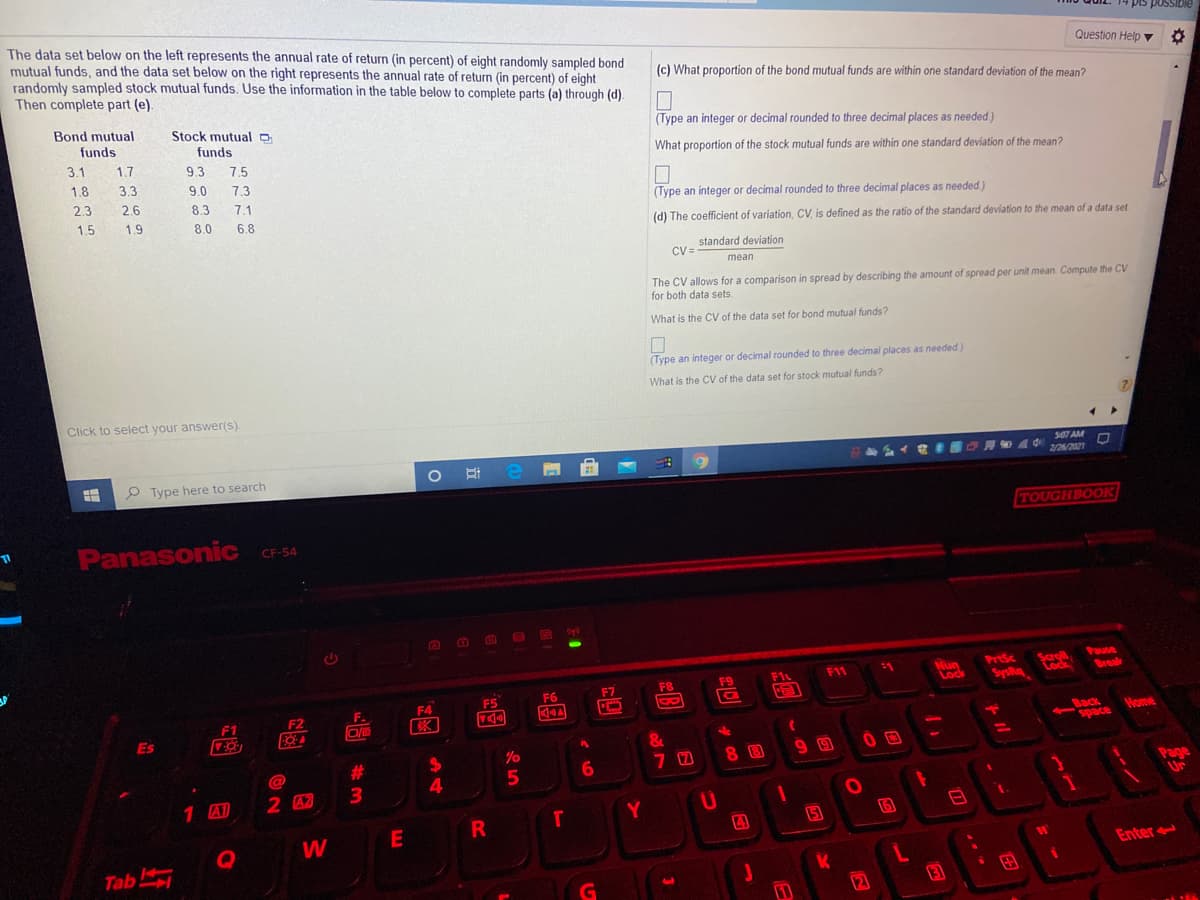

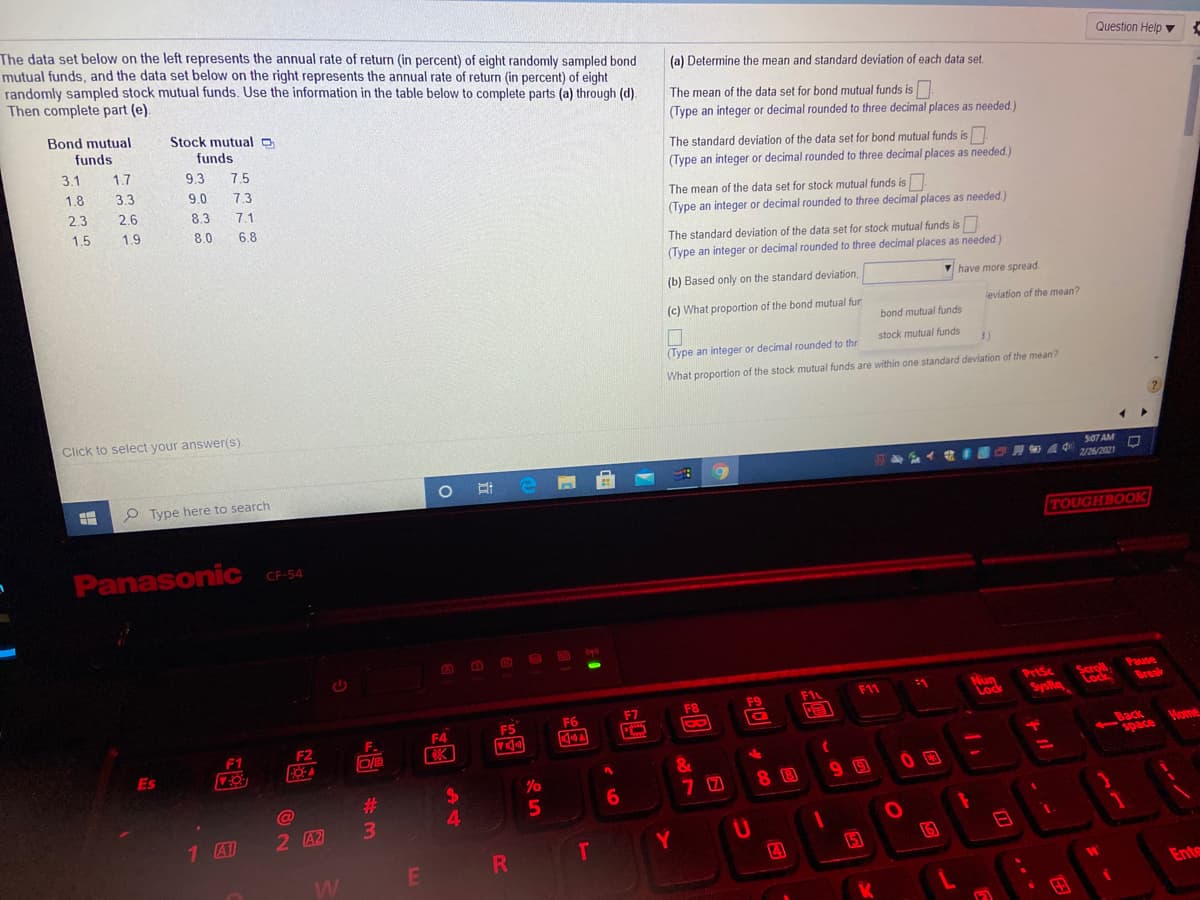

he data set below on the left represents the annual rate of return (in percent) of eight randomly sampled bond nutual funds, and the data set below on the right represents the annual rate of return (in percent) of eight randomly sampled stock mutual funds. Use the information in the table below to complete parts (a) through (d). Then complete part (e). (a) Determine the mean and standard deviation of each data set The mean of the data set for bond mutual funds is (Type an integer or decimal rounded to three decimal places as needed) Bond mutual funds Stock mutual O funds The standard deviation of the data set for bond mutual funds is 3.1 1.7 9.3 7.5 (Type an integer or decimal rounded to three decimal places as needed) 1.8 3.3 9.0 7.3 The mean of the data set for stock mutual funds is 2.3 2.6 8.3 7.1 (Type an integer or decimal rounded to three decimal places as needed 1.5 1.9 8.0 6.8 The standard deviation of the data set for stock mutual funds is (Type an integer or decimal rounded to three decimal places as needed) have more spread (b) Based only on the standard deviation, leviation of the mean? (c) What proportion of the bond mutual fur bond mutual funds stock mutual funds 1) (Type an integer or decimal rounded to thr What proportion of the stock mutual funds are within one standard deviation of the mean? Click to select your answer(s). 507 AM 2/26/2021

Inverse Normal Distribution

The method used for finding the corresponding z-critical value in a normal distribution using the known probability is said to be an inverse normal distribution. The inverse normal distribution is a continuous probability distribution with a family of two parameters.

Mean, Median, Mode

It is a descriptive summary of a data set. It can be defined by using some of the measures. The central tendencies do not provide information regarding individual data from the dataset. However, they give a summary of the data set. The central tendency or measure of central tendency is a central or typical value for a probability distribution.

Z-Scores

A z-score is a unit of measurement used in statistics to describe the position of a raw score in terms of its distance from the mean, measured with reference to standard deviation from the mean. Z-scores are useful in statistics because they allow comparison between two scores that belong to different normal distributions.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps