On February 28, 2023, the partners Anna, Juan. Berto aborized the liquidation of their partnership. The statement of financial position is as follows: AAA Statement of Financial Position February 28, 2023 Additional Informatic I The Cash Non-cash assets Total Assets P10,000 Accounts Payable 290,000 As, Capital Jusu, Capital Berto, Capital Total Liabilities and Capital P300,000 P100,000 100,000 20,000 80,000 P300,000

On February 28, 2023, the partners Anna, Juan. Berto aborized the liquidation of their partnership. The statement of financial position is as follows: AAA Statement of Financial Position February 28, 2023 Additional Informatic I The Cash Non-cash assets Total Assets P10,000 Accounts Payable 290,000 As, Capital Jusu, Capital Berto, Capital Total Liabilities and Capital P300,000 P100,000 100,000 20,000 80,000 P300,000

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter23: Accounting For Partnerships

Section23.3: Dissolving A Partnership

Problem 1WT

Related questions

Question

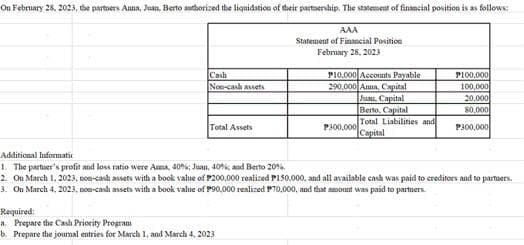

Transcribed Image Text:On February 28, 2023, the partners Anna, Juan. Berto authorized the liquidation of their partnership. The statement of financial position is as follows:

AAA

Statement of Financial Position

February 28, 2023

Cash

Non-cash assets

Total Assets

P10,000 Accounts Payable

290,000 Ana, Capital

Required:

a. Prepare the Cash Priority Program

b. Prepare the journal entries for March 1, and March 4, 2023

P300,000

Juau, Capital

Berto, Capital

Total Liabilities and

Capital

P100,000

100,000

20,000

80,000

P300,000

Additional Informatic

1. The partner's profit and loss ratio were Amma, 40%; Juan, 40% and Berto 20%

2. On March 1, 2023, non-cash assets with a book value of P200,000 realized P150,000, and all available cash was paid to creditors and to partners.

3. On March 4, 2023. non-cash assets with a book value of P90,000 realized P70,000, and that amount was paid to partners.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,