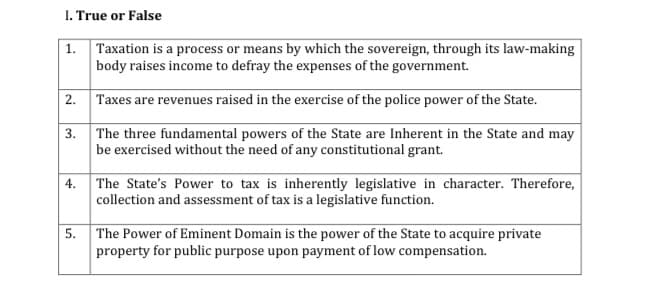

I. True or False 1. Taxation is a process or means by which the sovereign, through its law-making body raises income to defray the expenses of the government. 2. Taxes are revenues raised in the exercise of the police power of the State. 3. The three fundamental powers of the State are Inherent in the State and may be exercised without the need of any constitutional grant. 4. The State's Power to tax is inherently legislative in character. Therefore, collection and assessment of tax is a legislative function. 5. The Power of Eminent Domain is the power of the State to acquire private property for public purpose upon payment of low compensation.

I. True or False 1. Taxation is a process or means by which the sovereign, through its law-making body raises income to defray the expenses of the government. 2. Taxes are revenues raised in the exercise of the police power of the State. 3. The three fundamental powers of the State are Inherent in the State and may be exercised without the need of any constitutional grant. 4. The State's Power to tax is inherently legislative in character. Therefore, collection and assessment of tax is a legislative function. 5. The Power of Eminent Domain is the power of the State to acquire private property for public purpose upon payment of low compensation.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 2BD

Related questions

Question

Pls answer number 1 to 5

True or false

Transcribed Image Text:I. True or False

| 1. Taxation is a process or means by which the sovereign, through its law-making

body raises income to defray the expenses of the government.

2. Taxes are revenues raised in the exercise of the police power of the State.

3. The three fundamental powers of the State are Inherent in the State and may

be exercised without the need of any constitutional grant.

| 4. The State's Power to tax is inherently legislative in character. Therefore,

collection and assessment of tax is a legislative function.

The Power of Eminent Domain is the power of the State to acquire private

property for public purpose upon payment of low compensation.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage