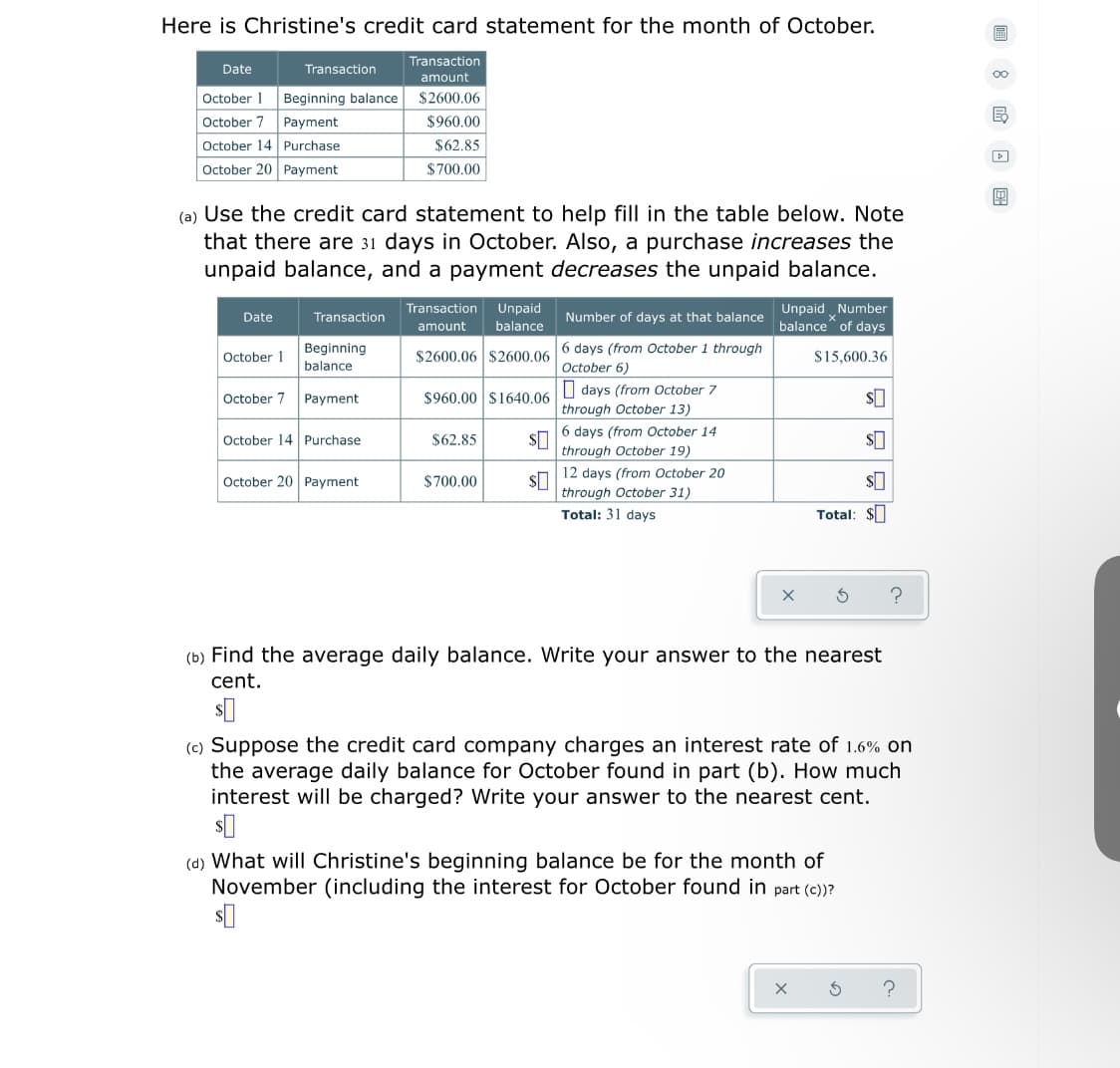

Here is Christine's credit card statement for the month of October. Transaction Date Transaction amount October 1 Beginning balance $2600.06 October 7 Payment October 14 Purchase October 20 Payment $960.00 $62.85 $700.00 (a) Use the credit card statement to help fill in the table below. Note that there are 31 days in October. Also, a purchase increases the unpaid balance, and a payment decreases the unpaid balance. Transaction Unpaid Unpaid Number Date Transaction Number of days at that balance amount balance balance of days 6 days (from October 1 through October 6) O days (from October 7 Beginning October 1 $2600.06 $2600.06 S15,600.36 balance October 7 Payment $960.00 $1640.06 through October 13) 6 days (from October 14 October 14 Purchase $62.85 through October 19) |12 days (from October 20 October 20 Payment $700.00 through October 31) Total: 31 days Total: $I (b) Find the average daily balance. Write your answer to the nearest cent. (c) Suppose the credit card company charges an interest rate of 1.6% on the average daily balance for October found in part (b). How much interest will be charged? Write your answer to the nearest cent. (d) What will Christine's beginning balance be for the month of November (including the interest for October found in part (c))?

Here is Christine's credit card statement for the month of October. Transaction Date Transaction amount October 1 Beginning balance $2600.06 October 7 Payment October 14 Purchase October 20 Payment $960.00 $62.85 $700.00 (a) Use the credit card statement to help fill in the table below. Note that there are 31 days in October. Also, a purchase increases the unpaid balance, and a payment decreases the unpaid balance. Transaction Unpaid Unpaid Number Date Transaction Number of days at that balance amount balance balance of days 6 days (from October 1 through October 6) O days (from October 7 Beginning October 1 $2600.06 $2600.06 S15,600.36 balance October 7 Payment $960.00 $1640.06 through October 13) 6 days (from October 14 October 14 Purchase $62.85 through October 19) |12 days (from October 20 October 20 Payment $700.00 through October 31) Total: 31 days Total: $I (b) Find the average daily balance. Write your answer to the nearest cent. (c) Suppose the credit card company charges an interest rate of 1.6% on the average daily balance for October found in part (b). How much interest will be charged? Write your answer to the nearest cent. (d) What will Christine's beginning balance be for the month of November (including the interest for October found in part (c))?

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 10EA: Millennial Manufacturing has net credit sales for 2018 in the amount of $1,433,630, beginning...

Related questions

Question

Transcribed Image Text:Here is Christine's credit card statement for the month of October.

Transaction

Date

Transaction

00

amount

October 1

Beginning balance

$2600.06

October 7

Payment

$960.00

October 14 Purchase

$62.85

October 20 Payment

$700.00

(a) Use the credit card statement to help fill in the table below. Note

that there are 31 days in October. Also, a purchase increases the

unpaid balance, and a payment decreases the unpaid balance.

Transaction

Unpaid

Unpaid Number

balance of days

Date

Transaction

Number of days at that balance

amount

balance

Beginning

6 days (from October 1 through

October 1

$2600.06 $2600.06

S15,600.36

balance

October 6)

| days (from October 7

October 7 Payment

$960.00 $1640.06

through October 13)

6 days (from October 14

October 14 Purchase

$62.85

through October 19)

12 days (from October 20

October 20 Payment

$700.00

through October 31)

Total: 31 days

Total: $I

(b) Find the average daily balance. Write your answer to the nearest

cent.

(c) Suppose the credit card company charges an interest rate of 1.6% on

the average daily balance for October found in part (b). How much

interest will be charged? Write your answer to the nearest cent.

(d) What will Christine's beginning balance be for the month of

November (including the interest for October found in part (c))?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,