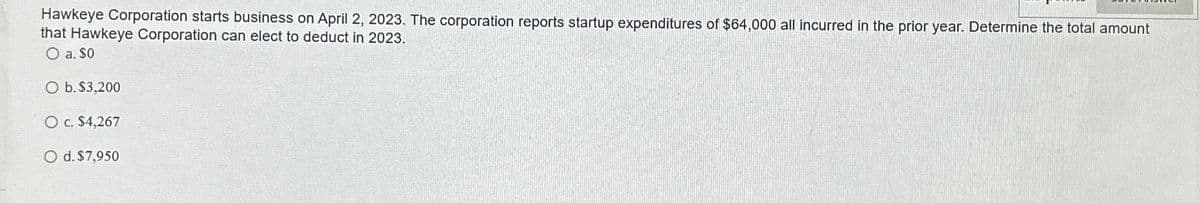

Hawkeye Corporation starts business on April 2, 2023. The corporation reports startup expenditures of $64,000 all incurred in the prior year. Determine the total amount that Hawkeye Corporation can elect to deduct in 2023. O a. $0 O b. $3,200 O c. $4,267 O d. $7,950

Hawkeye Corporation starts business on April 2, 2023. The corporation reports startup expenditures of $64,000 all incurred in the prior year. Determine the total amount that Hawkeye Corporation can elect to deduct in 2023. O a. $0 O b. $3,200 O c. $4,267 O d. $7,950

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 54P

Related questions

Question

Transcribed Image Text:Hawkeye Corporation starts business on April 2, 2023. The corporation reports startup expenditures of $64,000 all incurred in the prior year. Determine the total amount

that Hawkeye Corporation can elect to deduct in 2023.

O a. $0

O b. $3,200

O c. $4,267

O d. $7,950

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT