Here are data on $1,000 par value bonds issued by Microsoft GE Capital, and Morgan Stanley Assume you are thinking about buying these bonds Answer the following questions a. Assuming interest espaid annusly, calculate the values of the bonds if your required rates of return are as follows Microsoft, 7 percent, OE Capital, 15 percent, and Morgan Stanley 10 percent, where b. The bonds are selling for the following amounts Microsoft GE Capital Morgan Stanley $850 $738 $561 What are the expected rates of return for each bond? c. How would the value of the bonds change it (1) your required rate of noturn (r) increased 2 percentage points or (2) decreased 2 percentage points? d. Explain the implications of your answers in part (c) in terms of interest rate nsk, premium bonds, and discount bonds e. Should you buy the bonds? Explain a if your required rate of return on the Microsoft bond is 7 percent, what is the value of the bond? $(Round to the nearest cent) Review GE CAPITAL 7.50% 27 13 Coupon interest rate Yoars to maturity (Click on the icon kocated on the top right comer of the data table above in order to i confonts into a spreachshoot) MICROSOFT 525% Done MORGAN STA 9.00% X

Here are data on $1,000 par value bonds issued by Microsoft GE Capital, and Morgan Stanley Assume you are thinking about buying these bonds Answer the following questions a. Assuming interest espaid annusly, calculate the values of the bonds if your required rates of return are as follows Microsoft, 7 percent, OE Capital, 15 percent, and Morgan Stanley 10 percent, where b. The bonds are selling for the following amounts Microsoft GE Capital Morgan Stanley $850 $738 $561 What are the expected rates of return for each bond? c. How would the value of the bonds change it (1) your required rate of noturn (r) increased 2 percentage points or (2) decreased 2 percentage points? d. Explain the implications of your answers in part (c) in terms of interest rate nsk, premium bonds, and discount bonds e. Should you buy the bonds? Explain a if your required rate of return on the Microsoft bond is 7 percent, what is the value of the bond? $(Round to the nearest cent) Review GE CAPITAL 7.50% 27 13 Coupon interest rate Yoars to maturity (Click on the icon kocated on the top right comer of the data table above in order to i confonts into a spreachshoot) MICROSOFT 525% Done MORGAN STA 9.00% X

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.3E: Issue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8%...

Related questions

Question

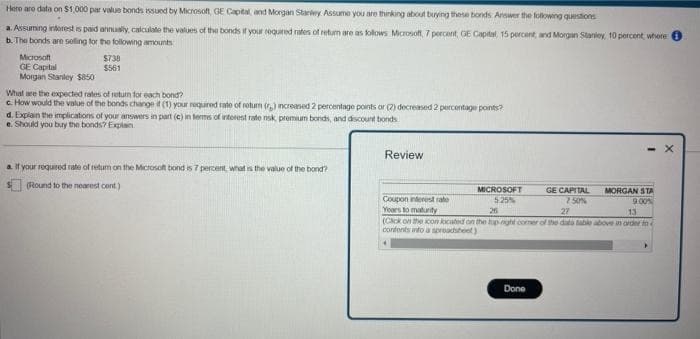

Transcribed Image Text:Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley Assume you are thinking about buying these bonds Answer the following questions

a. Assuming interest is paid annually, calculate the values of the bonds if your required rates of return are as follows Microsoft, 7 percent, GE Capital, 15 percent, and Morgan Stanley 10 percent where 0

b. The bonds are selling for the following amounts

Microsoft

GE Capital

Morgan Stanley $850

$738

$561

What are the expected rates of return for each bond?

c. How would the value of the bonds change it (1) your required rate of notumn (r) increased 2 percentage points or (2) decreased 2 percentage points?

d. Explain the implications of your answers in part (c) in terms of interest rate nsk, premium bonds, and discount bonds

e. Should you buy the bonds? Explain

a. If your required rate of return on the Microsoft bond is 7 percent, what is the value of the bond?

(Round to the nearest cont)

Review

Coupon interest rate

Yours to maturity

MICROSOFT

5.25%

GE CAPITAL

7.50%

Done

- X

MORGAN STA

9.00%

26

27

13

(Click on the icon located on the top-night corner of the data table above in order to

confonts into a spreadsheet)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College