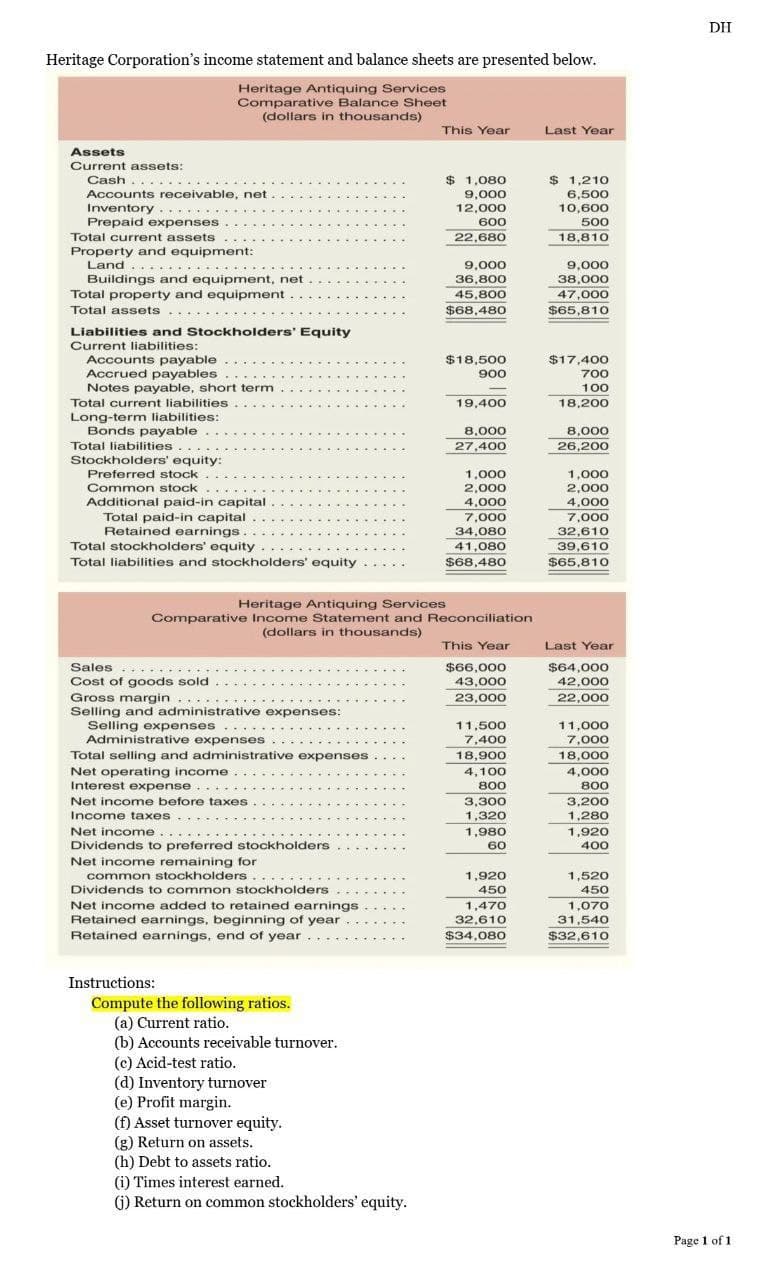

Heritage Corporation's income statement and balance sheets are presented below. Heritage Antiquing Services Comparative Balance Sheet (dollars in thousands) Assets Current assets: Cash..... Accounts receivable, net Inventory......... Prepaid expenses Total current assets Property and equipment: Land ....... Buildings and equipment, net Total property and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued payables Notes payable, short term Total current liabilities. Long-term liabilities: Bonds payable Total liabilities. Stockholders' equity: Preferred stock. Common stock Additional paid-in capital Total paid-in capital. Retained earnings. Total stockholders' equity Total liabilities and stockholders' equity Sales... Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses .. Administrative expenses Total selling and administrative expenses Net operating income Interest expense Net income before taxes Income taxes. Net income . Instructions: ......... Dividends to preferred stockholders Net income remaining for common stockholders........ Dividends to common stockholders Net income added to retained earnings Retained earnings, beginning of year Retained earnings, end of year Heritage Antiquing Services Comparative Income Statement and Reconciliation (dollars in thousands) Compute the following ratios. (a) Current ratio. (b) Accounts receivable turnover. (c) Acid-test ratio. (d) Inventory turnover (e) Profit margin. (f) Asset turnover equity. (g) Return on assets. (h) Debt to assets ratio. This Year (i) Times interest earned. (j) Return on common stockholders' equity. $ 1,080 9,000 12,000 600 22,680 9,000 36,800 45,800 $68,480 $18,500 900 19,400 8,000 27,400 1,000 2,000 4,000 7,000 34,080 41,080 $68,480 This Year $66,000 43,000 23,000 11,500 7,400 18,900 4,100 800 3,300 1,320 1,980 60 1,920 450 1,470 32,610 $34,080 Last Year $1,210 6,500 10,600 500 18,810 9,000 38,000 47,000 $65,810 $17,400 700 100 18,200 8,000 26,200 1,000 2,000 4,000 7,000 32,610 39,610 $65,810 Last Year $64,000 42,000 22,000 11,000 7,000 18,000 4,000 800 3,200 1,280 1,920 400 1,520 450 1,070 31,540 $32,610 DH Page 1 of 1.

Heritage Corporation's income statement and balance sheets are presented below. Heritage Antiquing Services Comparative Balance Sheet (dollars in thousands) Assets Current assets: Cash..... Accounts receivable, net Inventory......... Prepaid expenses Total current assets Property and equipment: Land ....... Buildings and equipment, net Total property and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued payables Notes payable, short term Total current liabilities. Long-term liabilities: Bonds payable Total liabilities. Stockholders' equity: Preferred stock. Common stock Additional paid-in capital Total paid-in capital. Retained earnings. Total stockholders' equity Total liabilities and stockholders' equity Sales... Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses .. Administrative expenses Total selling and administrative expenses Net operating income Interest expense Net income before taxes Income taxes. Net income . Instructions: ......... Dividends to preferred stockholders Net income remaining for common stockholders........ Dividends to common stockholders Net income added to retained earnings Retained earnings, beginning of year Retained earnings, end of year Heritage Antiquing Services Comparative Income Statement and Reconciliation (dollars in thousands) Compute the following ratios. (a) Current ratio. (b) Accounts receivable turnover. (c) Acid-test ratio. (d) Inventory turnover (e) Profit margin. (f) Asset turnover equity. (g) Return on assets. (h) Debt to assets ratio. This Year (i) Times interest earned. (j) Return on common stockholders' equity. $ 1,080 9,000 12,000 600 22,680 9,000 36,800 45,800 $68,480 $18,500 900 19,400 8,000 27,400 1,000 2,000 4,000 7,000 34,080 41,080 $68,480 This Year $66,000 43,000 23,000 11,500 7,400 18,900 4,100 800 3,300 1,320 1,980 60 1,920 450 1,470 32,610 $34,080 Last Year $1,210 6,500 10,600 500 18,810 9,000 38,000 47,000 $65,810 $17,400 700 100 18,200 8,000 26,200 1,000 2,000 4,000 7,000 32,610 39,610 $65,810 Last Year $64,000 42,000 22,000 11,000 7,000 18,000 4,000 800 3,200 1,280 1,920 400 1,520 450 1,070 31,540 $32,610 DH Page 1 of 1.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 35E: Classification of Cash Flows The following are several items that might be disclosed on a companys...

Related questions

Question

Transcribed Image Text:Heritage Corporation's income statement and balance sheets are presented below.

Heritage Antiquing Services

Comparative Balance Sheet

(dollars in thousands)

Assets

Current assets:

Cash.....

Accounts receivable, net

Inventory.........

Prepaid expenses

Total current assets

Property and equipment:

Land

..…....

Buildings and equipment, net

Total property and equipment

Total assets

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable

Accrued payables

Notes payable, short term

Total current liabilities.

Long-term liabilities:

Bonds payable

Total liabilities.

Stockholders' equity:

Preferred stock.

Common stock

Additional paid-in capital

Total paid-in capital.

Retained earnings.

Total stockholders' equity

Total liabilities and stockholders' equity

Sales...

Cost of goods sold

Gross margin

Selling and administrative expenses:

Selling expenses..

Administrative expenses

Total selling and administrative expenses

Net operating income

Interest expense

Net income before taxes

Income taxes.

Net income

.

Dividends to preferred stockholders

Net income remaining for

common stockholders........

Dividends to common stockholders

Net income added to retained earnings

Retained earnings, beginning of year

Retained earnings, end of year

Instructions:

Heritage Antiquing Services

Comparative Income Statement and Reconciliation

(dollars in thousands)

Compute the following ratios.

(a) Current ratio.

(b) Accounts receivable turnover.

(c) Acid-test ratio.

(d) Inventory turnover

(e) Profit margin.

(f) Asset turnover equity.

(g) Return on assets.

(h) Debt to assets ratio.

This Year

(i) Times interest earned.

(j) Return on common stockholders' equity.

$ 1,080

9,000

12,000

600

22,680

9,000

36,800

45,800

$68,480

$18,500

900

19,400

8,000

27,400

1,000

2,000

4,000

7,000

34,080

41,080

$68,480

This Year

$66,000

43,000

23,000

11,500

7,400

18,900

4,100

800

3,300

1,320

1,980

60

1,920

450

1,470

32,610

$34,080

Last Year

$1,210

6,500

10,600

500

18,810

9,000

38,000

47,000

$65,810

$17,400

700

100

18,200

8,000

26,200

1,000

2,000

4,000

7,000

32,610

39,610

$65,810

Last Year

$64,000

42,000

22,000

11,000

7,000

18,000

4,000

800

3,200

1,280

1,920

400

1,520

450

1,070

31,540

$32,610

DH

Page 1 of 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage