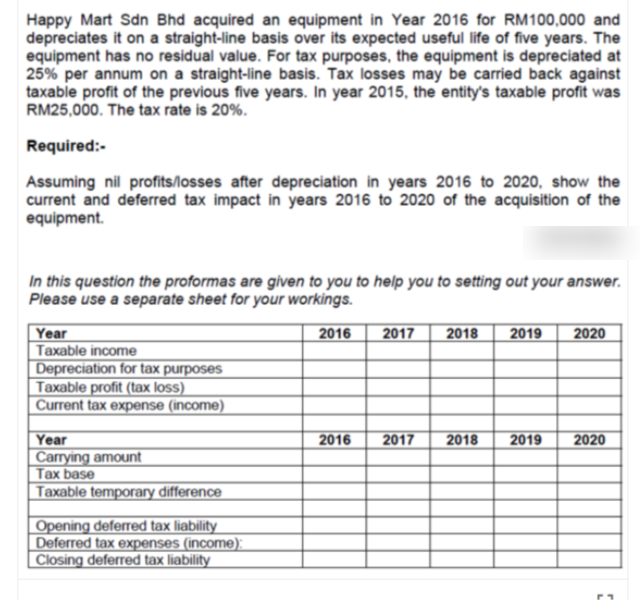

Happy Mart Sdn Bhd acquired an equipment in Year 2016 for RM100,000 and depreciates it on a straight-line basis over its expected useful life of five years. The equipment has no residual value. For tax purposes, the equipment is depreciated at 25% per annum on a straight-line basis. Tax losses may be carried back against taxable profit of the previous five years. In year 2015, the entity's taxable profit was RM25,000. The tax rate is 20%. Required:- Assuming nil profits/losses after depreciation in years 2016 to 2020, show the current and deferred tax impact in years 2016 to 2020 of the acquisition of the equipment. In this question the proformas are given to you to help you to setting out your answer. Please use a separate sheet for your workings. Year Taxable income Depreciation for tax purposes Taxable profit (tax loss) Current tax expense (income) 2016 2017 2018 2019 2020 Year |Carrying amount Tax base Taxable temporary difference 2016 2017 2018 2019 2020 Opening deferred tax liability Deferred tax expenses (income): Closing deferred tax liability

Happy Mart Sdn Bhd acquired an equipment in Year 2016 for RM100,000 and depreciates it on a straight-line basis over its expected useful life of five years. The equipment has no residual value. For tax purposes, the equipment is depreciated at 25% per annum on a straight-line basis. Tax losses may be carried back against taxable profit of the previous five years. In year 2015, the entity's taxable profit was RM25,000. The tax rate is 20%. Required:- Assuming nil profits/losses after depreciation in years 2016 to 2020, show the current and deferred tax impact in years 2016 to 2020 of the acquisition of the equipment. In this question the proformas are given to you to help you to setting out your answer. Please use a separate sheet for your workings. Year Taxable income Depreciation for tax purposes Taxable profit (tax loss) Current tax expense (income) 2016 2017 2018 2019 2020 Year |Carrying amount Tax base Taxable temporary difference 2016 2017 2018 2019 2020 Opening deferred tax liability Deferred tax expenses (income): Closing deferred tax liability

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 5RE: Turnip Company purchased an asset at a cost of 10,000 with a 10-year life during the current year....

Related questions

Question

Transcribed Image Text:Happy Mart Sdn Bhd acquired an equipment in Year 2016 for RM100,000 and

depreciates it on a straight-line basis over its expected useful life of five years. The

equipment has no residual value. For tax purposes, the equipment is depreciated at

25% per annum on a straight-line basis. Tax losses may be carried back against

taxable profit of the previous five years. In year 2015, the entity's taxable profit was

RM25,000. The tax rate is 20%.

Required:-

Assuming nil profits/losses after depreciation in years 2016 to 2020, show the

current and deferred tax impact in years 2016 to 2020 of the acquisition of the

equipment.

In this question the proformas are given to you to help you to setting out your answer.

Please use a separate sheet for your workings.

Year

Taxable income

Depreciation for tax purposes

Taxable profit (tax loss)

Current tax expense (income)

2016

2017

2018

2019

2020

Year

|Carrying amount

Tax base

Taxable temporary difference

2016

2017

2018

2019

2020

Opening deferred tax liability

Deferred tax expenses (income):

Closing deferred tax liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning