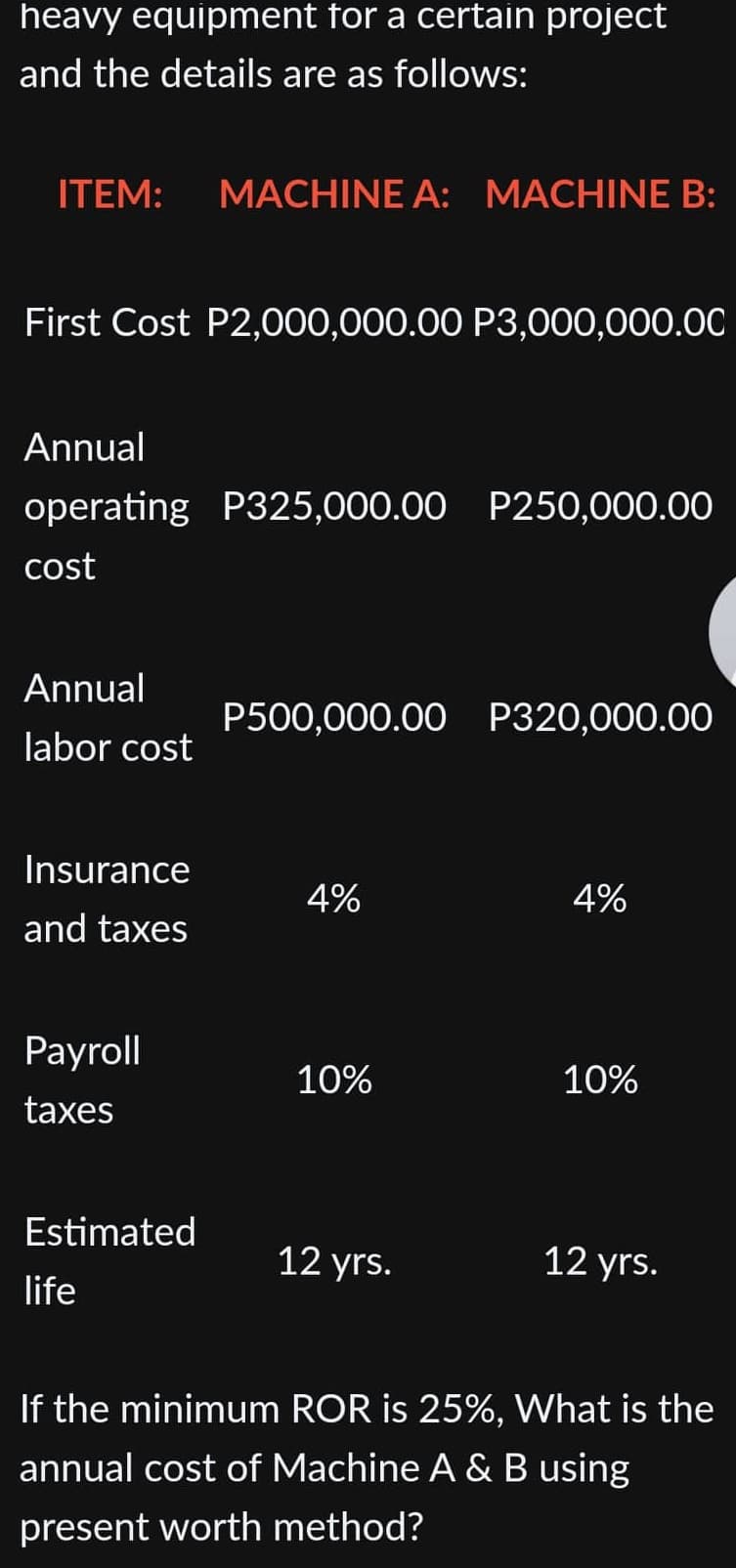

heavy equipment for a certain project and the details are as follows: ITEM: MACHINE A: MACHINE B: First Cost P2,000,000.00 P3,000,000.00 Annual operating P325,000.00 P250,000.00 cost Annual labor cost Insurance and taxes Payroll taxes Estimated life P500,000.00 P320,000.00 4% 10% 12 yrs. 4% 10% 12 yrs. If the minimum ROR is 25%, What is the annual cost of Machine A & B using present worth method?

Q: Which of the following involves a financial outflow from the U.S. economy? a. returns paid on U.S.…

A: In the economy there are outflows and inflows to economy because investors may invest outside and…

Q: Your firm is evaluating a capital budgeting project. The estimated cash flows appear below. The…

A: Net Present Value(NPV) refers to one of the concepts from the modern techniques of capital budgeting…

Q: The risk-free rate is 1.10% and the market risk premium is 6.84%. A stock with a β of 0.96 just paid…

A: Capital Asset Pricing Model (CAPM) is sued to determine the expected rate of return on an…

Q: Here is a table of call option quotes on Nike (NKE) from CBOT on 2 March 2020 On that day NKE traded…

A: The Bid and Ask prices: The bid price is the price at which a market maker is willing to purchase a…

Q: Evaluate the failure of intermediaries to rectify the behaviour to reduce the effects of the crisis…

A: Financial intermediaries refer to the procedure that channels funds for the third parties who are…

Q: Better Corporation can purchase a piece of equipment now for $120,000 or buy it 4 years from now for…

A:

Q: 5-year Treasury bonds yield 6.2%. The inflation premium (IP) is 1.9%, and the maturity risk premium…

A: Treasury bonds are bonds issued by the U.S. Federal government. Essentially treasury bonds are…

Q: Made sure you differentiate portfolio investments from FDI. Can we argue that a "A closed economy,…

A: FDI and Portfolio investment - FDI or Foreign Direct Investment involves a large commitment of…

Q: Your investment club has only two stocks in its portfolio. $50,000 is invested in a stock with a…

A: The portfolio beta represents the beta of the whole portfolio. the portfolio beta is the sum of the…

Q: Calculate the payback period for each product. 2. Calculate the net present value for each product.…

A: Payback Period: It refers to the period in which an investment or a project recovers its initial…

Q: Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the…

A: The NPV analysis provides the investor with information about the profitability of a project. It is…

Q: The management of River Corporation is considering the purchase of a new machine costing $380,000.…

A: Average rate of return = (Average annual net income / Average Investment)

Q: An automobile manufacturer is considering the installation of a high-tech material handling system…

A: IRR is a method to evaluate the profitability of the potential investment. IRR is a rate where the…

Q: If the old stock price is $50/share and ex-rights price is $49/share then the value of a right is…

A: Theoretical ex-rights price (TERP) The projected value of a company's share following a rights issue…

Q: On July 30, 2021, the following information was available to an investor: Yield on 10 Year TIPS:…

A: TIPS are treasury inflation-protected securities. These securities are indexed to inflation and…

Q: After four challenging yet fruitful years, you just graduated from college. Your parents gave you…

A: Future Value: The future value is the value of annuity or the sum lump amount after a certain period…

Q: What is the value today of a money machine that will pay $4,016.00 every six months for 23.00 years?…

A: Value of machine would be present value of payments to be received in future based on interest rate…

Q: Calculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on…

A: Purchase price = $711 Down payment = 0.10 or 10% Amount financed = Purchase price * (1 - Down…

Q: True or False. According to M&M Proposition I, a firm's capital structure is completely irrelevant…

A: This statement is true. According to MM proposition I when there is no taxes or in other words,…

Q: The company is going to invest P26,000, P34,000, P46,000, and P54,000 respectively into a savings…

A: Solution:- When an amount is invested somewhere, it earns interest on it. The amount initially…

Q: What is the expected annual capital gain yield for Pear Corp stock based on the Dividend Discount…

A: Capital gain yield : Capital Gain is the portion of an investment's overall return that results…

Q: Type of Bond GO190001 MO190002 Characteristics of Bonds An 8.5%, 4-year bond with a par value of…

A:

Q: What is a real estate investment trust? Explain the difference between public and private REITs. How…

A: The following question are answered below : What is a real estate investment trust? Explain the…

Q: Find the periodic withdrawals PMT for the given annuity account. HINT [See Quick Example 4.] (Assume…

A: The periodic withdrawals depend on the the period and interest rate of annuity and initial amount of…

Q: ments. The first replacement payment is due in three years and the second payment is due in termine…

A: The effective interest is the interest after considering the impact of compounding on interest and…

Q: Hello! Please help me with as much of this as you can. Thank you! Present Value of an Annuity of $1…

A: Net Present Value = Present Value of Cash Inflows - Initial Investment Cash Payback = Initial…

Q: $12.50 per share is the current price for Foster Farms' stock. The dividend is projected to increase…

A: The dividend discounting model is a method of finding out the value of securities after discounting…

Q: A small office building could be purchased for sole use by the corporation at a total price of $5.3…

A: In this question , we would be preparing cashflow statement for the ABC Corporation. Note #…

Q: what risks and capital budgeting issues may arise with international investments and what strategies…

A: Capital budgeting techniques are used to evaluate project proposals, but in the case of…

Q: 3) Michael invests an amount $1,000 into a fund at the beginning of each year for 10 years. At the…

A: Future value of the annuity includes the amount being deposited and amount of compound interest…

Q: WACC Shi Import-Export's balance sheet shows $300 million in debt, $50 million in preferred stock,…

A: WACC means weighted average cost of capital of the company. It means combined cost of capital for…

Q: 2. Explain why the expected return of a corpor bond does not equal its yield to maturity.

A: The expected return on bond is what we are expecting the return from bond it depends on the market…

Q: Hi, on what does it depend if this statement is true or false? "According to the organizational…

A: Organizational behavior theory refers to the activity to monitor the way and the process of…

Q: If you saved $5,000 per year (at the end of each year) for 10 years in an account with a 4% interest…

A: Here, To Find: Future value (FV) =?

Q: You have been given the following return information for a mutual fund, the market index, and the…

A: Sharpe ratio is the ratio, which was developed by William F. Sharpe that are used to helps the…

Q: Which of the following statements is not correct? The higher the sales growth rate g is, the…

A: Additional fund needed is the amount of money a company needs to raise from its external sources to…

Q: Find the future value, using the future value formula and a calculator. (Round your answer to the…

A: The FV is the actual value of an investment that the investor receives at maturity. It helps…

Q: Say you purchase a computer for $1300 at 7% interest and want to have it paid off in 48 months. Use…

A: A loan is an agreement between two parties in which one party gives money to the other party in…

Q: friend is celebrating her birthday and wants to start saving for her anticipated retirement. She…

A: There is need of planning for the retirement and if done on the time than will have good income on…

Q: Show what you typed into the TVM solver plus any additional work!

A: Information Provided: Future value = $200,000 Monthly savings = $150 APR = 2.75%

Q: You needed $10,000 and obtained the following loan: Loan specifics: You are expected to pay 24 equal…

A:

Q: At what per annum rate must $232 be compounded monthly for it to grow to $617 in 10 years?

A: EXCEL FORMULA:

Q: A corporation will pay a dividend of $1.75 per share at this years end and a dividend of $2.25 per…

A: The value of the stock is the PV of all future dividends and price of the stock.Timeline is as…

Q: d) What is the WACC of e) What would be the firm's value and overall cost of capital, value) debt in…

A: MM Proposition II with taxes: The MM Proposition I with taxes states that the value of the levered…

Q: 7. Assume you currently have all your wealth ($1MM) invested in the Vanguard 500 fund, and that you…

A: By diversification the risk is reduced and overall rate of return increases and hence it is always…

Q: The company expects cash collections during the year of P250,000. In addition, it expects P25,000 in…

A: Cash flows are a source of liquidity for the company and increasing cash flows will increase the…

Q: What is the net present value (NPV) of your proposed expansion into the Canada? Assume that the cash…

A: When a company decides whether to invest or not then it uses tools like the IRR and NPV methods.…

Q: Identify the main differences between common stock and preferred stock.

A: Preferred stock are hybrid type of security between the equity and bonds and they have features of…

Q: A large stock portfolio earned 12% for each of the first 10 years then 5% per year for the next 5…

A: Solution:- Annual rate of return means the rate of return earned annually over the period of the…

Q: The S&P 500 is currently at a value of 4,130 (as of July 29th, 2022 market close). On the same day,…

A: The futures price can be determined with the formula below:Futures Price = Spot price x e(r-y)T =…

Step by step

Solved in 2 steps

- Cost of plant R3 600 000Import duty R 900 000Installation cost R 300 000Net cash flows Year 1-10 R1 400 000 per annum (excluding residual value)Residual/scrap value R1 200 000The company uses straight-line depreciation. The cost of capital for projects of similar risk is 18%. 2.1 Calculate the investment’s Accounting Rate of Return (ARR). Briefly explain if the ARR is acceptable or not based on a target rate of return of 40%. Assume a payback period of 4 years. Determine the payback period and state if the investment isacceptable or not. Calculate and comment on the viability of the proposed investment based on the net present value(NPV) method. Discuss whether the advantages of using the NPV method outweigh the disadvantagesVista Limited intends purchasing a new machine and has a choice between the following two machines:Equipment AEquipment BInitial costR220 000R240 000Expected useful life5 years5 yearsScrap valueNilNilExpected net cash inflows:RREnd of:Year 155 00070 000Year 260 00070 000Year 362 00070 000Year 460 00070 000Year 570 00070 000The company estimates that its cost of capital is 12%. Required:2.1 Calculate the Payback Period of both equipment. (Answers must be expressed in years, months and days). 2.2 Calculate the Accounting Rate of Return (on initial investment) for both equipment A and B. (Answers must be expressed to 2 decimal places). 2.3 Calculate the Net Present Value of each equipment. (Round off amounts to the nearest Rand.) 2.4 Calculate the Internal Rate of Return of Equipment B.Consider the following financial data for an investment project:• Required capital investment al n = 0: $ 100,000• Project service life: I 0 yea rs• Salvage value at N = I 0: $15,000• Annual revenue: $150.000• Annual O&M costs (not including depreciation): $50.000• Depreciation method for tax purpose: seven-year MACRS• Income tax rate: 40%.Determine the project cash flow at the end of year lO.(a) $69.000(b) $73.000(c) $66.000(d) $67.000

- Vista Limited intends purchasing a new machine and has a choice between the following two machines:Equipment AEquipment BInitial costR220 000R240 000Expected useful life5 years5 yearsScrap valueNilNilExpected net cash inflows:RREnd of:Year 155 00070 000Year 260 00070 000Year 362 00070 000Year 460 00070 000Year 570 00070 000The company estimates that its cost of capital is 12%. Calculate the Internal Rate of Return of Equipment B.A project is estimated to cost P120T, last 8 years & have a salvage value of P20T. The annual gross income is expected to average P50k & annual expenses is P5T. If capital is earning 10% determine if this is a desirable investment using annual cost method, what is the net cost. : a. 24,255.598 b. P24,756.951 c. 25,245.598 d. P27,535.412Given the two machines’ data Machine A Machine B First Cost P8,000.00 P14,000.00 Salvage value 0 2,000.00 Annual operation 3,000.00 2,400.00 Annual maintenance 1,200.00 1,000.00 Taxes and insurance 3% 3% Life, years 10 15 Money is worth at least 16% Using equivalent uniform annual cost method, determine the value of alternative A and alternative B:

- The following information relates to machines A and B. Year Machine A Machine B Shs Shs 0 (100,000) (120,000) 1 60,000 50,000 2 40,000 50,000 3 20,000 50,000 Find the Internal Rate of Return (IRR) of the project at rates 10%)Consider a project with the following information: Initial fixed asset investment = $515,000; straight-line depreciation to zero over the 4-year life; zero salvage value; price = $47; variable costs = $29; fixed costs = $207,000; quantity sold = 102,000 units; tax rate = 21 percent. How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Change in OCF/ Change in Q =?The following information relates to two projects of which you have to select one to invest in.Both projects have an initial cost of $400,000 and only one can be undertaken.Project X YExpected profits $ $Year 1 160,000 60,000Year 2 160,000 100,000Year 3 80,000 180,000Year 4 40,000 240,000Estimated resale value atthe end of year 4 80,000 80,000i) Profit is calculated after deducting straight line depreciationii) The cost of capital is 16%Required:a) For both projects, calculate the following:i) The payback period to one decimal place ii) The accounting rate of return using average investments iii) The net present value iv) Advise the board which project in your opinion should be undertaken, givingreasons for your decision.

- Tiffany Co. is analyzing two projects for the future. Assume that only one project can be selected. Project Y Project X Cost of machine P680,000 P600,000 Net cash flow: Year 1 240,000 40,000 Year 2 240,000 260,000 Year 3 240,000 260,000 Year 4 0 200,000 If the company is using the payback period method and it requires a payback of three years or less, which project should be selected? Group of answer choices Project Y. Project Y because it has a lower initial investment. Both X and Y are acceptable projects. Project X. Neither X nor Y is an acceptable project.Philip Construction Company started a project with a contract price of P80 million. The cost incurred to date is P12 million and the estimated cost to complete is still P48 million. Under the cost cost basis, how much is the income from construction? a) P 20 Million b) P 8 Million c) P 32 Million d) P 4 MillionYou are considering an investment proj ect with the following financialin formation:(a) Required investment = $500,000(b) Project life= 5 years(c) Salvage value= $50,000(d) Depreciation method = s traight-line depreciation (no ha lf-year convention)(e) Unit price = $40(f) Unit variable cost = $18(g) Fixed annual cost = $230.000(h) Annual sales volume= I 00,000 units(i) Tax rate = 35%G) MARR = 15%Suppose the company is most concerned about the impact of its price estimate on the projects rate of return. How would you address this concern