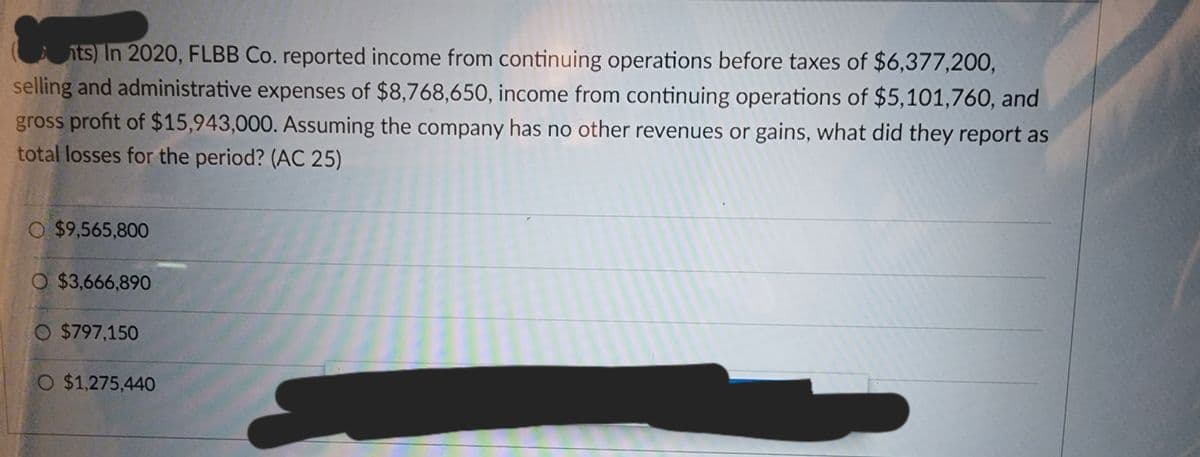

gross profit of $15,943,000. Assu

Q: From March Direct Materials Direct Labor Applied overhead Beginning goods in process For April…

A: Overhead Applied :— Applied overhead is a type of direct overhead expense that is recorded under the…

Q: Question 4 Identify and order the main activities in the 'Cash Disbursement process 2 3 [Choose]…

A: A disbursement means money paid by one party to another party during a particular period ., This…

Q: XYZ, Inc. declared on January 1, 2015, that it will pay a cash dividend of $1.00 per share at the…

A: Share price is the sum of present value of all dividends. For finite series of dividends, P0…

Q: Question 2 During January 2017, Esy PC Ltd, a retailer of personal computers, began operations. The…

A: Inventory Valuation Method includes: FIFO method LIFO method Weighted average method FIFO method -…

Q: In a certain department store, the monthly salary of a saleslady is partly constant and partly…

A: Salary includes the fixed Salary and Variable Salary in that case employee will received the fixed…

Q: Mary is a 47-year old corporate attorney. She earns $225,000 per year and receives group term life…

A: Income from the benefits which has been got by the employee from the employer requires to be…

Q: Using the table in Exercise 10, calculate the net present value for each project shown below at the…

A: Net Present Value=(Present Value of Cash Inflows-Present Value of Cash Outflows) The disparity…

Q: MANUFACTURING PROFIT A manufacturer estimates that it costs $14 to produce each unit of a particular…

A: Profit Calculation Formula: Particulars Sales Less: Variable Cost = Contribution…

Q: outstanding had increased to 8,31

A: Stockholders are the Persons of entities whom the company issues its ownership rights in the form of…

Q: Create a statement of cash flow for the current year using Wright Co's income statement and balance…

A: Solution Cash flow statement is prepared according to cash basis of accounting not accrual basis.…

Q: The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30…

A: Adjsuting Entries :— It is the journal entry to adjust the excess or less balances of expenses and…

Q: Based on the following post-closing trial balance of Rigodon Corporation on June 30, the end of its…

A: Net Profit Can be calculated by comparing the capital. Net Profit - Closing Owner's Equity + Drawing…

Q: please explain step-by-step how to calculate an operational budget with the information provided:…

A: Operational Budget: The operational budget of a firm is a thorough prediction of what the company…

Q: Luke Corporation produces a variety of products, each within their own division. Last year, the…

A: Regression Analysis Regression analysis is a group of statistical methods used to determine the…

Q: CellPeak produces shelving units. The variable cost of each shelving unit comprises of direct…

A: Lets understand the basics. Profit means a amount after deducting variable cost and fixed cost from…

Q: Canine Couture is a specialty dog clothing boutique that sells clothing and clothing accessories for…

A: Operating Income :— Operating income refers to the adjusted revenue of a company after all expenses…

Q: Problem Isabel Company had outstanding share capital with par value of P50,000,000 and 12%…

A: Solution Share premium account is the difference between the par value of share issued and the issue…

Q: Western Trucking operates a fleet of delivery trucks. The fixed expenses to operate the fleet are…

A: Total variable cost = 92,097 miles x $0.49 per mile = $45,127.53

Q: The Houston Manufacturing Company presents the following partial lists of account balances, after…

A: According to the given question, we are required to prepare the single-step income statement and…

Q: Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Note 5: Cash and Investments (partial) Available-for-sale investments as of December 31, 2016, and…

A: “As the question has more than 3 sub-parts, the first 3 subparts are answered. If you want the…

Q: A PRICE TAG OF P2,600.00 IS PAYABLE IN 60 DAYS BUT IF PAID WITHIN 30 DAYS IT WILL HAVE A 4%…

A: The question is based on the concept of Financial Management. Rate of Interest = Discount *…

Q: PROBLEM 1: COST CENTER: ABC Corporation, a corporation with fully decentralized its operations, is…

A: Relevant costs are the costs associated with a particular department or unit that will be incurred…

Q: Use the information provided for Harding Company to answer the question that follow. Harding Company…

A: Calculation for current assets : Particulars Amount ( In $ ) Accounts receivable 66,770…

Q: ints) During 2021, Querido Co. reported net income of $337,000. The company also reported the…

A: Cash flow from operation is a part of the cash flow statement that shows the net cash flow from the…

Q: Question # 5: You are a financial manager in Gama Corporation. You have the task of getting the…

A: Comment - Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Cost of Goods Sold, Income Statement, and Statement of Comprehensive Income Gaskin Company derives…

A: COGS - Cost of goods sold is the direct cost incurred for the production of any goods Opening…

Q: Partners W, X, Y, and Z form the Ace partnership, contributing the following: W Y Interest X 40% Z…

A: Solution A partnership is a form of business in which two or more partners are agree to share profit…

Q: Flow of Costs and Income Statement Ginocera Inc. is a designer, manufacturer, and distributor of…

A: Income statement is a financial statement which records the revenue earned and expenses incurred by…

Q: LO.1, 8 Compute the taxable income for 2020 for Emily on the basis of the following information. Her…

A: Taxable income means the income of a person which is taxable by income tax. Income to be considered…

Q: ABC Ltd was registered on 1" January 2021 with an authorized share capital of 1,000,000 shares at a…

A: The process of funding the capital of a firm by issuing ordinary or equity shares to the public is…

Q: Identify and define the two major types of controls in an accounting information system.

A: Accounting Controls Accounting controls are the policies and procedures that a company adopts to…

Q: Adjustment for Merchandise Inventory Using T Accounts: Periodic Inventory System Ibby Smith owns…

A: Introduction: A periodic inventory system only upgrades the ending inventory balance in the general…

Q: Q-3 The Assessee was a Company carrying on business of manufacture and sale of Art-Silk cloth. It…

A: As per the provision of Income Tax Act 1961, where any person receives any money or other assets…

Q: Mokwena Limited acquired 48% investment

A: As per my knowledge the amount that will be recorded as investment in asociate…

Q: Target sold $150,000 of merchandise at one of its stores on Saturday. It collected $100,000 cash…

A: The revenue and expenses are recorded differently under cash basis accounting and accrual basis…

Q: A 13-43 Ethics involved with statement of cash flows preparation (Learning Objectives 1, 2, & 3) The…

A: Professional ethics seem to be norms established by professional associations for the behaviour as…

Q: Based on the following data for the current year, what is the inventory turnover (rounded to one…

A: The inventory turnover ratio seems to be an efficiency measure that assesses a firm's capacity to…

Q: Required information [The following information applies to the questions displayed below.] Martinez…

A: Answer:- Fixed cost meaning:- A cost that remains constant regardless of how many units of goods or…

Q: a) For a charge per copy between $0.07 to $0.11 and daily demands of 500, 1000, 1500, and 2000…

A: Copier can make maximum copies upto 100,000 copies per year so, at Daily demand of 500 and 365 days…

Q: Coporation completed the following transactions realting to investment in other company ordinary…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Emily is paid a semimonthly salary of 900. She works 8.5 hours of overtime in one week. What is her…

A: Normal time for which a worker is required to work on site is 8 hours in a day. Total Wages can be…

Q: Pro-Weave manufactures stadium blankets by passing the products through a weaving department and…

A: Introduction: A journal entry is used to record a business transaction in the company's accounting…

Q: nts) On April 1 each year, TAEL Co. receives interest on a $161,000, 6%, 6 year note receivable. On…

A: Interest revenue is the interest earned on the note receivable issued. While calculating interest…

Q: How much is the cost of goods sold to be reported by the branch for March? How much is the true…

A: We are authorized to answer three subparts at a time, since you have not mentioned which part you…

Q: Department M had 2,600 units 58% completed in process at the beginning of June, 12,100 units…

A: Equivalent units of production = Units at end of the period + Completed Units - Units at beginning…

Q: Department S had 500 units 70% completed in process at the beginning of the period, 8,600 units…

A: Introduction: Equivalent production units are represented by the work-in-process inventory at the…

Q: P10,000 IS BORROWED FOR 75 DAYS AT 20% PER ANNUM SIMPLE INTEREST. HOW MUCH WILL BE DUE AT THE END OF…

A: Simple interest is a method of interest calculation where principal amount is multiply with time and…

Q: Accounting During 2021, B&C owed the following assets. B&C sold the land, office building, and…

A: HY convention of dep menas when an asset is purcased in between of…

Q: Complete the Contribution Margin Income Statement below with the following data: Sales per unit,…

A: A contribution margin is an excess value of sales revenue over the variable cost. It is also an…

Step by step

Solved in 2 steps

- Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and taxable income for 2020. The prior period adjustment was the result of an error in calculating bad debt expense for 2019. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. When the company applies intraperiod income tax allocation, the prior period adjustment will be shown on the: a. income statement at 12,000 b. income statement at 8,400 (net of 3,600 income taxes) c. retained earnings statement at 12,000 d. retained earnings statement at 8,400 (net of 3,600 income taxes)Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________

- The Bookbinder Company had 500,000 cumulative operating losses prior to the beginning of last year. It had 100,000 in pre-tax earnings last year before using the past operating losses and has 300,000 in the current year before using any past operating losses. It projects 350,000 pre-tax earnings next year. a. How much taxable income was there last year? How much, if any, cumulative losses remained at the end of the last year? b. What is the taxable income in the current year? How much, if any, cumulative losses remain at the end of the current year? c. What is the projected taxable income for next year? How much, if any, cumulative losses are projected to remain at the end of next year?Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax income from continuing operations (of which revenues are 295,000), the following items are included in this pretax income: Colts taxable income totals 93,000 in 2019. The difference between the pretax financial income and the taxable income is due to the excess of tax depreciation over financial depreciation on assets used in continuing operations. At the beginning of 2019, Colt had a retained earnings balance of 310.000 and a deferred tax liability of 8,100. During 2019, Colt declared and paid dividends of 48,000. It is subject to tax rates of 15% on the first 50,000 of income and 30% on income in excess of 50,000. Based on proper interperiod tax allocation procedures, Colt has determined that its 2019 ending deferred tax liability is 14,100. Required: 1. Prepare a schedule for Colt to allocate the total 2019 income tax expense to the various components of pretax income. 2. Prepare Colts income tax journal entry at the end of 2019. 3. Prepare Colts 2019 income statement. 4. Prepare Colts 2019 statement of retained earnings. 5. Show the related income tax disclosures on Colts December 31, 2019, balance sheet.