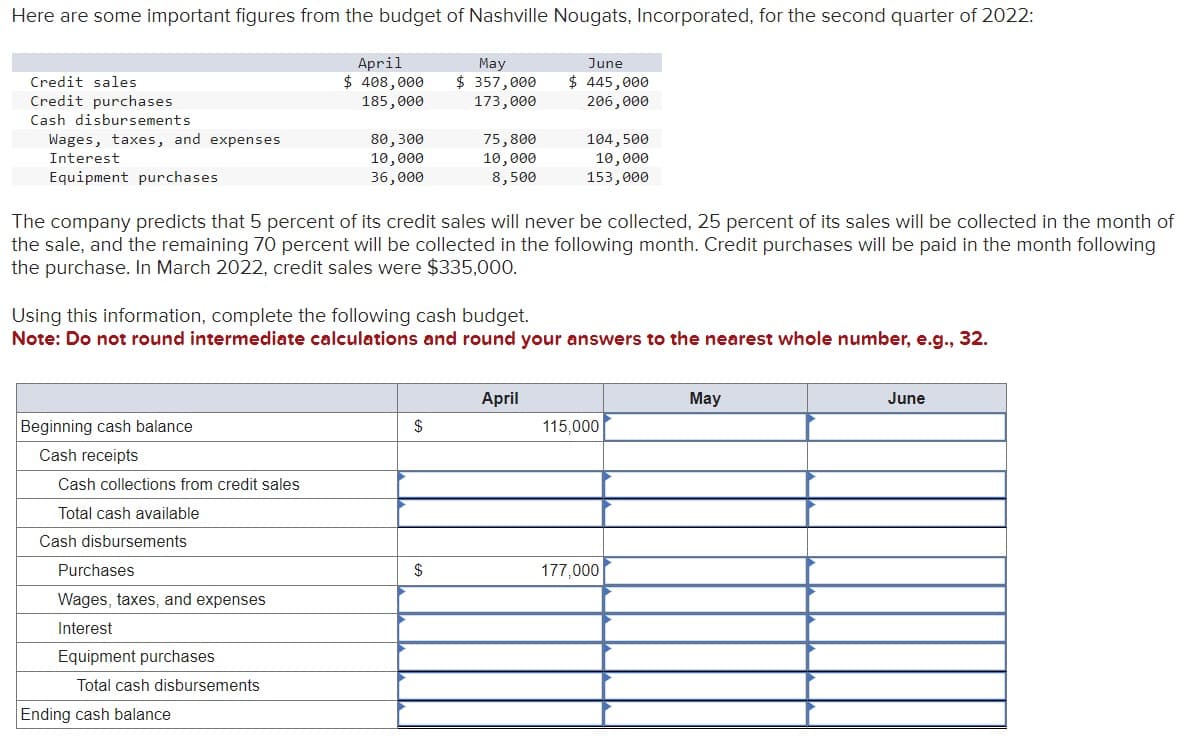

Here are some important figures from the budget of Nashville Nougats, Incorporated, for the second quarter of 2022: Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases Beginning cash balance Cash receipts Cash collections from credit sales. Total cash available Cash disbursements Purchases Wages, taxes, and expenses Interest April $ 408,000 185,000 Equipment purchases Total cash disbursements 80, 300 10,000 36,000 The company predicts that 5 percent of its credit sales will never be collected, 25 percent of its sales will be collected in the month the sale, and the remaining 70 percent will be collected in the following month. Credit purchases will be paid in the month followin the purchase. In March 2022, credit sales were $335,000. Ending cash balance. Using this information, complete the following cash budget. Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. May $ 357,000 173,000 $ 75,800 10,000 8,500 $ June $ 445,000 206,000 104,500 10,000 153,000 April 115,000 177,000 May June

Here are some important figures from the budget of Nashville Nougats, Incorporated, for the second quarter of 2022: Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases Beginning cash balance Cash receipts Cash collections from credit sales. Total cash available Cash disbursements Purchases Wages, taxes, and expenses Interest April $ 408,000 185,000 Equipment purchases Total cash disbursements 80, 300 10,000 36,000 The company predicts that 5 percent of its credit sales will never be collected, 25 percent of its sales will be collected in the month the sale, and the remaining 70 percent will be collected in the following month. Credit purchases will be paid in the month followin the purchase. In March 2022, credit sales were $335,000. Ending cash balance. Using this information, complete the following cash budget. Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. May $ 357,000 173,000 $ 75,800 10,000 8,500 $ June $ 445,000 206,000 104,500 10,000 153,000 April 115,000 177,000 May June

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter16: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 16MC: In an attempt to better understand RR’s cash position, Johnson developed a cash budget for the first...

Related questions

Question

Bhupatbhai

Transcribed Image Text:Here are some important figures from the budget of Nashville Nougats, Incorporated, for the second quarter of 2022:

Credit sales

Credit purchases

Cash disbursements

Wages, taxes, and expenses

Interest

Equipment purchases

Beginning cash balance

Cash receipts

Cash collections from credit sales

Total cash available

Cash disbursements

Purchases

Wages, taxes, and expenses

Interest

April

$ 408,000

185,000

Equipment purchases

Total cash disbursements

80,300

10,000

36,000

The company predicts that 5 percent of its credit sales will never be collected, 25 percent of its sales will be collected in the month of

the sale, and the remaining 70 percent will be collected in the following month. Credit purchases will be paid in the month following

the purchase. In March 2022, credit sales were $335,000.

Ending cash balance

Using this information, complete the following cash budget.

Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.

May

$ 357,000

173,000

$

75,800

10,000

8,500

$

June

$ 445,000

206,000

104,500

10,000

153,000

April

115,000

177,000

May

June

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning