Henrich is a single taxpayer. In 2022

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 15DQ: LO.5 Beige Corporation has a fiscal year ending April 30. For the year ending April 30, 2018, Beige...

Related questions

Question

Henrich is a single taxpayer. In 2022, his taxable income is $488,500. What are his income tax and net investment income tax liability in each of the following alternative scenarios? Use Tax Rate Schedule, Dividends and

Note: Do not round intermediate calculations. Leave no answer blank. Enter zero if applicable. Round your final answers to 2 decimal places.

Required:

- His $488,500 of taxable income includes $56,000 of long-term

capital gain that is taxed at preferential rates. Assume his modified AGI is $520,000. - Henrich has $199,250 of taxable income, which includes $51,700 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $218,500.

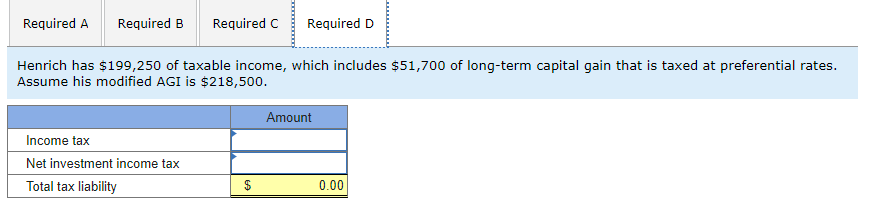

Transcribed Image Text:Required A Required B Required C Required D

Henrich has $199,250 of taxable income, which includes $51,700 of long-term capital gain that is taxed at preferential rates.

Assume his modified AGI is $218,500.

Income tax

Net investment income tax

Total tax liability

$

Amount

0.00

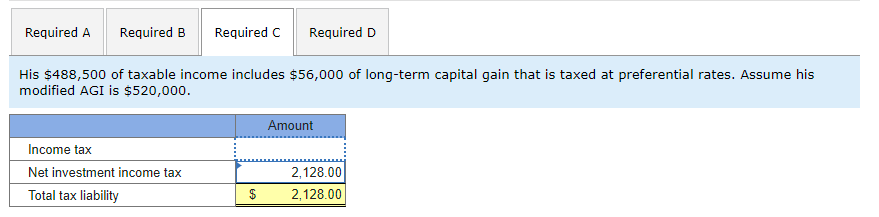

Transcribed Image Text:Required A Required B Required C

His $488,500 of taxable income includes $56,000 of long-term capital gain that is taxed at preferential rates. Assume his

modified AGI is $520,000.

Income tax

Net investment income tax

Total tax liability

$

Required D

Amount

2,128.00

2,128.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT