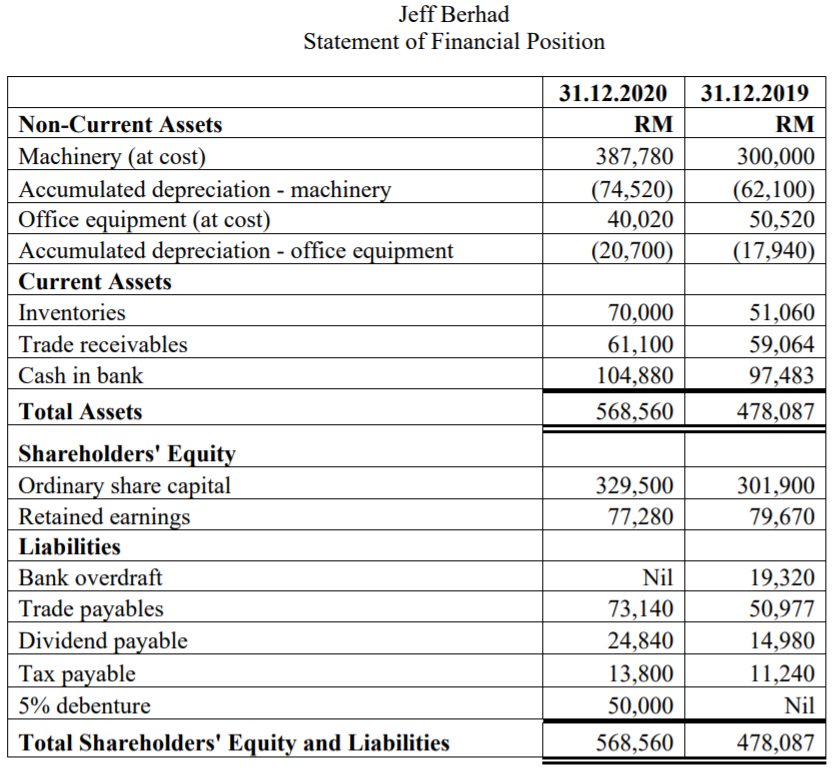

he following Statement of Financial Position is related to Jeff Berhad. Additional information: (1) During the year, depreciation for machinery is RM22,750. Machinery with a net value of RM2,760 was disposed at a profit of RM2,000. (2) Depreciation for office equipment during the year is RM5,520. Office equipment with cost of RM24,300 was sold for RM18,780. Loss on disposal of office equipment is RM2,760. (3) The net profit before tax is RM41,770. Tax charge for the year is RM17,250. (4) The cash dividends declared were RM26,910. In addition, the company received cash from issuance of share capital and debenture during the year. Required: (a) Based on the above information, prepare the Statement of Cash Flows for the year ended 31 December 2020 for Jeff Berhad using the indirect method. (b) Based on your understanding, discuss which method is the better way to present the Statement of Cash Flows: Direct Method or Indirect Method?

The following

Additional information:

(1) During the year,

(2) Depreciation for office equipment during the year is RM5,520. Office equipment with cost of RM24,300 was sold for RM18,780. Loss on disposal of office equipment is RM2,760.

(3) The net profit before tax is RM41,770. Tax charge for the year is RM17,250.

(4) The cash dividends declared were RM26,910. In addition, the company received cash from issuance of share capital and debenture during the year.

Required:

(a) Based on the above information, prepare the Statement of Cash Flows for the year ended 31 December 2020 for Jeff Berhad using the indirect method.

(b) Based on your understanding, discuss which method is the better way to present the Statement of Cash Flows: Direct Method or Indirect Method?

Step by step

Solved in 3 steps with 1 images