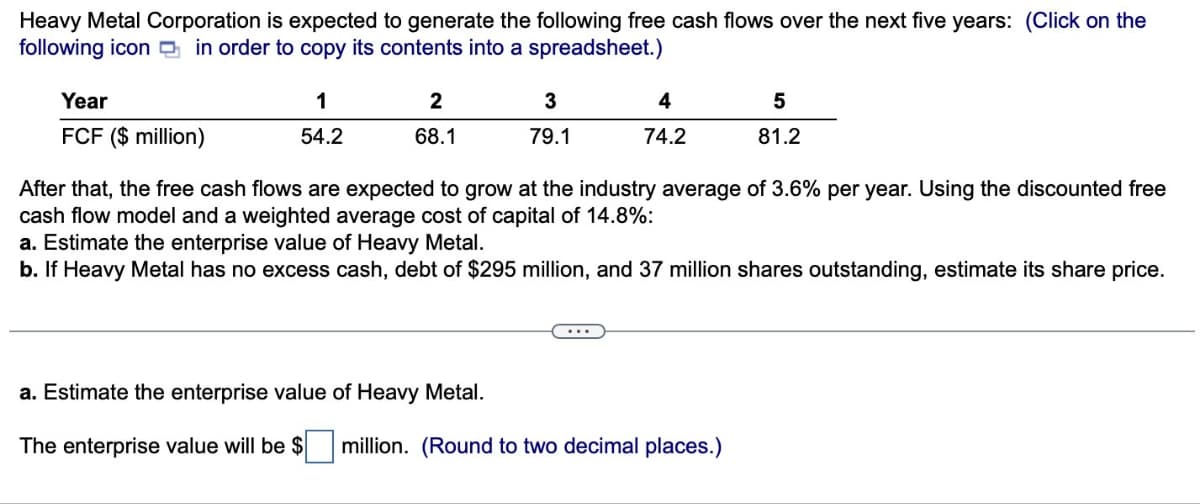

Heavy Metal Corporation is expected to generate the following free cash flows over the next five years: (Click on the following icon in order to copy its contents into a spreadsheet.) Year FCF ($ million) 1 54.2 2 3 4 5 68.1 79.1 74.2 81.2 After that, the free cash flows are expected to grow at the industry average of 3.6% per year. Using the discounted free cash flow model and a weighted average cost of capital of 14.8%: a. Estimate the enterprise value of Heavy Metal. b. If Heavy Metal has no excess cash, debt of $295 million, and 37 million shares outstanding, estimate its share price. a. Estimate the enterprise value of Heavy Metal. The enterprise value will be $ million. (Round to two decimal places.)

Heavy Metal Corporation is expected to generate the following free cash flows over the next five years: (Click on the following icon in order to copy its contents into a spreadsheet.) Year FCF ($ million) 1 54.2 2 3 4 5 68.1 79.1 74.2 81.2 After that, the free cash flows are expected to grow at the industry average of 3.6% per year. Using the discounted free cash flow model and a weighted average cost of capital of 14.8%: a. Estimate the enterprise value of Heavy Metal. b. If Heavy Metal has no excess cash, debt of $295 million, and 37 million shares outstanding, estimate its share price. a. Estimate the enterprise value of Heavy Metal. The enterprise value will be $ million. (Round to two decimal places.)

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 9P

Related questions

Question

Pradip.jg

Transcribed Image Text:Heavy Metal Corporation is expected to generate the following free cash flows over the next five years: (Click on the

following icon in order to copy its contents into a spreadsheet.)

Year

FCF ($ million)

1

54.2

2

3

4

5

68.1

79.1

74.2

81.2

After that, the free cash flows are expected to grow at the industry average of 3.6% per year. Using the discounted free

cash flow model and a weighted average cost of capital of 14.8%:

a. Estimate the enterprise value of Heavy Metal.

b. If Heavy Metal has no excess cash, debt of $295 million, and 37 million shares outstanding, estimate its share price.

a. Estimate the enterprise value of Heavy Metal.

The enterprise value will be $ million. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning