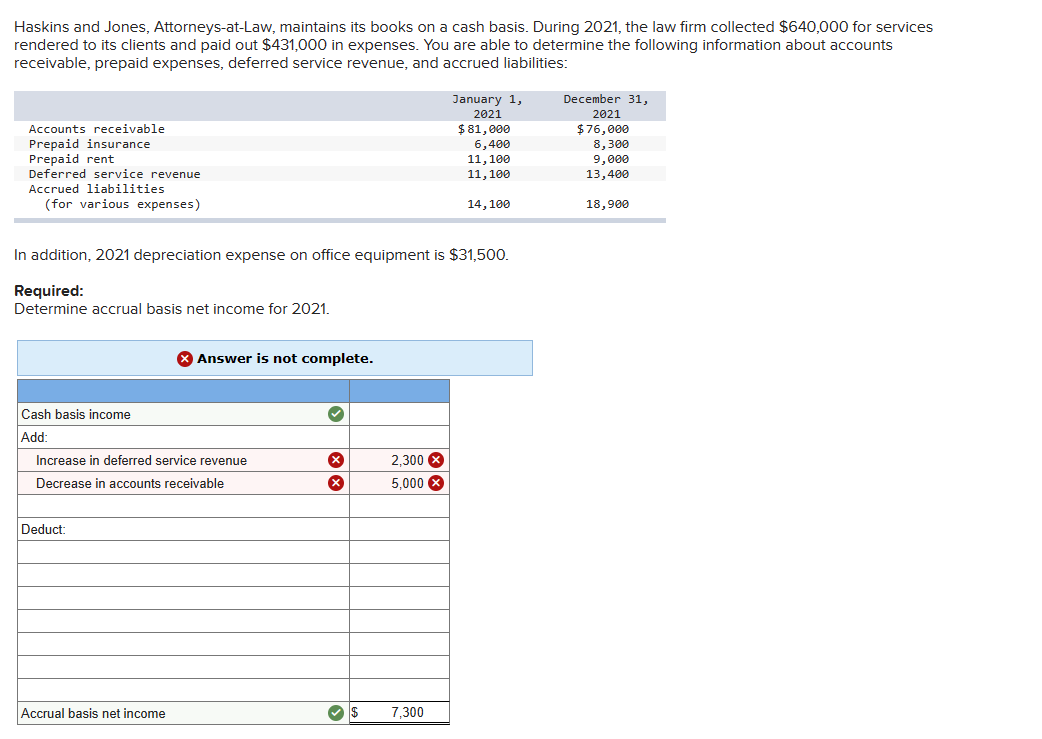

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm collected $640,000 for services rendered to its clients and paid out $431,000 in expenses. You are able to determine the following information about accounts receivable, prepaid expenses, deferred service revenue, and accrued liabilities: Accounts receivable Prepaid insurance Prepaid rent Deferred service revenue Accrued liabilities (for various expenses) In addition, 2021 depreciation expense on office equipment is $31,500. Required: Determine accrual basis net income for 2021. Cash basis income Add: Increase in deferred service revenue Decrease in accounts receivable Deduct: Answer is not complete. Accrual basis net income X X 2,300 X 5,000 X January 1, 2021 $ 81,000 6,400 11,100 11, 100 14, 100 ✓ $ 7,300 December 31, 2021 $76,000 8,300 9,000 13,400 18,900

Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm collected $640,000 for services rendered to its clients and paid out $431,000 in expenses. You are able to determine the following information about accounts receivable, prepaid expenses, deferred service revenue, and accrued liabilities: Accounts receivable Prepaid insurance Prepaid rent Deferred service revenue Accrued liabilities (for various expenses) In addition, 2021 depreciation expense on office equipment is $31,500. Required: Determine accrual basis net income for 2021. Cash basis income Add: Increase in deferred service revenue Decrease in accounts receivable Deduct: Answer is not complete. Accrual basis net income X X 2,300 X 5,000 X January 1, 2021 $ 81,000 6,400 11,100 11, 100 14, 100 ✓ $ 7,300 December 31, 2021 $76,000 8,300 9,000 13,400 18,900

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 5C: It is February 16, 2020, and you are auditing Davenport Corporation's financial statements for 2019...

Related questions

Topic Video

Question

100%

Not understanding the explanation provided, see image

Transcribed Image Text:Haskins and Jones, Attorneys-at-Law, maintains its books on a cash basis. During 2021, the law firm collected $640,000 for services

rendered to its clients and paid out $431,000 in expenses. You are able to determine the following information about accounts

receivable, prepaid expenses, deferred service revenue, and accrued liabilities:

Accounts receivable

Prepaid insurance

Prepaid rent

Deferred service revenue

Accrued liabilities

(for various expenses)

In addition, 2021 depreciation expense on office equipment is $31,500.

Required:

Determine accrual basis net income for 2021.

Cash basis income

Add:

Increase in deferred service revenue

Decrease in accounts receivable

Deduct:

Answer is not complete.

Accrual basis net income

X

X

2,300 X

5,000 X

January 1,

2021

$ 81,000

6,400

11,100

11, 100

14, 100

✓ $ 7,300

December 31,

2021

$76,000

8,300

9,000

13,400

18,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT