Here are the changes to the original problem and the revised conditions for this decision-making problem: With a favorable market, John Thompson thinks a large facility would result in a net profit of $195,000 to his firm. If the market is unfavorable, the construction of a large facility would result in $185,000 net loss. A small plant would result in a net profit of $110,000 in a favorable market, but a net loss of $25,000 would occur if the market was unfavorable. Doing nothing would result in $0 profit in either market conditions. a) Create a decision table, like the one presented on Table 3.1 (page #65). b) What is your recommendation if you would apply the Maximax criterion (Optimistic)? Follow the guidance from your textbook and create a table similar to Table 3.2 (page #66). c) What is your recommendation if you would apply the Maximin Criterion (Pessimistic)? Follow the guidance from your textbook and create a table similar to Table 3.3 (page #66).

Here are the changes to the original problem and the revised conditions for this decision-making problem: With a favorable market, John Thompson thinks a large facility would result in a net profit of $195,000 to his firm. If the market is unfavorable, the construction of a large facility would result in $185,000 net loss. A small plant would result in a net profit of $110,000 in a favorable market, but a net loss of $25,000 would occur if the market was unfavorable. Doing nothing would result in $0 profit in either market conditions. a) Create a decision table, like the one presented on Table 3.1 (page #65). b) What is your recommendation if you would apply the Maximax criterion (Optimistic)? Follow the guidance from your textbook and create a table similar to Table 3.2 (page #66). c) What is your recommendation if you would apply the Maximin Criterion (Pessimistic)? Follow the guidance from your textbook and create a table similar to Table 3.3 (page #66).

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section: Chapter Questions

Problem 36P

Related questions

Question

Need help solving A, B and C.

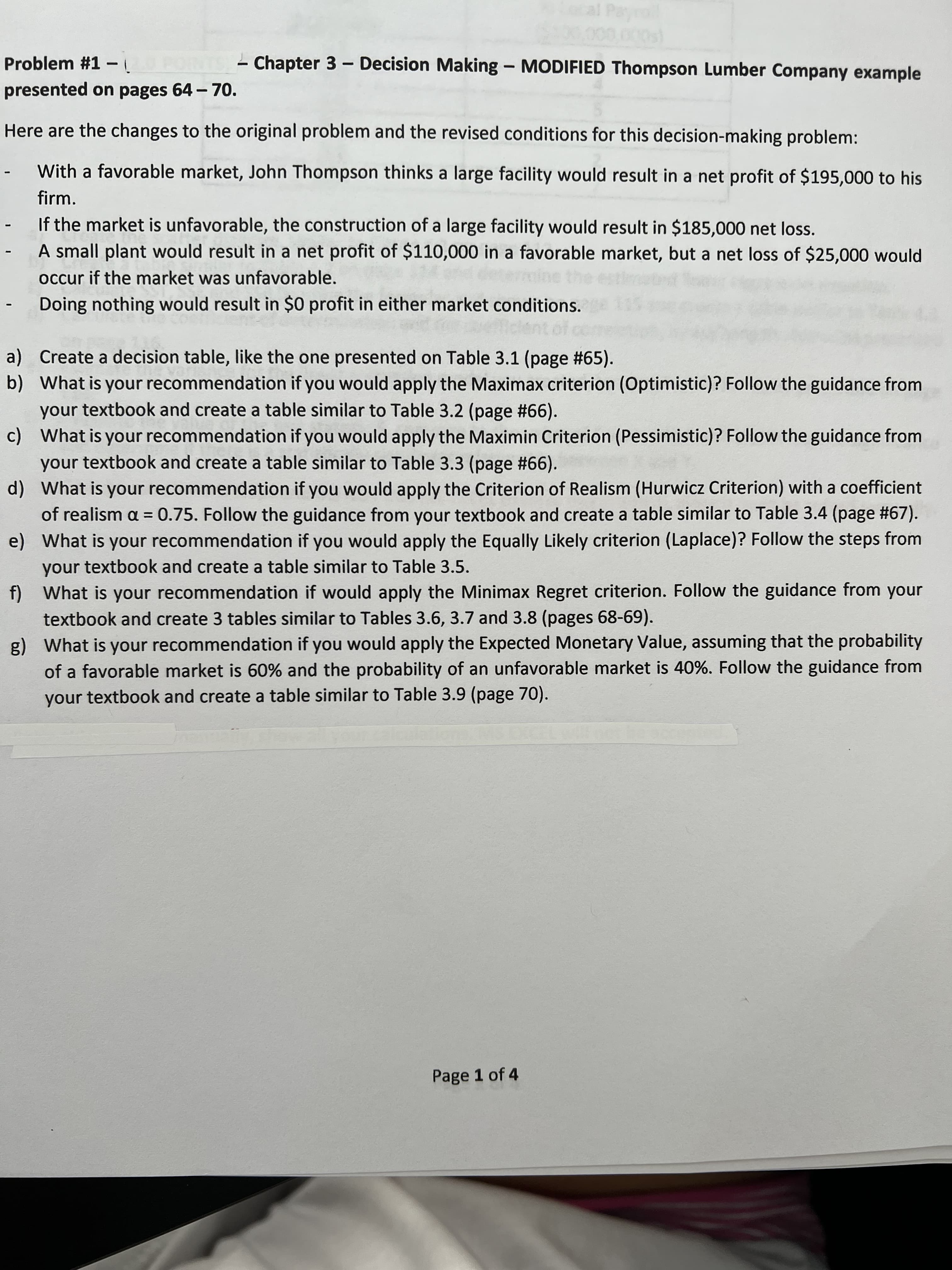

Transcribed Image Text:Problem #1 -

- Chapter 3 - Decision Making - MODIFIED Thompson Lumber Company example

presented on pages 64 - 70.

Here are the changes to the original problem and the revised conditions for this decision-making problem:

With a favorable market, John Thompson thinks a large facility would result in a net profit of $195,000 to his

firm.

If the market is unfavorable, the construction of a large facility would result in $185,000 net loss.

A small plant would result in a net profit of $110,000 in a favorable market, but a net loss of $25,000 would

occur if the market was unfavorable.

Doing nothing would result in $0 profit in either market conditions.

a) Create a decision table, like the one presented on Table 3.1 (page #65).

b) What is your recommendation if you would apply the Maximax criterion (Optimistic)? Follow the guidance from

your textbook and create a table similar to Table 3.2 (page #66).

c) What is your recommendation if you would apply the Maximin Criterion (Pessimistic)? Follow the guidance from

your textbook and create a table similar to Table 3.3 (page #66).

d) What is your recommendation if you would apply the Criterion of Realism (Hurwicz Criterion) with a coefficient

of realism a = 0.75. Follow the guidance from your textbook and create a table similar to Table 3.4 (page #67).

e) What is your recommendation if you would apply the Equally Likely criterion (Laplace)? Follow the steps from

your textbook and create a table similar to Table 3.5.

f) What is your recommendation if would apply the Minimax Regret criterion. Follow the guidance from your

textbook and create 3 tables similar to Tables 3.6, 3.7 and 3.8 (pages 68-69).

g) What is your recommendation if you would apply the Expected Monetary Value, assuming that the probability

of a favorable market is 60% and the probability of an unfavorable market is 40%. Follow the guidance from

your textbook and create a table similar to Table 3.9 (page 70).

Page 1 of 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,