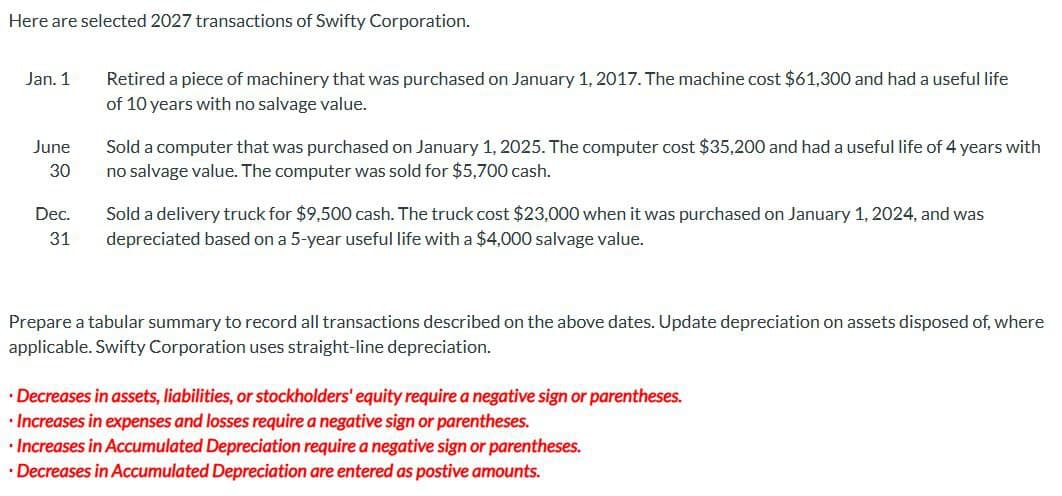

Here are selected 2027 transactions of Swifty Corporation. Jan. 1 June 30 Dec. 31 Retired a piece of machinery that was purchased on January 1, 2017. The machine cost $61,300 and had a useful life of 10 years with no salvage value. Sold a computer that was purchased on January 1, 2025. The computer cost $35,200 and had a useful life of 4 years with no salvage value. The computer was sold for $5,700 cash. Sold a delivery truck for $9,500 cash. The truck cost $23,000 when it was purchased on January 1, 2024, and was depreciated based on a 5-year useful life with a $4,000 salvage value. Prepare a tabular summary to record all transactions described on the above dates. Update depreciation on assets disposed of, where applicable. Swifty Corporation uses straight-line depreciation. ⚫Decreases in assets, liabilities, or stockholders' equity require a negative sign or parentheses. • Increases in expenses and losses require a negative sign or parentheses. • Increases in Accumulated Depreciation require a negative sign or parentheses. ⚫Decreases in Accumulated Depreciation are entered as postive amounts.

Here are selected 2027 transactions of Swifty Corporation. Jan. 1 June 30 Dec. 31 Retired a piece of machinery that was purchased on January 1, 2017. The machine cost $61,300 and had a useful life of 10 years with no salvage value. Sold a computer that was purchased on January 1, 2025. The computer cost $35,200 and had a useful life of 4 years with no salvage value. The computer was sold for $5,700 cash. Sold a delivery truck for $9,500 cash. The truck cost $23,000 when it was purchased on January 1, 2024, and was depreciated based on a 5-year useful life with a $4,000 salvage value. Prepare a tabular summary to record all transactions described on the above dates. Update depreciation on assets disposed of, where applicable. Swifty Corporation uses straight-line depreciation. ⚫Decreases in assets, liabilities, or stockholders' equity require a negative sign or parentheses. • Increases in expenses and losses require a negative sign or parentheses. • Increases in Accumulated Depreciation require a negative sign or parentheses. ⚫Decreases in Accumulated Depreciation are entered as postive amounts.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 10E: Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual...

Related questions

Question

None

Transcribed Image Text:Here are selected 2027 transactions of Swifty Corporation.

Jan. 1

June

30

Dec.

31

Retired a piece of machinery that was purchased on January 1, 2017. The machine cost $61,300 and had a useful life

of 10 years with no salvage value.

Sold a computer that was purchased on January 1, 2025. The computer cost $35,200 and had a useful life of 4 years with

no salvage value. The computer was sold for $5,700 cash.

Sold a delivery truck for $9,500 cash. The truck cost $23,000 when it was purchased on January 1, 2024, and was

depreciated based on a 5-year useful life with a $4,000 salvage value.

Prepare a tabular summary to record all transactions described on the above dates. Update depreciation on assets disposed of, where

applicable. Swifty Corporation uses straight-line depreciation.

⚫Decreases in assets, liabilities, or stockholders' equity require a negative sign or parentheses.

• Increases in expenses and losses require a negative sign or parentheses.

• Increases in Accumulated Depreciation require a negative sign or parentheses.

⚫Decreases in Accumulated Depreciation are entered as postive amounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT