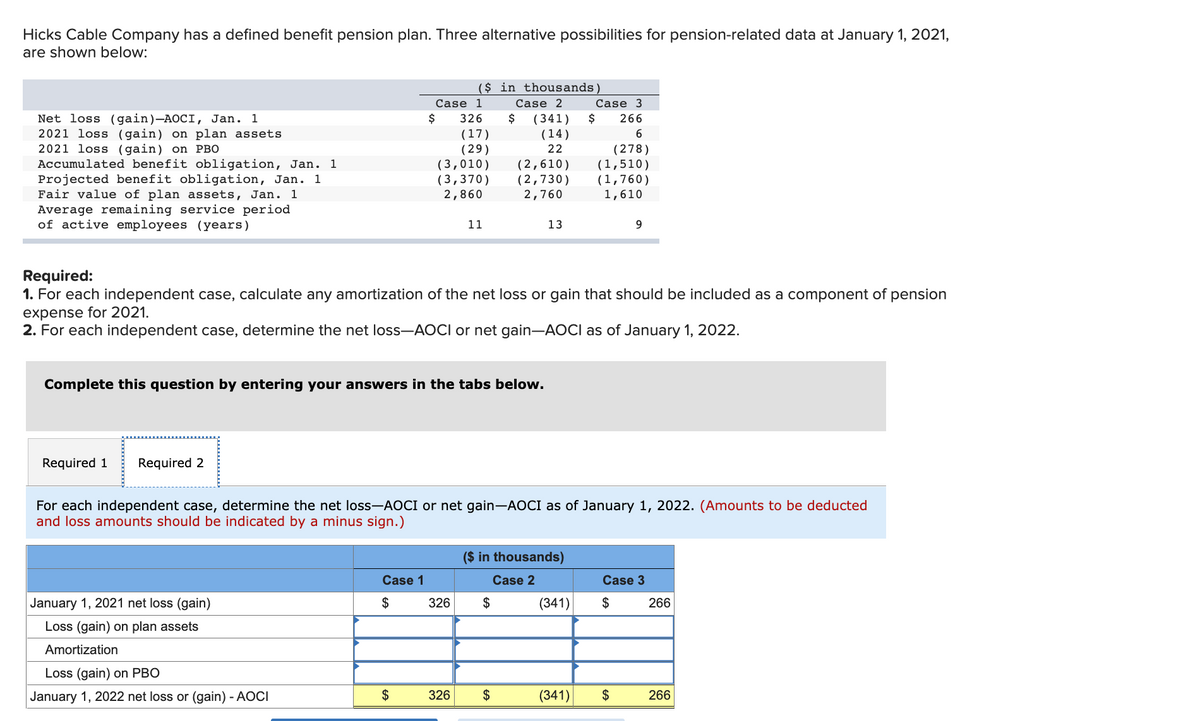

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021, are shown below: ($ in thousands) Case 1 Case 2 $ (341) (14) 22 Case 3 Net loss (gain)-AOCI, Jan. 1 2021 loss (gain) on plan assets 2021 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) 326 (17) (29) (3,010) (3,370) 2,860 266 6 (2,610) (2,730) 2,760 (278) (1,510) (1,760) 1,610 11 13 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022.

Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021, are shown below: ($ in thousands) Case 1 Case 2 $ (341) (14) 22 Case 3 Net loss (gain)-AOCI, Jan. 1 2021 loss (gain) on plan assets 2021 loss (gain) on PBO Accumulated benefit obligation, Jan. 1 Projected benefit obligation, Jan. 1 Fair value of plan assets, Jan. 1 Average remaining service period of active employees (years) 326 (17) (29) (3,010) (3,370) 2,860 266 6 (2,610) (2,730) 2,760 (278) (1,510) (1,760) 1,610 11 13 Required: 1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension expense for 2021. 2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 4E

Related questions

Question

Part 1 and part 2 of this question please

Transcribed Image Text:Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021,

are shown below:

($ in thousands)

Case 1

Case 2

Case 3

Net loss (gain)-AOCI, Jan. 1

2021 loss (gain) on plan assets

2021 loss (gain) on PBO

Accumulated benefit obligation, Jan. 1

Projected benefit obligation, Jan. 1

Fair value of plan assets, Jan. 1

$

326

2$

(341)

2$

266

(17)

(29)

(3,010)

(3,370)

2,860

(14)

(278)

(1,510)

(1,760)

1,610

22

(2,610)

(2,730)

2,760

Average remaining service period

of active employees (years)

11

13

9.

Required:

1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension

expense for 2021.

2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022. (Amounts to be deducted

and loss amounts should be indicated by a minus sign.)

($ in thousands)

Case 1

Case 2

Case 3

January 1, 2021 net loss (gain)

2$

326

$

(341)

2$

266

Loss (gain) on plan assets

Amortization

Loss (gain) on PBO

January 1, 2022 net loss or (gain) - AOCI

2$

326

2$

(341)

$

266

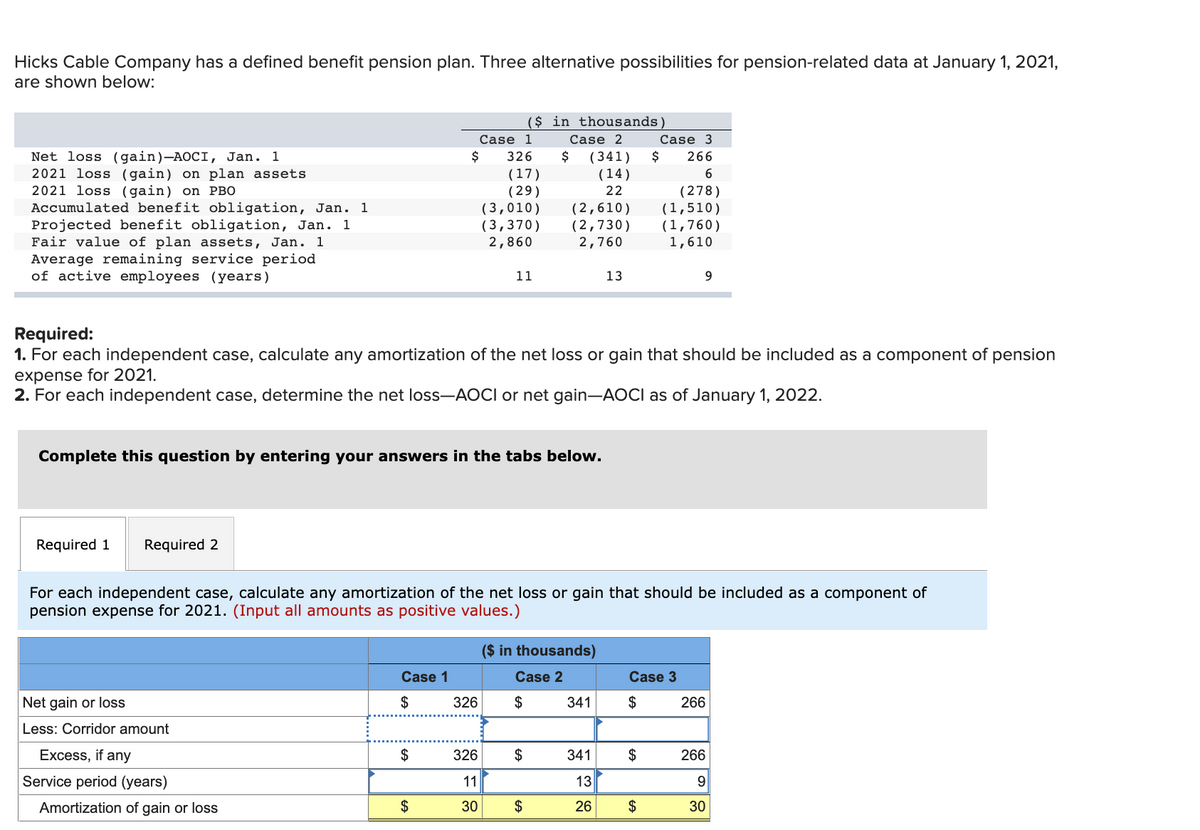

Transcribed Image Text:Hicks Cable Company has a defined benefit pension plan. Three alternative possibilities for pension-related data at January 1, 2021,

are shown below:

($ in thousands)

Case 1

Case 2

Case 3

Net loss (gain)-AOCI, Jan. 1

2021 loss (gain) on plan assets

2021 loss (gain) on PBO

Accumulated benefit obligation, Jan. 1

Projected benefit obligation, Jan. 1

Fair value of plan assets, Jan. 1

$

326

2$

(341)

2$

266

(17)

(29)

(3,010)

(3,370)

2,860

(14)

(278)

(1,510)

(1,760)

1,610

22

(2,610)

(2,730)

2,760

Average remaining service period

of active employees (years)

11

13

9.

Required:

1. For each independent case, calculate any amortization of the net loss or gain that should be included as a component of pension

expense for 2021.

2. For each independent case, determine the net loss-AOCI or net gain-AOCI as of January 1, 2022.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

For each independent case, calculate any amortization of the net loss or gain that should be included as a component of

pension expense for 2021. (Input all amounts as positive values.)

($ in thousands)

Case 1

Case 2

Case 3

Net gain or loss

$

326

$

341

$

266

Less: Corridor amount

Excess, if any

$

326

2$

341

2$

266

Service period (years)

11

13

Amortization of gain or loss

$

30

$

26

$

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT