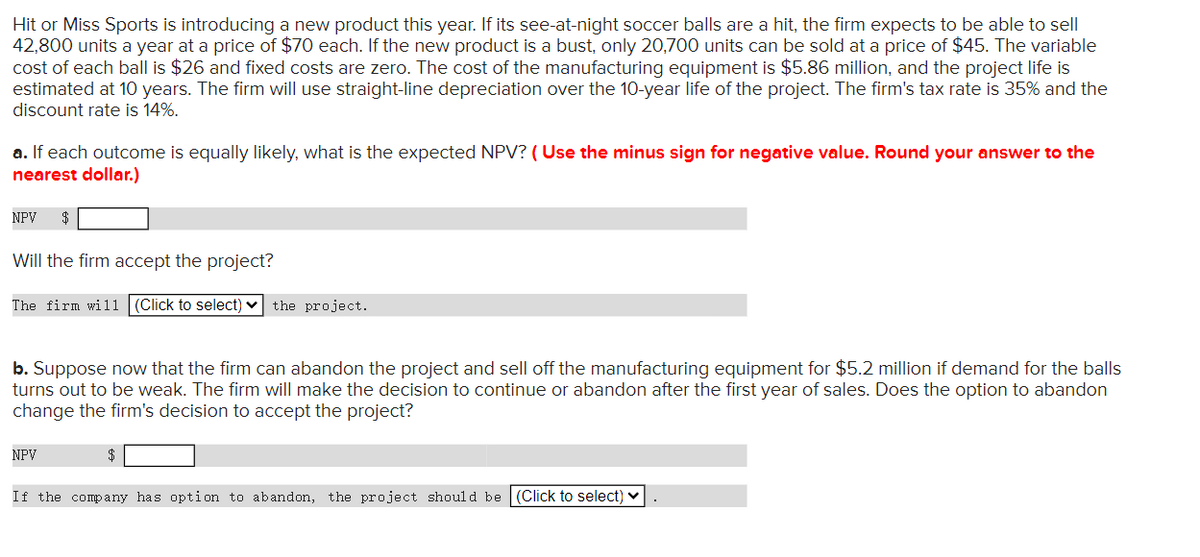

Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 42,800 units a year at a price of $70 each. If the new product is a bust, only 20,700 units can be sold at a price of $45. The variable cost of each ball is $26 and fixed costs are zero. The cost of the manufacturing equipment is $5.86 million, and the project life is estimated at 10 years. The firm will use straight-line depreciation over the 10-year life of the project. The firm's tax rate is 35% and the discount rate is 14%. a. If each outcome is equally likely, what is the expected NPV? ( Use the minus sign for negative value. Round your answer to the nearest dollar.) NPV $ Will the firm accept the project? The firm will |(Click to select) - the project. b. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.2 million if demand for the balls turns out to be weak. The firm will make the decision to continue or abandon after the first year of sales. Does the option to abandon change the firm's decision to accept the project? NPV $

Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 42,800 units a year at a price of $70 each. If the new product is a bust, only 20,700 units can be sold at a price of $45. The variable cost of each ball is $26 and fixed costs are zero. The cost of the manufacturing equipment is $5.86 million, and the project life is estimated at 10 years. The firm will use straight-line depreciation over the 10-year life of the project. The firm's tax rate is 35% and the discount rate is 14%. a. If each outcome is equally likely, what is the expected NPV? ( Use the minus sign for negative value. Round your answer to the nearest dollar.) NPV $ Will the firm accept the project? The firm will |(Click to select) - the project. b. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.2 million if demand for the balls turns out to be weak. The firm will make the decision to continue or abandon after the first year of sales. Does the option to abandon change the firm's decision to accept the project? NPV $

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 4EB: Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all...

Related questions

Question

Transcribed Image Text:Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell

42,800 units a year at a price of $70 each. If the new product is a bust, only 20,700 units can be sold at a price of $45. The variable

cost of each ball is $26 and fixed costs are zero. The cost of the manufacturing equipment is $5.86 million, and the project life is

estimated at 10 years. The firm will use straight-line depreciation over the 10-year life of the project. The firm's tax rate is 35% and the

discount rate is 14%.

a. If each outcome is equally likely, what is the expected NPV? ( Use the minus sign for negative value. Round your answer to the

nearest dollar.)

NPV

$

Will the firm accept the project?

The firm will

(Click to select) v

the project.

b. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.2 million if demand for the balls

turns out to be weak. The firm will make the decision to continue or abandon after the first year of sales. Does the option to abandon

change the firm's decision to accept the project?

NPV

$

If the company has option to abandon, the project shoul d be (Click to select)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning