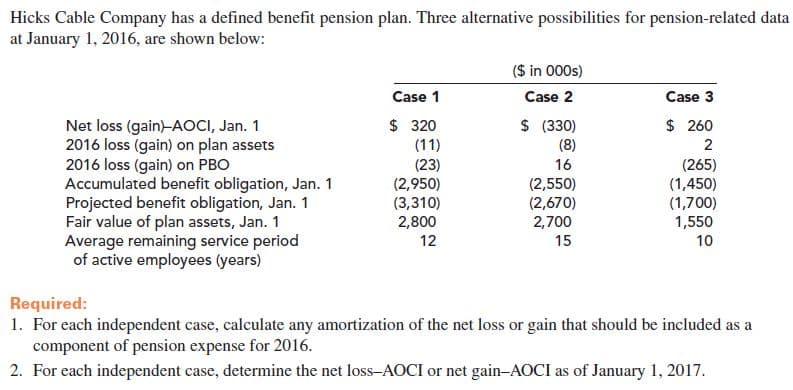

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2016, are shown below: ($ in 000s) Case 1 Case 2 Case 3 $ (330) (8) 16 (2,550) (2,670) 2,700 Net loss (gain)-AOCI, Jan. 1 2016 loss (gain) on plan assets 2016 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) $ 320 $ 260 (11) (23) (2,950) (265) (1,450) (1,700) 1,550 (3,310) 2,800 12 15 10 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2016. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2017.

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2016, are shown below: ($ in 000s) Case 1 Case 2 Case 3 $ (330) (8) 16 (2,550) (2,670) 2,700 Net loss (gain)-AOCI, Jan. 1 2016 loss (gain) on plan assets 2016 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) $ 320 $ 260 (11) (23) (2,950) (265) (1,450) (1,700) 1,550 (3,310) 2,800 12 15 10 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2016. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2017.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data

at January 1, 2016, are shown below:

($ in 000s)

Case 1

Case 2

Case 3

$ (330)

(8)

16

(2,550)

(2,670)

2,700

Net loss (gain)-AOCI, Jan. 1

2016 loss (gain) on plan assets

2016 loss (gain) on PBO

Accumulated benefit obligation, Jan. 1

Projected benefit obligation, Jan. 1

Fair value of plan assets, Jan. 1

Average remaining service period

of active employees (years)

$ 320

$ 260

(11)

(23)

(2,950)

(265)

(1,450)

(1,700)

1,550

(3,310)

2,800

12

15

10

Required:

1. For each independent case, calculate any amortization of the net loss or gain that should be included as a

component of pension expense for 2016.

2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning