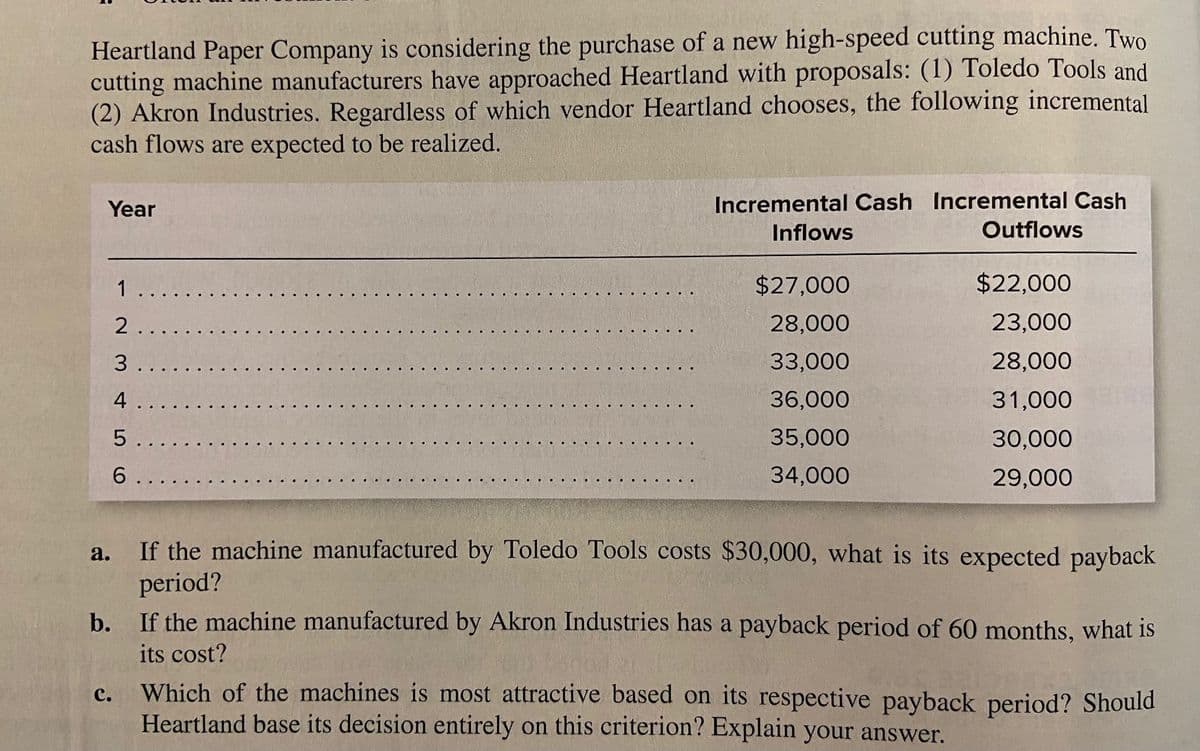

Heartland Paper Company is considering the purchase of a new high-speed cutting machine. Two cutting machine manufacturers have approached Heartland with proposals: (1) Toledo Tools and (2) Akron Industries. Regardless of which vendor Heartland chooses, the following incremental cash flows are expected to be realized. Incremental Cash Incremental Cash Outflows Year Inflows 1 $27,000 $22,000 28,000 23,000 3 33,000 28,000 36,000 31,000 35,000 30,000 6. 34,000 29,000

Heartland Paper Company is considering the purchase of a new high-speed cutting machine. Two cutting machine manufacturers have approached Heartland with proposals: (1) Toledo Tools and (2) Akron Industries. Regardless of which vendor Heartland chooses, the following incremental cash flows are expected to be realized. Incremental Cash Incremental Cash Outflows Year Inflows 1 $27,000 $22,000 28,000 23,000 3 33,000 28,000 36,000 31,000 35,000 30,000 6. 34,000 29,000

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 1PB: A bookstore is planning to purchase an automated inventory/remote marketing system, which includes...

Related questions

Question

26.2

Transcribed Image Text:Heartland Paper Company is considering the purchase of a new high-speed cutting machine. Two

cutting machine manufacturers have approached Heartland with proposals: (1) Toledo Tools and

(2) Akron Industries. Regardless of which vendor Heartland chooses, the following incremental

cash flows are expected to be realized.

Incremental Cash Incremental Cash

Outflows

Year

Inflows

1

$27,000

$22,000

2.

28,000

23,000

3.

33,000

28,000

4

36,000

31,000

35,000

30,000

6..

34,000

29,000

If the machine manufactured by Toledo Tools costs $30,000, what is its expected payback

a.

period?

If the machine manufactured by Akron Industries has a payback period of 60 months, what is

b.

its cost?

Which of the machines is most attractive based on its respective payback period? Should

Heartland base its decision entirely on this criterion? Explain your answer.

с.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning