Here is a simplified balance sheet for Locust Farming: 12 Locust Farming Balance Sheet ($ in millions) $ 42,528 46,840 Current liabilities Long-term debt Other liabilities Equity $ 29,751 27,756 14,325 17,536 $ 89,368 Current assets Long-term assets 01:19:37 Total $89,368 Total Locust has 661 million shares outstanding with a market price of $87 a share. a. Calculate the company's market value added. (Enter your answers in millions.) Market value Market value added million million b. Calculate the market-to-book ratio. (Round your answer to 2 decimal places.) Market-to-book ratio

Here is a simplified balance sheet for Locust Farming: 12 Locust Farming Balance Sheet ($ in millions) $ 42,528 46,840 Current liabilities Long-term debt Other liabilities Equity $ 29,751 27,756 14,325 17,536 $ 89,368 Current assets Long-term assets 01:19:37 Total $89,368 Total Locust has 661 million shares outstanding with a market price of $87 a share. a. Calculate the company's market value added. (Enter your answers in millions.) Market value Market value added million million b. Calculate the market-to-book ratio. (Round your answer to 2 decimal places.) Market-to-book ratio

Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 12SP

Related questions

Question

Transcribed Image Text:< >

A ezto.mheducation.com

M Question 12 - Midterm 1 - Connect

C Finance question | Chegg.com

Midterm 1

Saved

Help

Save & Exit

Submit

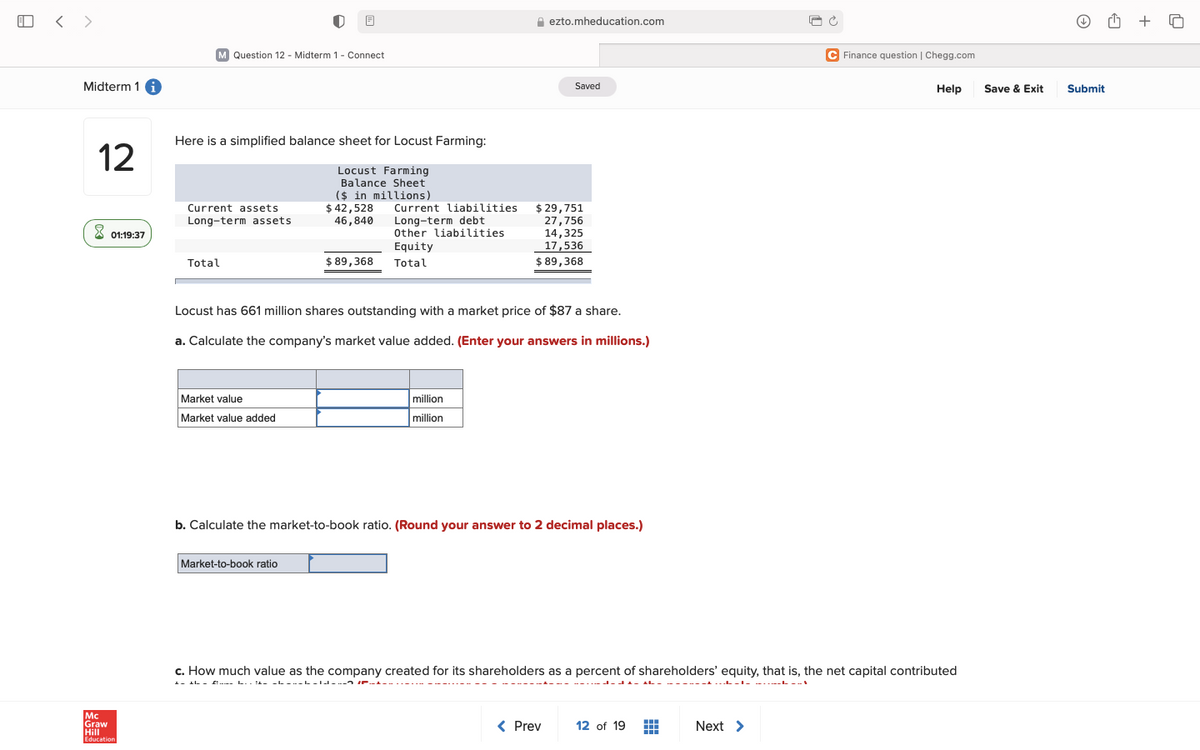

Here is a simplified balance sheet for Locust Farming:

12

Locust Farming

Balance Sheet

($ in millions)

$ 42,528

46,840

$ 29,751

27,756

14,325

17,536

$ 89,368

Current assets

Current liabilities

Long-term debt

Other liabilities

Long-term assets

8 01:19:37

Equity

Total

$ 89,368

Total

Locust has 661 million shares outstanding with a market price of $87 a share.

a. Calculate the company's market value added. (Enter your answers in millions.)

Market value

million

Market value added

million

b. Calculate the market-to-book ratio. (Round your answer to 2 decimal places.)

Market-to-book ratio

c. How much value as the company created for its shareholders as a percent of shareholders' equity, that is, the net capital contributed

E.-- L. - 1- -L-.--L-I- ---n r.-1--

Mc

Graw

Hill

< Prev

12 of 19

Next >

Education

Transcribed Image Text:< >

A ezto.mheducation.com

M Question 13 - Midterm 1 - Connect

C Get Homework Help With Chegg Study | Chegg.com

Midterm 1

Saved

Help

Save & Exit

Submit

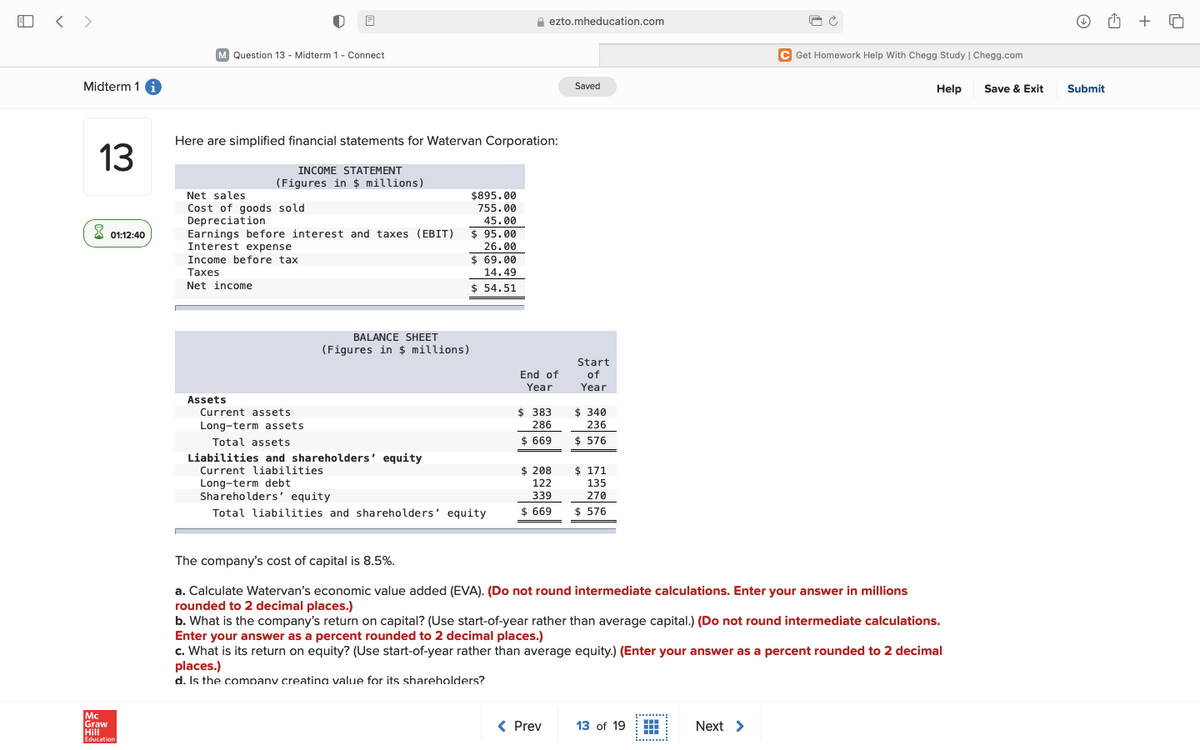

Here are simplified financial statements for Watervan Corporation:

13

INCOME STATEMENT

(Figures in $ millions)

Net sales

Cost of goods sold

Depreciation

Earnings before interest and taxes (EBIT)

Interest expense

Income before tax

$895.00

755.00

45.00

8 01:12:40

$ 95.00

26.00

$ 69.00

Taxes

14.49

Net income

$ 54.51

BALANCE SHEET

(Figures in $ millions)

Start

of

End of

Year

Year

Assets

Current assets

$ 383

$ 340

Long-term assets

Total assets

286

236

$ 669

$ 576

Liabilities and shareholders' equity

Current liabilities

$ 208

$ 171

Long-term debt

Shareholders' equity

122

339

135

270

Total liabilities and shareholders' equity

$ 669

$ 576

The company's cost of capital is 8.5%.

a. Calculate Watervan's economic value added (EVA). (Do not round intermediate calculations. Enter your answer in millions

rounded to 2 decimal places.)

b. What is the company's return on capital? (Use start-of-year rather than average capital.) (Do not round intermediate calculations.

Enter your answer as a percent rounded to 2 decimal places.)

c. What is its return on equity? (Use start-of-year rather than average equity.) (Enter your answer as a percent rounded to 2 decimal

places.)

d. Is the company creatina value for its shareholders?

Mc

Graw

Hill

< Prev

13 of 19

Next >

Education

.....:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning