On December 31, 2022, Bramble Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $50,400. The balance sheet showed total assets, $124,800; total liabilities, $64,800; and stockholders' equity, $60,000. The data for the three adjusting entries were: (1) Depreciation of $9,720 was not recorded on equipment. (2) Salaries and wages amounting to $10,720 for the last two days in December were not paid and not recorded. The next payroll will be in January. (3) Rent of $6,400 was paid for two months in advance on December 1. The entire amount was debited to Prepaid Rent when paid. Complete the following tabulation to correct the financial statement. (If an amount reduces the account balance then enter using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter O for fields with no amounts.)

On December 31, 2022, Bramble Company prepared an income statement and balance sheet and failed to take into account three adjusting entries. The incorrect income statement showed net income of $50,400. The balance sheet showed total assets, $124,800; total liabilities, $64,800; and stockholders' equity, $60,000. The data for the three adjusting entries were: (1) Depreciation of $9,720 was not recorded on equipment. (2) Salaries and wages amounting to $10,720 for the last two days in December were not paid and not recorded. The next payroll will be in January. (3) Rent of $6,400 was paid for two months in advance on December 1. The entire amount was debited to Prepaid Rent when paid. Complete the following tabulation to correct the financial statement. (If an amount reduces the account balance then enter using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter O for fields with no amounts.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11P: A review of Anderson Corporations books indicates that the errors and omissions pertaining to the...

Related questions

Question

Incorrect balance effect of stock holder = $60000

Transcribed Image Text:On December 31, 2022, Bramble Company prepared an income statement and balance sheet and failed to take into account three

adjusting entries. The incorrect income statement showed net income of $50,400. The balance sheet showed total assets, $124,800;

total liabilities, $64,800; and stockholders' equity, $60,000.

The data for the three adjusting entries were:

(1)

Depreciation of $9,720 was not recorded on equipment.

(2)

Salaries and wages amounting to $10,720 for the last two days in December were not paid and not recorded. The next

payroll will be in January.

(3)

Rent of $6,400 was paid for two months in advance on December 1. The entire amount was debited to Prepaid Rent when

paid.

Complete the following tabulation to correct the financial statement. (If an amount reduces the account balance then enter using either a

negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter O for fields with no amounts.)

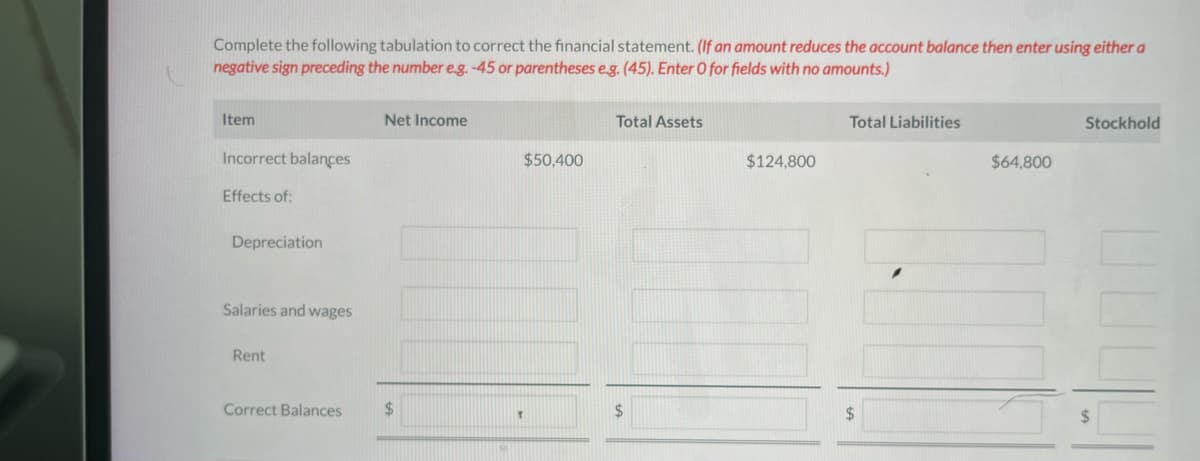

Transcribed Image Text:Complete the following tabulation to correct the financial statement. (If an amount reduces the account balance then enter using either a

negative sign preceding the number e.g. -45 or parentheses e.g. (45). Enter O for fields with no amounts.)

Item

Net Income

Total Assets

Total Liabilities

Stockhold

Incorrect balances

$50,400

$124,800

$64,800

Effects of:

Depreciation

Salaries and wages

Rent

Correct Balances

T

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning