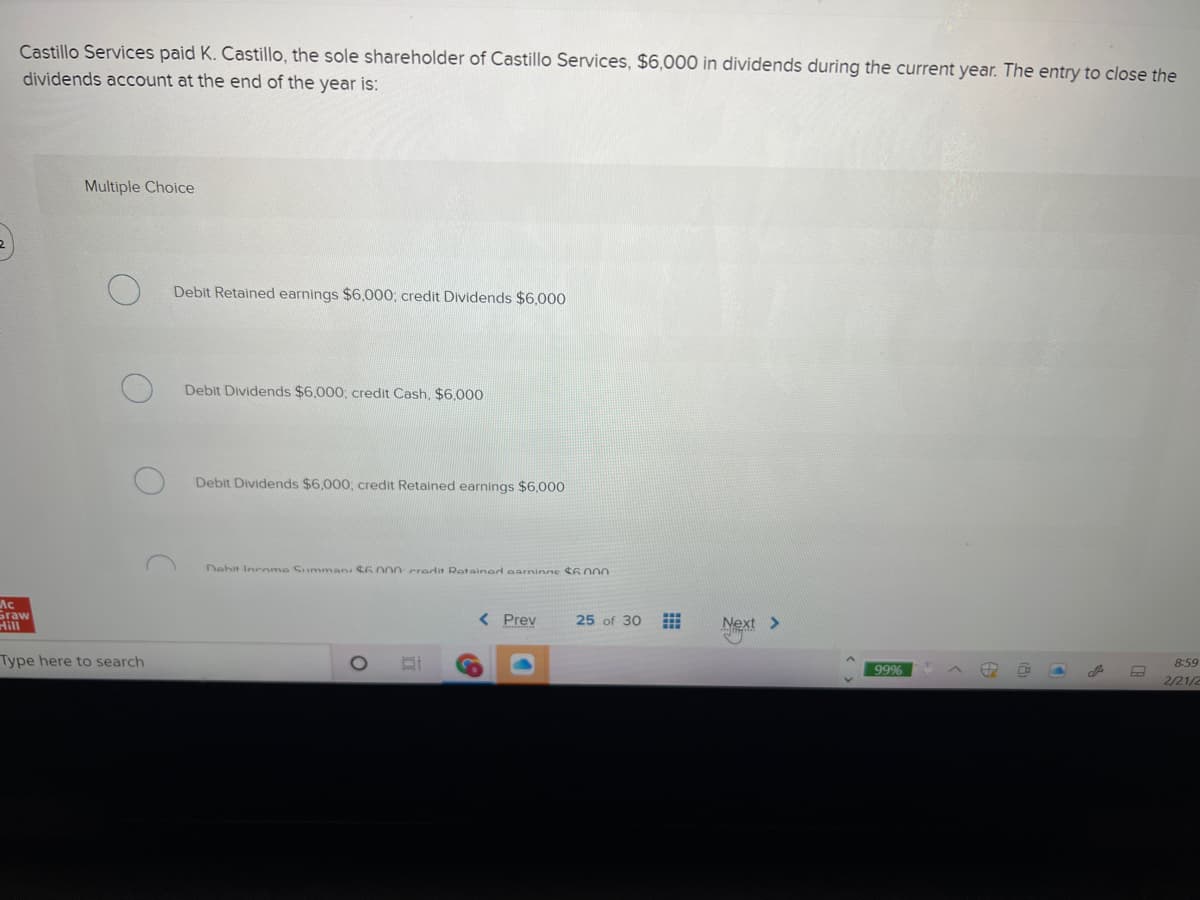

Castillo Services paid K. Castillo, the sole shareholder of Castillo Services, $6,000 in dividends during the current year. The entry to close the dividends account at the end of the year is:

Castillo Services paid K. Castillo, the sole shareholder of Castillo Services, $6,000 in dividends during the current year. The entry to close the dividends account at the end of the year is:

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 18EB: Tart Restaurant Holdings, Incorporated began the year with a retained earnings balance of $950,000....

Related questions

Question

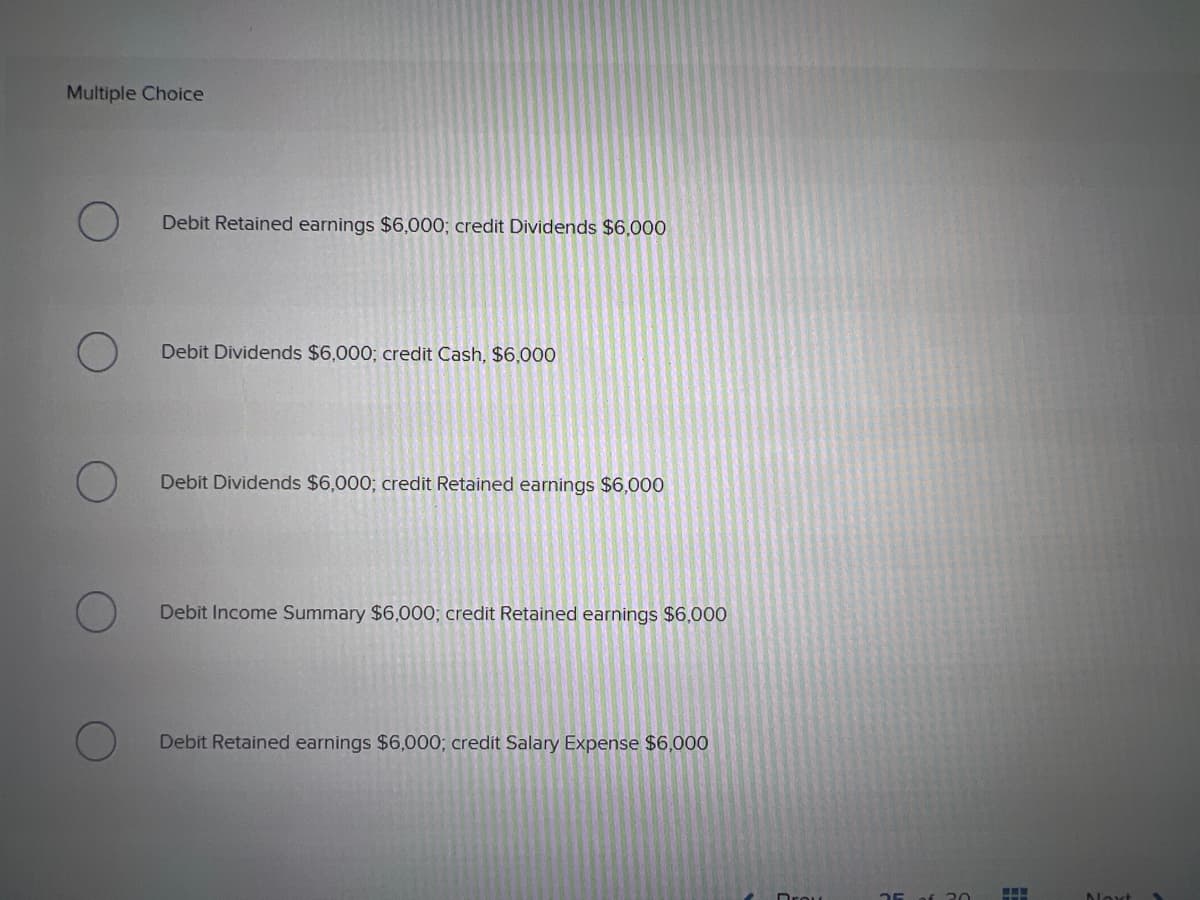

Transcribed Image Text:Multiple Choice

Debit Retained earnings $6,000; credit Dividends $6,000

Debit Dividends $6,000; credit Cash, $6,000

Debit Dividends $6,000; credit Retained earnings $6,000

Debit Income Summary $6,000; credit Retained earnings $6,000

Debit Retained earnings $6,000; credit Salary Expense $6,000

20

Noxt

Transcribed Image Text:Castillo Services paid K. Castillo, the sole shareholder of Castillo Services, $6,000 in dividends during the current year. The entry to close the

dividends account at the end of the year is:

Multiple Choice

Debit Retained earnings $6.000; credit Dividends $6,000

Debit Dividends $6,000; credit Cash, $6,000

Debit Dividends $6.000, credit Retained earnings $6,000

Dehit Incnme Summan $6 000credit Retained earninge C6000

Ac

Graw

Hill

< Prev

25 of 30

Next >

Type here to search

8:59

99%

2/21/2

Expert Solution

Step 1

Solution:

Closing entries are prepared at the end of accounting period to close temporary accounts to income summary or retained earnings.

Temporary accounts are those accounts that are not carried to next accounting period and same is not part of balance sheet.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning