Hart Labs, Inc. provides mad cow disease testing for both state and federal governmental agricultural agencies. Because the company's customers are governmental agencies, prices are strictly regulated. Therefore, Hart Labs must constantly monitor and control its testing costs. Shown below are the standard costs for a typical test. Direct materials (2 test tubes @$1.00 per tube) $2.00 Direct labor (1 hour @ $32 per hour) 32.00 Variable overhead (1 hour @ $6.00 per hour) 6.00 Fixed overhead (1 hour @ $13.00 per hour) 13.00 Total standard cost per test $53.00 The lab does not maintain an inventory of test tubes. As a result, the tubes purchased each month are used that month. Actual activity for the month of November 2020, when 1,400 tests were conducted, resulted in the following. Direct materials (2,940 test tubes) $2,646 Direct labor (1,442 hours) 44,702 Variable overhead 8,512 Fixed overhead 16,968 Monthly budgeted fixed overhead is $17,030. Revenues for the month were $93,800, and selling and administrative expenses wer $4,600. Compute the price and quantity variances for direct materials and direct labor. Materials price variance 24 Materials quantity variance 24 Labor price variance 24 Labor quantity variance 24 Compute the total overhead variance. >

Hart Labs, Inc. provides mad cow disease testing for both state and federal governmental agricultural agencies. Because the company's customers are governmental agencies, prices are strictly regulated. Therefore, Hart Labs must constantly monitor and control its testing costs. Shown below are the standard costs for a typical test. Direct materials (2 test tubes @$1.00 per tube) $2.00 Direct labor (1 hour @ $32 per hour) 32.00 Variable overhead (1 hour @ $6.00 per hour) 6.00 Fixed overhead (1 hour @ $13.00 per hour) 13.00 Total standard cost per test $53.00 The lab does not maintain an inventory of test tubes. As a result, the tubes purchased each month are used that month. Actual activity for the month of November 2020, when 1,400 tests were conducted, resulted in the following. Direct materials (2,940 test tubes) $2,646 Direct labor (1,442 hours) 44,702 Variable overhead 8,512 Fixed overhead 16,968 Monthly budgeted fixed overhead is $17,030. Revenues for the month were $93,800, and selling and administrative expenses wer $4,600. Compute the price and quantity variances for direct materials and direct labor. Materials price variance 24 Materials quantity variance 24 Labor price variance 24 Labor quantity variance 24 Compute the total overhead variance. >

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter7: Allocating Costs Of Support Departments And Joint Products

Section: Chapter Questions

Problem 33P: Biotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the...

Related questions

Question

Transcribed Image Text:HART LABS, INC.

Income Statement

%24

>

>

>

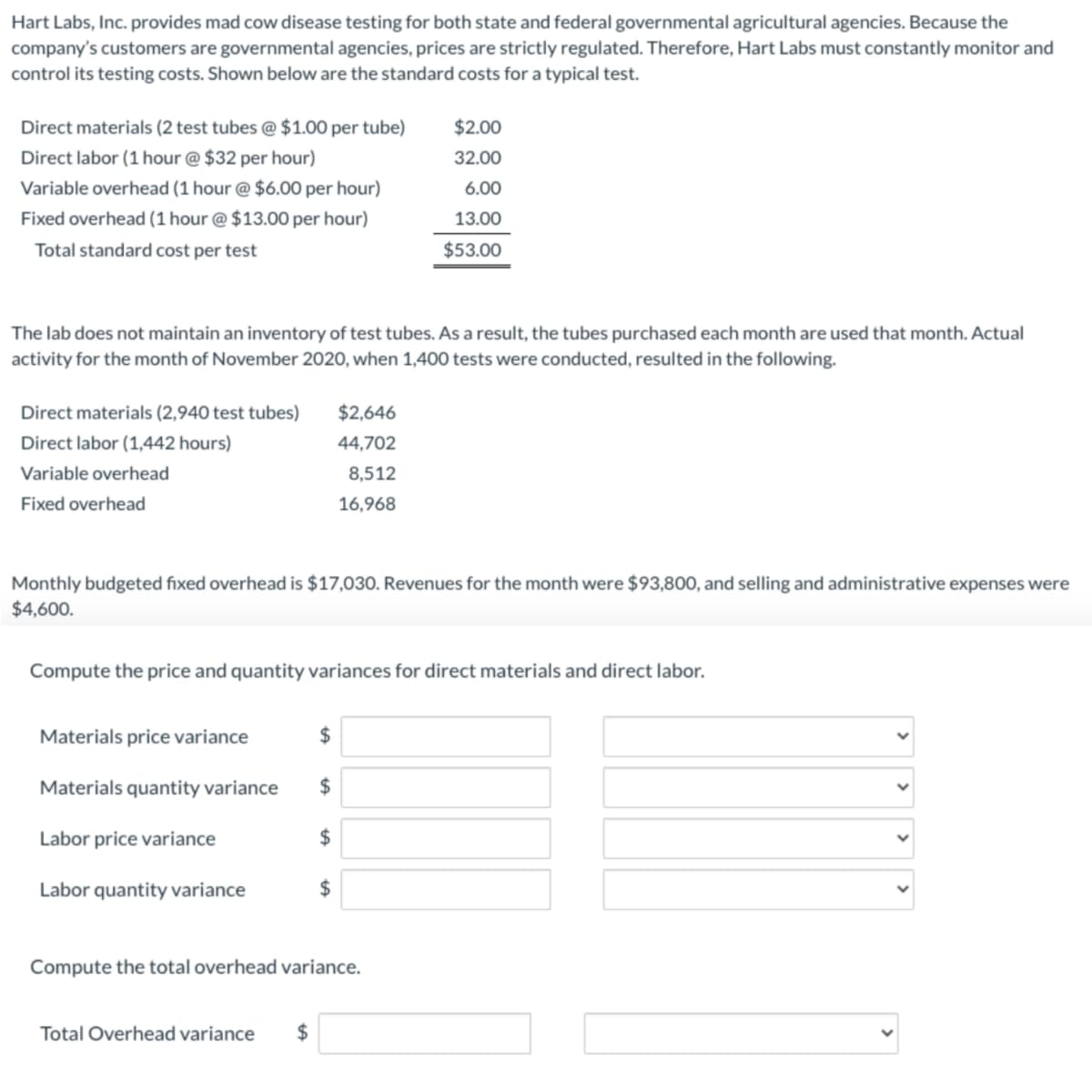

Transcribed Image Text:Hart Labs, Inc. provides mad cow disease testing for both state and federal governmental agricultural agencies. Because the

company's customers are governmental agencies, prices are strictly regulated. Therefore, Hart Labs must constantly monitor and

control its testing costs. Shown below are the standard costs for a typical test.

Direct materials (2 test tubes @ $1.00 per tube)

$2.00

Direct labor (1 hour @ $32 per hour)

32.00

Variable overhead (1 hour @ $6.00 per hour)

6.00

Fixed overhead (1 hour @ $13.00 per hour)

13.00

Total standard cost per test

$53.00

The lab does not maintain an inventory of test tubes. As a result, the tubes purchased each month are used that month. Actual

activity for the month of November 2020, when 1,400 tests were conducted, resulted in the following.

Direct materials (2,940 test tubes)

$2,646

Direct labor (1,442 hours)

44,702

Variable overhead

8,512

Fixed overhead

16,968

Monthly budgeted fixed overhead is $17,030. Revenues for the month were $93,800, and selling and administrative expenses were

$4,600.

Compute the price and quantity variances for direct materials and direct labor.

Materials price variance

24

Materials quantity variance

2$

Labor price variance

2$

Labor quantity variance

2$

Compute the total overhead variance.

Total Overhead variance

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning