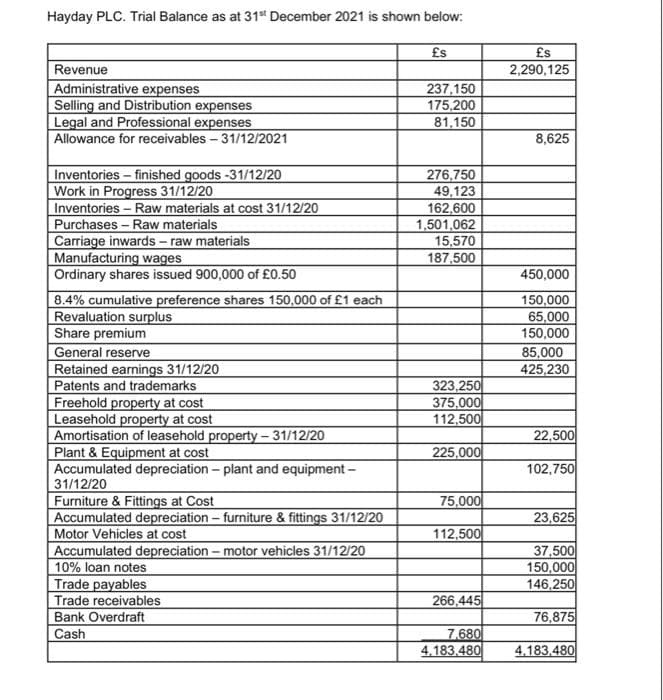

Hayday PLC. Trial Balance as at 31st December 2021 is shown below: £s Revenue Administrative expenses 237,150 175,200 Selling and Distribution expenses Legal and Professional expenses Allowance for receivables - 31/12/2021 81,150 276,750 Inventories - finished goods -31/12/20 Work in Progress 31/12/20 49,123 Inventories - Raw materials at cost 31/12/20 162,600 Purchases-Raw materials 1,501,062 Carriage inwards - raw materials 15,570 Manufacturing wages 187,500 Ordinary shares issued 900,000 of £0.50 8.4% cumulative preference shares 150,000 of £1 each Revaluation surplus Share premium General reserve Retained earnings 31/12/20 Patents and trademarks Freehold property at cost Leasehold property at cost Amortisation of leasehold property - 31/12/20 Plant & Equipment at cost Accumulated depreciation - plant and equipment - 31/12/20 Furniture & Fittings at Cost Accumulated depreciation - furniture & fittings 31/12/20 Motor Vehicles at cost Accumulated depreciation - motor vehicles 31/12/20 10% loan notes Trade payables Trade receivables Bank Overdraft Cash 323,250 375,000 112,500 225,000 75,000 112,500 266,445 7,680 4.183.480 £s 2,290,125 8,625 450,000 150,000 65,000 150,000 85,000 425,230 22,500 102,750 23,625 37,500 150,000 146,250 76,875 4,183,480

Hayday PLC. Trial Balance as at 31st December 2021 is shown below: £s Revenue Administrative expenses 237,150 175,200 Selling and Distribution expenses Legal and Professional expenses Allowance for receivables - 31/12/2021 81,150 276,750 Inventories - finished goods -31/12/20 Work in Progress 31/12/20 49,123 Inventories - Raw materials at cost 31/12/20 162,600 Purchases-Raw materials 1,501,062 Carriage inwards - raw materials 15,570 Manufacturing wages 187,500 Ordinary shares issued 900,000 of £0.50 8.4% cumulative preference shares 150,000 of £1 each Revaluation surplus Share premium General reserve Retained earnings 31/12/20 Patents and trademarks Freehold property at cost Leasehold property at cost Amortisation of leasehold property - 31/12/20 Plant & Equipment at cost Accumulated depreciation - plant and equipment - 31/12/20 Furniture & Fittings at Cost Accumulated depreciation - furniture & fittings 31/12/20 Motor Vehicles at cost Accumulated depreciation - motor vehicles 31/12/20 10% loan notes Trade payables Trade receivables Bank Overdraft Cash 323,250 375,000 112,500 225,000 75,000 112,500 266,445 7,680 4.183.480 £s 2,290,125 8,625 450,000 150,000 65,000 150,000 85,000 425,230 22,500 102,750 23,625 37,500 150,000 146,250 76,875 4,183,480

Chapter5: Process Costing

Section: Chapter Questions

Problem 12EA: What are the total costs to account for if a companys beginning inventory had $231,432 in materials,...

Related questions

Question

Transcribed Image Text:Hayday PLC. Trial Balance as at 31st December 2021 is shown below:

£s

Revenue

Administrative expenses

237,150

175,200

Selling and Distribution expenses

Legal and Professional expenses

Allowance for receivables - 31/12/2021

81,150

276,750

Inventories - finished goods -31/12/20

Work in Progress 31/12/20

49,123

Inventories - Raw materials at cost 31/12/20

162,600

Purchases - Raw materials

1,501,062

Carriage inwards - raw materials

15,570

Manufacturing wages

187,500

Ordinary shares issued 900,000 of £0.50

8.4% cumulative preference shares 150,000 of £1 each

Revaluation surplus

Share premium

General reserve

Retained earnings 31/12/20

Patents and trademarks

Freehold property at cost

Leasehold property at cost

Amortisation of leasehold property - 31/12/20

Plant & Equipment at cost

Accumulated depreciation - plant and equipment -

31/12/20

Furniture & Fittings at Cost

Accumulated depreciation - furniture & fittings 31/12/20

Motor Vehicles at cost

Accumulated depreciation - motor vehicles 31/12/20

10% loan notes

Trade payables

Trade receivables

Bank Overdraft

Cash

323,250

375,000

112,500

225,000

75,000

112,500

266,445

7.680

4,183,480

£s

2,290,125

8,625

450,000

150,000

65,000

150,000

85,000

425,230

22,500

102,750

23,625

37,500

150,000

146,250

76,875

4,183,480

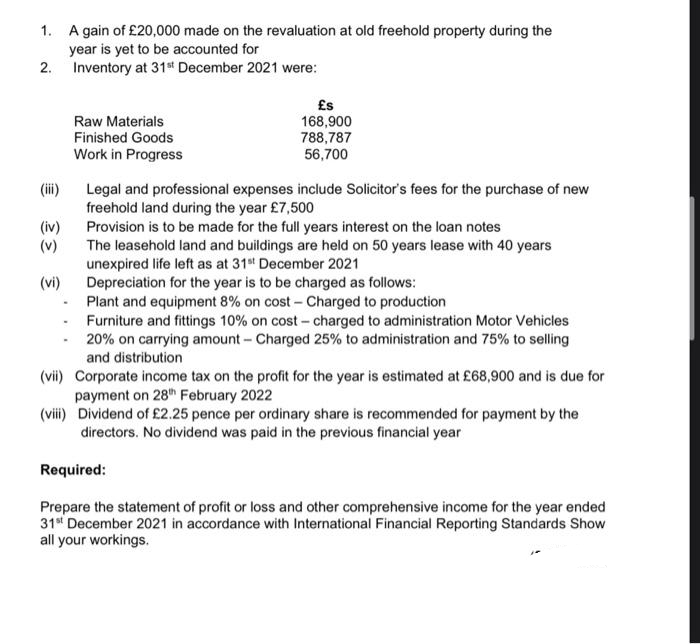

Transcribed Image Text:1.

A gain of £20,000 made on the revaluation at old freehold property during the

year is yet to be accounted for

2.

Inventory at 31st December 2021 were:

Raw Materials

Finished Goods

Work in Progress

£s

168,900

788,787

56,700

(iii)

Legal and professional expenses include Solicitor's fees for the purchase of new

freehold land during the year £7,500

Provision is to be made for the full years interest on the loan notes

The leasehold land and buildings are held on 50 years lease with 40 years

unexpired life left as at 31st December 2021

Depreciation for the year is to be charged as follows:

Plant and equipment 8% on cost - Charged to production

-

Furniture and fittings 10% on cost-charged to administration Motor Vehicles

-20% on carrying amount-Charged 25% to administration and 75% to selling

and distribution

(vii) Corporate income tax on the profit for the year is estimated at £68,900 and is due for

payment on 28th February 2022

(viii) Dividend of £2.25 pence per ordinary share is recommended for payment by the

directors. No dividend was paid in the previous financial year

Required:

Prepare the statement of profit or loss and other comprehensive income for the year ended

31st December 2021 in accordance with International Financial Reporting Standards Show

all your workings.

(iv)

(v)

(vi)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College